Paperwork

Employee Paperwork Requirements

Introduction to Employee Paperwork Requirements

When it comes to hiring new employees, there are numerous legal and administrative requirements that employers must adhere to. One of the most critical aspects of this process is the completion of necessary paperwork. Employee paperwork requirements vary by country, state, or province, but there are some common documents that are universally required. In this article, we will delve into the world of employee paperwork, exploring the various documents that employers must obtain from their employees, and the importance of maintaining accurate and up-to-date records.

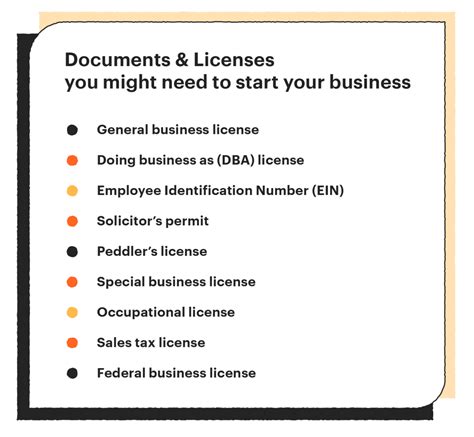

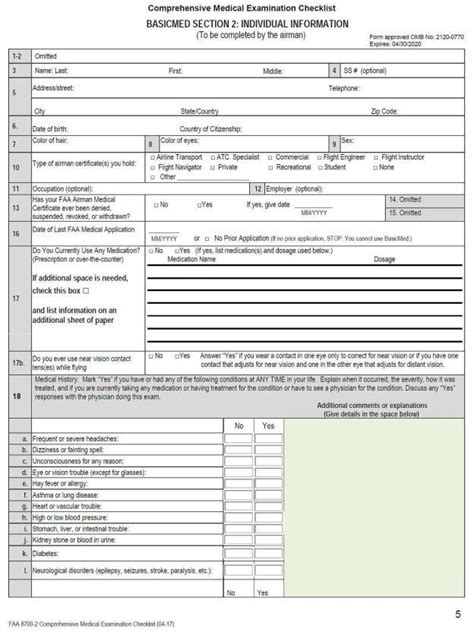

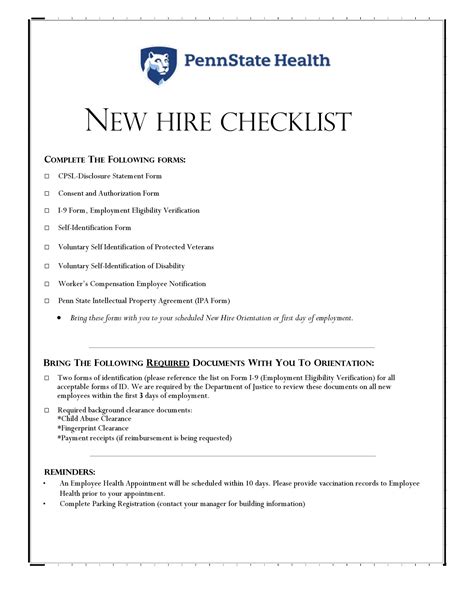

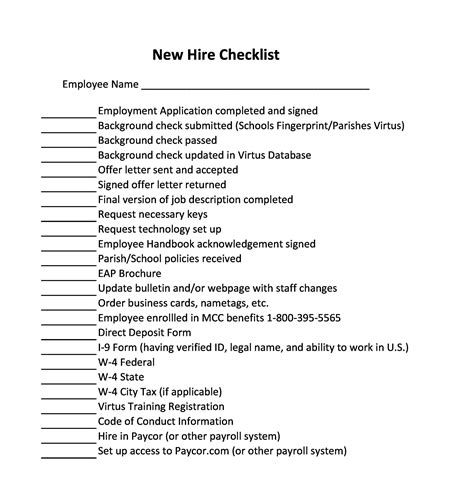

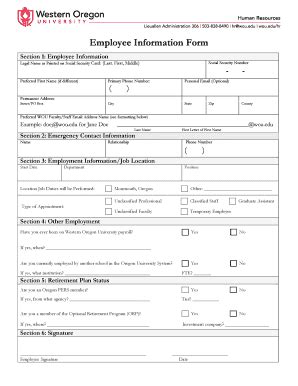

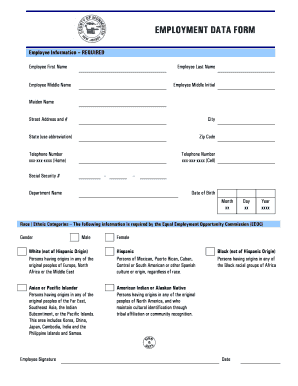

Essential Employee Paperwork Documents

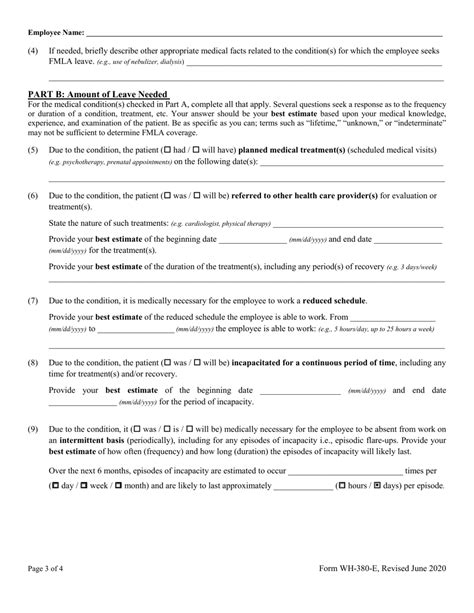

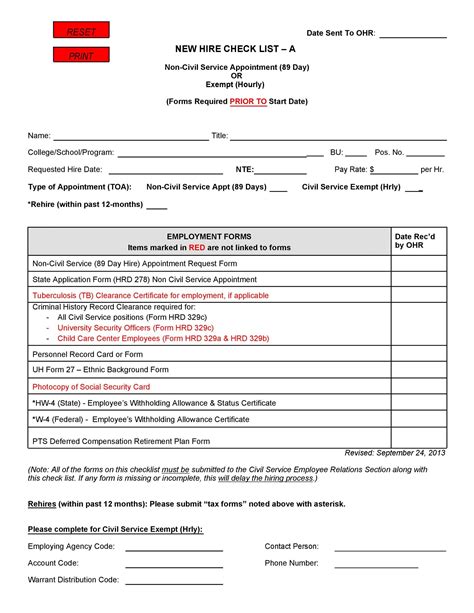

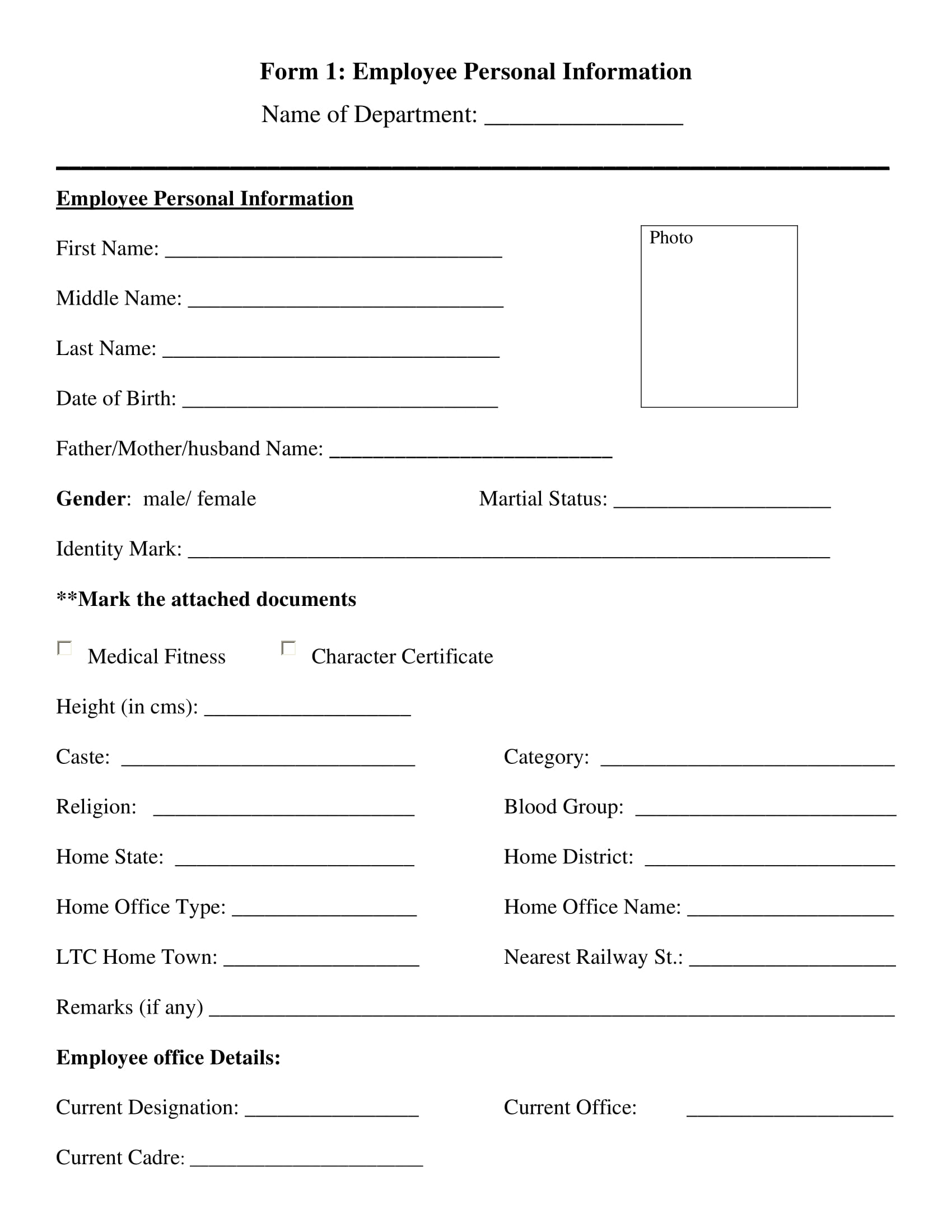

The following are some of the most critical employee paperwork documents that employers must obtain: * Identification documents: These include passports, driver’s licenses, or state ID cards, which serve as proof of identity and age. * Employment eligibility verification: This is typically done using Form I-9 in the United States, which verifies an employee’s eligibility to work in the country. * Tax withholding forms: These include Form W-4, which determines the amount of taxes to be withheld from an employee’s paycheck. * Benefits enrollment forms: These forms are used to enroll employees in company-sponsored benefits, such as health insurance, retirement plans, or life insurance. * Emergency contact information: This includes the names and contact details of employees’ emergency contacts, such as spouses, parents, or siblings.

Importance of Accurate and Up-to-Date Records

Maintaining accurate and up-to-date employee records is crucial for several reasons: * Compliance with labor laws: Employers must comply with various labor laws, such as minimum wage and overtime regulations, and accurate records help ensure compliance. * Tax purposes: Employers must report employee income and taxes withheld to the relevant tax authorities, and accurate records facilitate this process. * Benefits administration: Accurate records help employers administer benefits correctly, ensuring that employees receive the benefits they are entitled to. * Emergency situations: In the event of an emergency, accurate records can help employers contact employees’ emergency contacts quickly and efficiently.

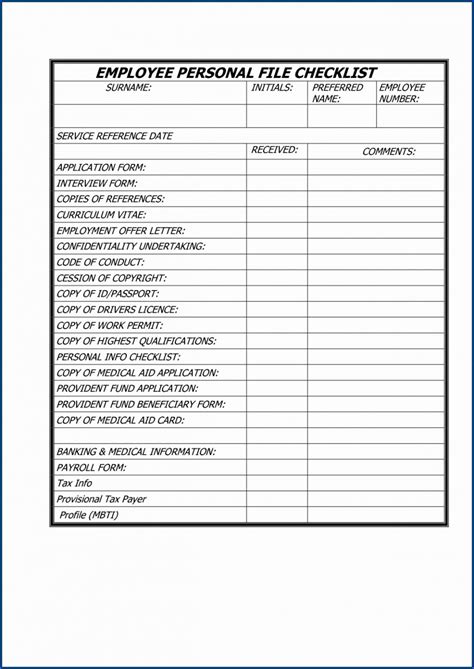

Best Practices for Managing Employee Paperwork

To ensure that employee paperwork is managed efficiently and effectively, employers should follow these best practices: * Implement a centralized record-keeping system: This can be a physical or digital system, but it should be easily accessible and secure. * Designate a responsible person or team: This person or team should be responsible for maintaining and updating employee records. * Use standardized forms and templates: This helps ensure consistency and accuracy across all employee records. * Regularly review and update records: Employers should regularly review and update employee records to ensure they are accurate and up-to-date.

| Document | Purpose | Frequency |

|---|---|---|

| Form I-9 | Employment eligibility verification | Once at hire |

| Form W-4 | Tax withholding | Annually or as needed |

| Benefits enrollment forms | Benefits administration | Annually or as needed |

📝 Note: Employers should consult with their HR department or legal counsel to ensure compliance with all relevant laws and regulations regarding employee paperwork requirements.

Conclusion and Final Thoughts

In conclusion, employee paperwork requirements are a critical aspect of the hiring process, and employers must ensure that they obtain and maintain accurate and up-to-date records. By following best practices and implementing a centralized record-keeping system, employers can ensure compliance with labor laws, administer benefits correctly, and respond efficiently in emergency situations. Remember, accurate and up-to-date employee records are essential for maintaining a well-organized and compliant workforce.

What is the purpose of Form I-9?

+

Form I-9 is used to verify an employee’s eligibility to work in the United States.

How often should employee records be updated?

+

Employee records should be updated regularly, such as when an employee’s address or benefits change, or annually to ensure accuracy and compliance.

What are the consequences of non-compliance with employee paperwork requirements?

+

Non-compliance with employee paperwork requirements can result in fines, penalties, and legal action, as well as damage to an employer’s reputation and relationships with employees.