Update S-Corp Paperwork Info

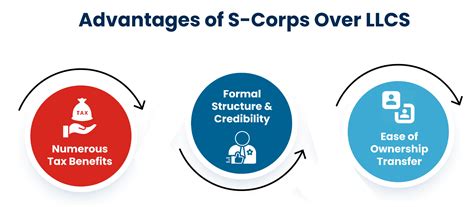

Understanding the Basics of S-Corp Paperwork

When it comes to managing an S-Corporation, one of the most critical aspects is ensuring that all paperwork is in order. This not only helps in maintaining compliance with regulatory requirements but also in streamlining the operations of the business. Proper documentation is key to avoiding potential issues with the IRS and state authorities. In this article, we will delve into the details of S-Corp paperwork, including the necessary forms, filings, and record-keeping requirements.

Initial Setup and Registration

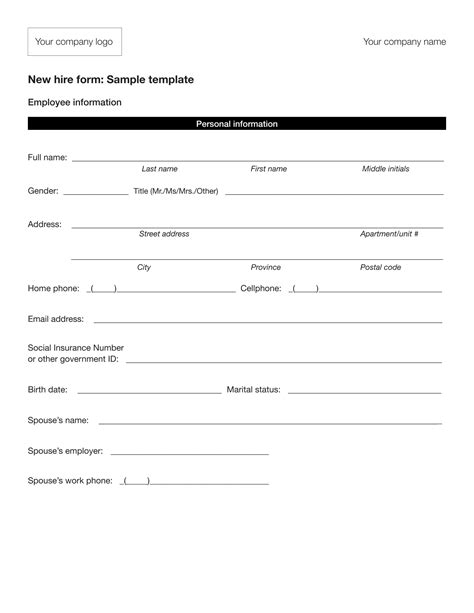

The journey of an S-Corp begins with its formation. This involves filing Articles of Incorporation with the state where the business is located. Alongside this, the company must also obtain an EIN (Employer Identification Number) from the IRS, which is essential for tax purposes. The EIN is used to open a business bank account, apply for credit, and file tax returns. It’s also crucial for distinguishing the business entity from its owners for legal and tax purposes.

Choosing S-Corp Status

To elect S-Corp status, the corporation must file Form 2553 with the IRS. This form, also known as the Election by a Small Business Corporation, must be filed within a specific timeframe—typically within 75 days of the corporation’s formation or during the preceding tax year, if the corporation wants the election to take effect for that year. Timeliness is critical here, as missing the deadline can result in the corporation being treated as a C-Corp for tax purposes, which might not be desirable due to the potential for double taxation.

Ongoing Compliance and Filings

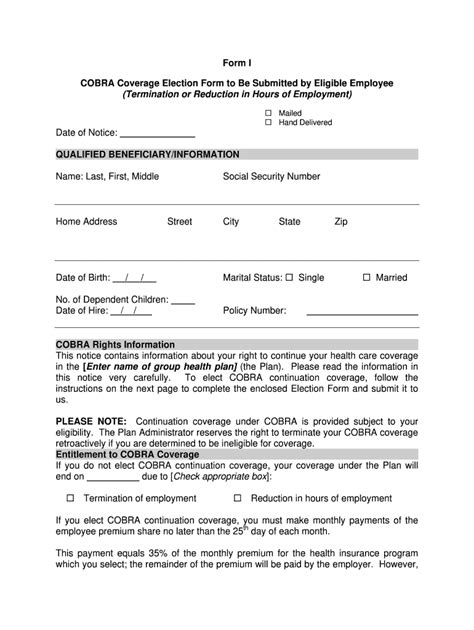

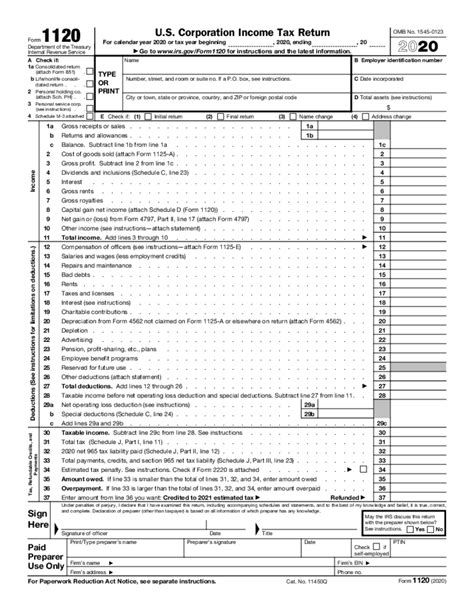

After the initial setup, there are several ongoing compliance requirements that S-Corps must adhere to. These include: - Annual Reports: Most states require corporations to file annual reports, which provide updated information about the company, such as its address, officers, and directors. - Tax Returns: S-Corps must file Form 1120S, the U.S. Income Tax Return for an S Corporation, annually with the IRS. This form reports the corporation’s income, deductions, and credits, and it also includes a schedule K-1 for each shareholder, detailing their share of income, deductions, and credits. - Employment Taxes: If the S-Corp has employees, it must also file employment tax returns, such as Form 941, the Employer’s Quarterly Federal Tax Return, and Form W-2 and Form W-3 for reporting wages and taxes withheld.

Record Keeping

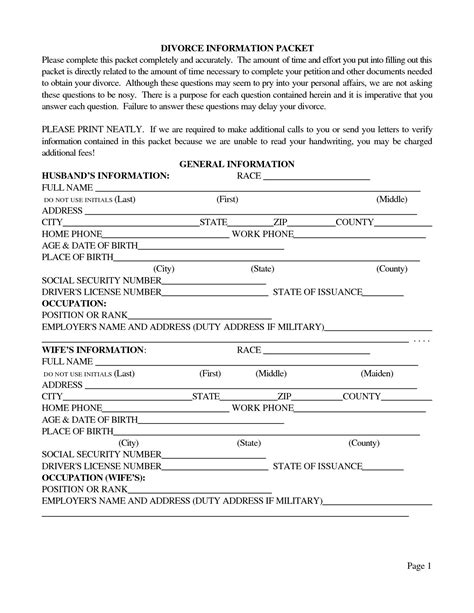

Accurate and detailed record-keeping is essential for any S-Corp. This includes maintaining records of: - Minutes of meetings of shareholders and the board of directors. - Shareholder information, including ownership percentages and contact details. - Financial statements, such as balance sheets and income statements. - Tax returns and filings, both federal and state.

| Document | Purpose |

|---|---|

| Articles of Incorporation | Initial registration of the corporation with the state. |

| Form 2553 | Election by a small business corporation to be treated as an S-Corp for tax purposes. |

| Form 1120S | Annual tax return for an S-Corporation. |

| Annual Reports | Update company information with the state. |

📝 Note: It's essential to consult with a tax professional or attorney to ensure all necessary paperwork and filings are completed accurately and on time, as requirements can vary by state and change over time.

Conclusion and Next Steps

Managing the paperwork for an S-Corp is a critical component of its operation. By understanding the initial setup requirements, ongoing compliance needs, and the importance of accurate record-keeping, businesses can ensure they are well-organized and compliant with all relevant laws and regulations. This not only helps in avoiding legal and financial issues but also in focusing on the core aspects of the business—growth, innovation, and customer satisfaction.

As we wrap up this discussion on S-Corp paperwork, it’s clear that while the process can seem daunting, breaking it down into manageable parts and seeking professional advice when needed can make all the difference. Whether you’re just starting out or are looking to ensure your existing S-Corp is on the right track, prioritizing your paperwork and compliance is a step in the right direction.

What is the primary purpose of filing Form 2553?

+

The primary purpose of filing Form 2553 is to elect S-Corp status with the IRS, allowing the corporation to be treated as a pass-through entity for tax purposes.

How often must S-Corps file tax returns?

+

S-Corps must file their tax returns annually, using Form 1120S, which is due on the 15th day of the third month following the end of the tax year.

What are the consequences of not filing S-Corp paperwork on time?

+

Failure to file necessary paperwork on time can result in penalties, fines, and in some cases, loss of S-Corp status. It can also lead to legal and compliance issues that may impact the business’s operations and reputation.