Start Small Business Paperwork

Understanding the Basics of Small Business Paperwork

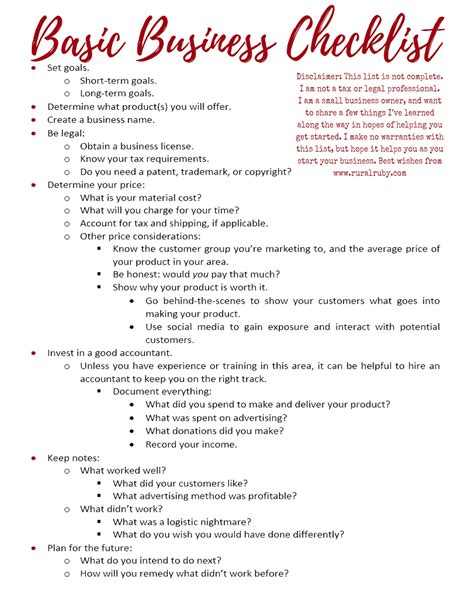

When starting a small business, it’s easy to get overwhelmed by the sheer amount of paperwork involved. From licenses and permits to tax forms and employee contracts, the list can seem endless. However, staying organized and on top of paperwork is crucial for the success and longevity of any business. In this post, we’ll break down the essential paperwork needed to start a small business and provide tips on how to manage it all.

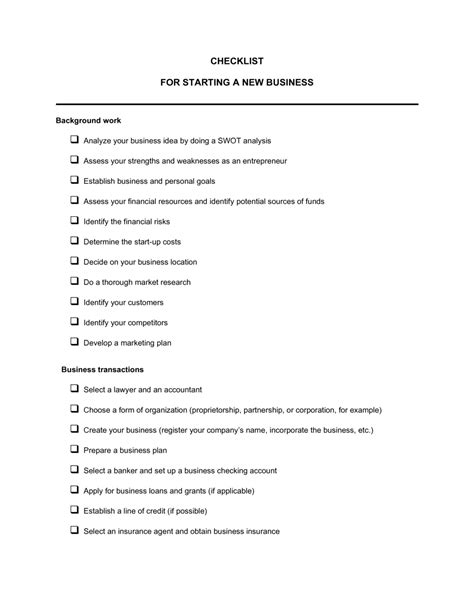

Business Structure and Registration

The first step in starting a small business is to determine its structure. This can be a sole proprietorship, partnership, limited liability company (LLC), or corporation. Each structure has its own set of paperwork requirements. For example, an LLC will need to file articles of organization with the state, while a corporation will need to file articles of incorporation. Additionally, businesses will need to register for an Employer Identification Number (EIN) with the IRS.

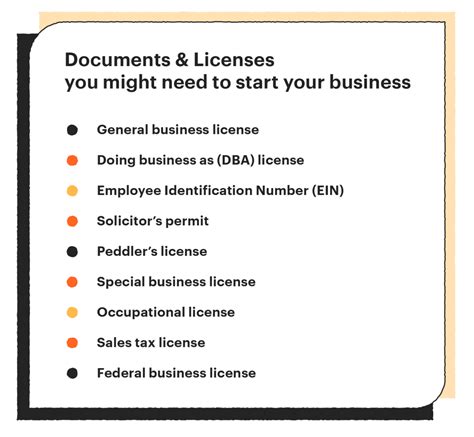

Licenses and Permits

Depending on the type of business and its location, various licenses and permits may be required. These can include: * Business license: Required by most states to operate a business * Sales tax permit: Required to collect and remit sales tax * Zoning permit: Required to ensure compliance with local zoning laws * Health department permit: Required for businesses that handle food or provide healthcare services

💡 Note: The specific licenses and permits required will vary depending on the business and its location, so it's essential to check with local authorities to determine what is needed.

Tax Forms and Compliance

Small businesses are required to file various tax forms with the IRS, including: * Form 1040: Personal income tax return * Form 1120: Corporate income tax return * Form 1065: Partnership income tax return * Form 941: Employer’s quarterly federal tax return Businesses must also comply with tax laws and regulations, such as withholding taxes from employee wages and paying self-employment taxes.

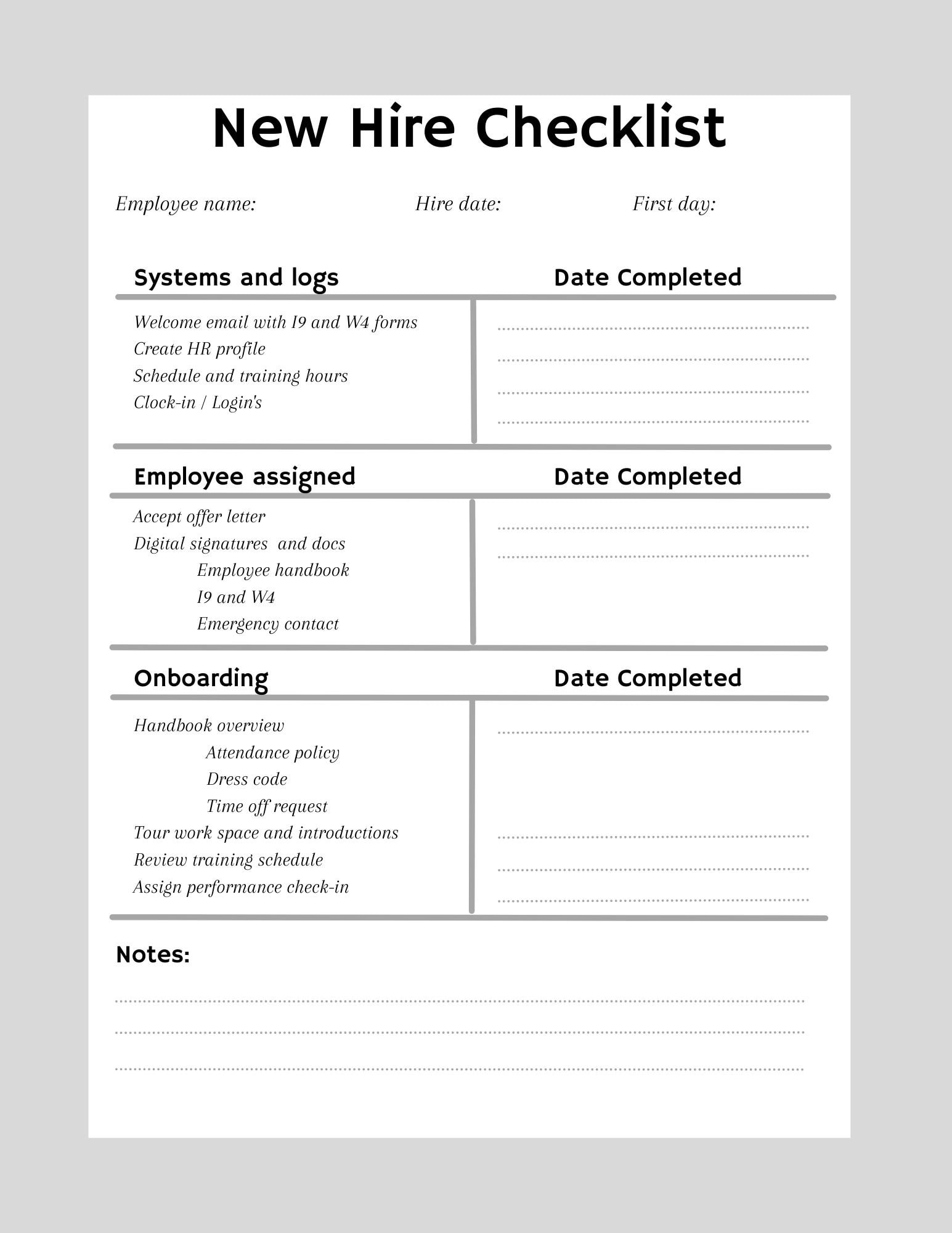

Employee Contracts and Benefits

If a small business has employees, it will need to provide employee contracts that outline the terms of employment, including salary, benefits, and job responsibilities. Businesses may also need to provide benefits, such as health insurance, retirement plans, and paid time off.

Insurance and Risk Management

Small businesses need to consider insurance and risk management to protect against potential losses. This can include: * Liability insurance: Protects against lawsuits and damages * Property insurance: Protects against damage to business property * Workers’ compensation insurance: Protects against employee injuries * Business interruption insurance: Protects against losses due to business disruptions

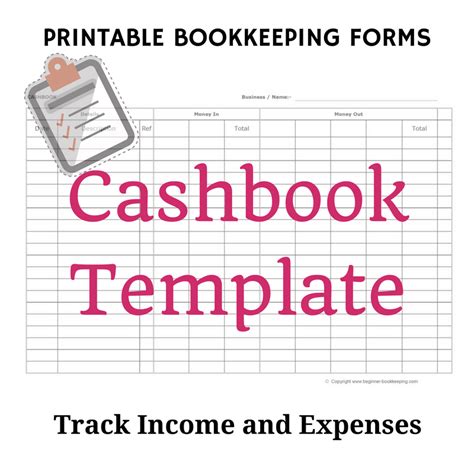

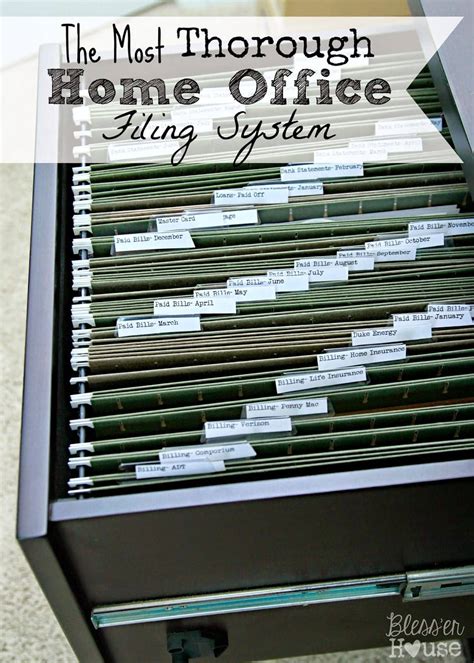

Record Keeping and Organization

To stay on top of paperwork, small businesses need to implement a record-keeping system that includes: * Digital storage: Cloud-based storage solutions, such as Google Drive or Dropbox * Physical storage: File cabinets and storage units for physical documents * Organization tools: Spreadsheets, calendars, and project management software

| Document | Description |

|---|---|

| Business license | Required to operate a business |

| Articles of organization | Required to form an LLC |

| Employee contracts | Outline terms of employment |

As a small business owner, it’s essential to stay organized and proactive when it comes to paperwork. By understanding the basics of small business paperwork and implementing a record-keeping system, businesses can ensure compliance with laws and regulations, reduce stress, and focus on growth and success.

In the end, starting a small business requires a lot of paperwork, but with the right knowledge and tools, it can be managed effectively. By following the tips and guidelines outlined in this post, small business owners can ensure that their paperwork is in order, and they can focus on building a successful and thriving business.

What is the first step in starting a small business?

+

The first step in starting a small business is to determine its structure, such as a sole proprietorship, partnership, LLC, or corporation.

What licenses and permits are required to start a small business?

+

The licenses and permits required to start a small business vary depending on the type of business and its location, but may include a business license, sales tax permit, zoning permit, and health department permit.

How can small business owners stay organized and manage paperwork effectively?

+

Small business owners can stay organized and manage paperwork effectively by implementing a record-keeping system, using digital storage solutions, and staying proactive and up-to-date on laws and regulations.