7 Tax Paper Tips

Understanding Tax Papers and Their Importance

Tax papers are an essential part of the tax filing process, providing critical information to the government about an individual’s or business’s income, expenses, and tax obligations. With the ever-changing tax laws and regulations, it’s crucial to stay informed and up-to-date on the best practices for managing tax papers. In this article, we will discuss seven valuable tips for handling tax papers efficiently and effectively.

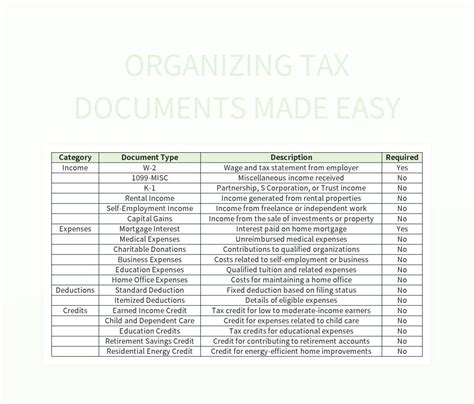

Tip 1: Organize Your Tax Papers

To start, it’s vital to have a well-organized system for storing and managing tax papers. This includes keeping all relevant documents, such as W-2 forms, 1099 forms, and receipts, in a secure and easily accessible location. Consider using a file folder or a digital storage system to keep track of your tax papers. This will help you quickly locate the information you need when filing your taxes.

Tip 2: Understand the Different Types of Tax Papers

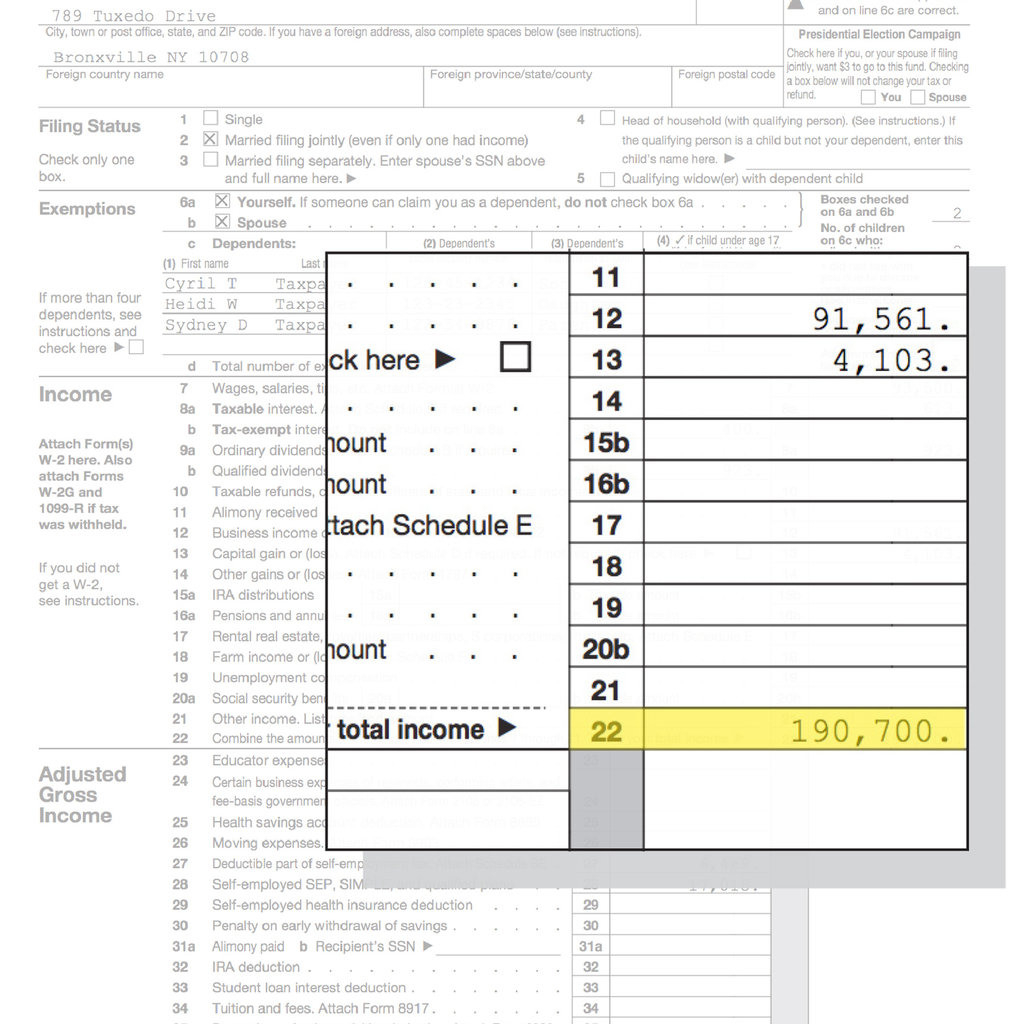

There are various types of tax papers, each serving a specific purpose. It’s essential to understand the differences between them, including: * W-2 forms: Used to report employee income and taxes withheld * 1099 forms: Used to report self-employment income and other types of income * Receipts: Used to document business expenses and charitable donations * Invoices: Used to track business income and expenses

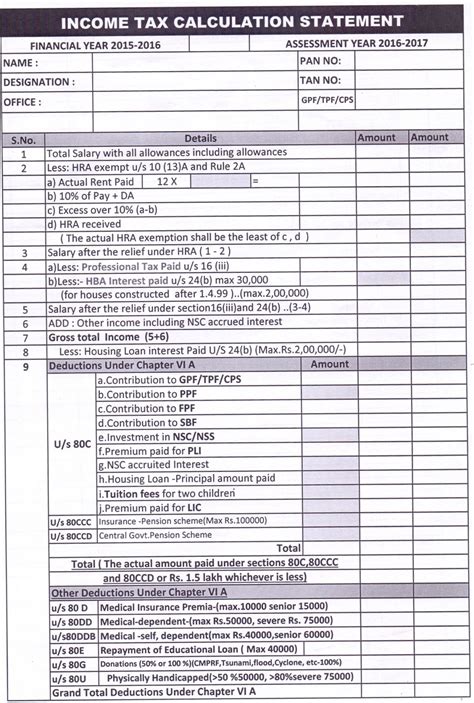

Tip 3: Keep Accurate Records

Maintaining accurate and detailed records is critical for tax purposes. This includes keeping track of: * Business income and expenses * Charitable donations * Medical expenses * Mileage logs for business use of a vehicle * Home office expenses It’s also important to keep records of any tax-related correspondence with the government or tax authorities.

Tip 4: Take Advantage of Tax Deductions

Tax deductions can help reduce your taxable income, resulting in a lower tax bill. Some common tax deductions include: * Charitable donations * Medical expenses * Home office expenses * Business use of a vehicle * Education expenses It’s essential to keep accurate records of these expenses to claim them on your tax return.

Tip 5: Stay Up-to-Date on Tax Law Changes

Tax laws and regulations are constantly changing, so it’s crucial to stay informed about any updates that may affect your tax situation. This includes changes to tax rates, deductions, and credits. You can stay up-to-date by: * Visiting the official government website * Consulting with a tax professional * Attending tax seminars or workshops

Tip 6: Consider Hiring a Tax Professional

If you’re unsure about how to handle your tax papers or need help with tax planning, consider hiring a tax professional. They can provide expert guidance on: * Tax preparation and filing * Tax planning and strategy * Audit representation * Tax controversy resolution

Tip 7: Keep Your Tax Papers Secure

Finally, it’s essential to keep your tax papers secure to protect your personal and financial information. This includes: * Storing physical documents in a secure location, such as a safe or locked file cabinet * Using strong passwords and encryption for digital storage * Avoiding public Wi-Fi or unsecured networks when accessing tax information online

📝 Note: Always keep your tax papers and related documents in a secure and easily accessible location to ensure you can quickly retrieve the information you need when filing your taxes.

To summarize, managing tax papers effectively requires organization, attention to detail, and a thorough understanding of tax laws and regulations. By following these seven tips, you can ensure that your tax papers are in order, and you’re taking advantage of all the tax deductions and credits available to you. This will help you navigate the tax filing process with confidence and minimize the risk of errors or audits. In the end, it’s all about being proactive and staying informed to achieve a stress-free tax experience.

What is the purpose of a W-2 form?

+

A W-2 form is used to report employee income and taxes withheld to the government.

How long should I keep my tax papers?

+

Can I claim charitable donations on my tax return?

+

Yes, charitable donations can be claimed as a tax deduction on your tax return, but you must have a receipt or proof of the donation.