-

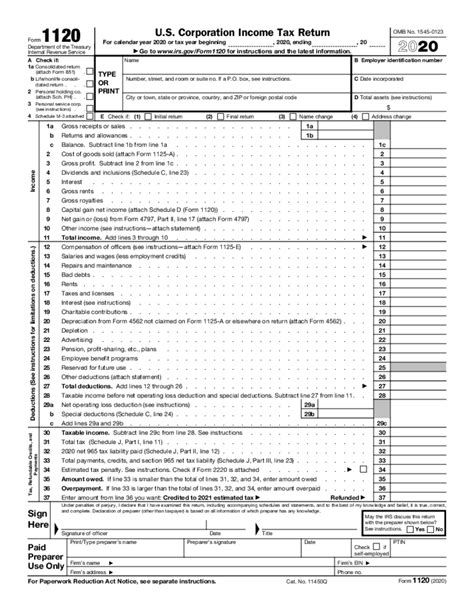

Update S-Corp Paperwork Info

Update S-corp paperwork by amending articles, filing Form 1120, and revising bylaws, ensuring compliance with IRS regulations and state laws, and reflecting changes in business structure, ownership, or operations, to maintain accurate corporate records and avoid penalties.

Read More » -

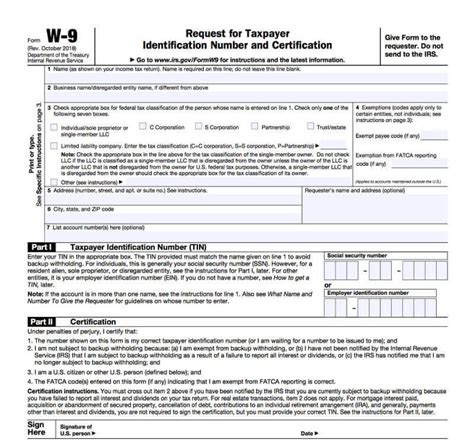

5 Forms for 1099 Hire

Hiring a 1099 employee requires specific paperwork, including contracts, invoices, and tax forms like W-9 and 1099-MISC, to ensure compliance with IRS regulations and independent contractor agreements, freelancing laws, and self-employment taxes.

Read More » -

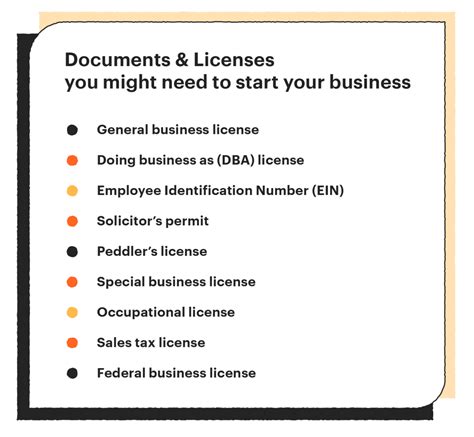

Start Small Business Paperwork

Start a small business with essential paperwork, including licenses, permits, and registrations, to ensure compliance and legitimacy, covering business formation, tax IDs, and insurance requirements.

Read More » -

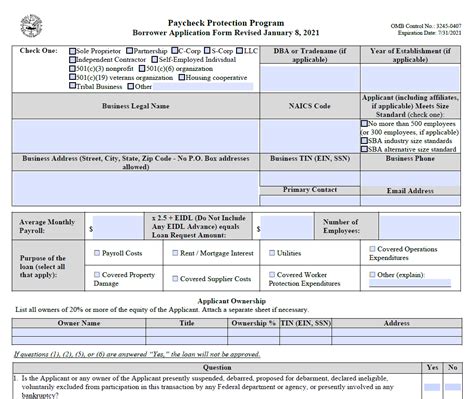

PPP Loan Paperwork Requirements

Discover required paperwork for PPP, including loan applications, payroll documentation, and tax forms, to ensure a smooth loan forgiveness process with necessary small business financing and COVID-19 relief measures.

Read More »