PPP Loan Paperwork Requirements

Introduction to PPP Loan Paperwork Requirements

The Paycheck Protection Program (PPP) is a loan program implemented by the US government to help small businesses and other eligible entities maintain their payroll and cover certain expenses during the COVID-19 pandemic. The program has undergone several updates and changes, but one aspect remains constant: the need for thorough and accurate paperwork to ensure loan approval and forgiveness. In this article, we will delve into the PPP loan paperwork requirements, exploring the necessary documents, application process, and tips for a smooth experience.

Eligibility Criteria and Required Documents

To apply for a PPP loan, businesses must meet specific eligibility criteria, including being a small business, self-employed individual, sole proprietor, or non-profit organization, with 500 or fewer employees. The required documents typically include: * Business tax returns: The business’s most recent tax return (typically Form 1040 for sole proprietors or Form 1120 for corporations) * Payroll documentation: Payroll processor records, payroll tax filings, or invoices from payroll providers * Employee count and compensation: Documentation showing the number of employees and their compensation, such as W-2 forms or payroll ledgers * Business identification: Articles of incorporation, business licenses, or other documents verifying the business’s identity

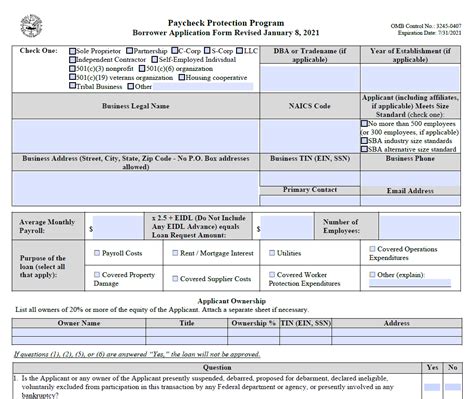

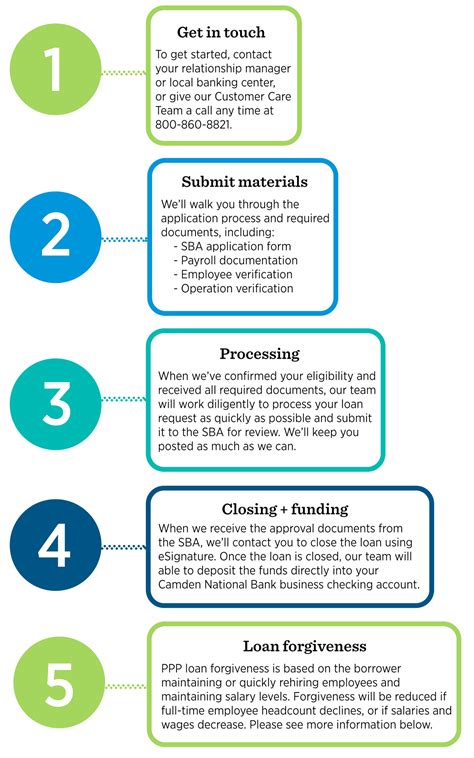

Application Process and Necessary Forms

The PPP loan application process involves submitting the required documents and completing the necessary forms. The primary form is the PPP Borrower Application Form (SBA Form 2483), which requires information about the business, its owners, and the loan amount requested. Additional forms may include: * SBA Form 2484: Lender’s Application for Forgiveness of Paycheck Protection Program Loan * SBA Form 3508: Paycheck Protection Program Loan Forgiveness Application * IRS Form 941: Employer’s Quarterly Federal Tax Return (for payroll tax documentation)

Calculating the Loan Amount and Forgiveness

The loan amount is calculated based on the business’s average monthly payroll costs, multiplied by 2.5. Forgiveness is available for loans used for eligible expenses, such as: * Payroll costs: Salaries, wages, commissions, and tips * Mortgage interest: Interest on mortgages for real or personal property * Rent: Rent payments for leased properties * Utilities: Payments for electricity, gas, water, transportation, and internet services

The following table illustrates the eligible expenses and their corresponding forgiveness percentages:

| Expense Category | Forgiveness Percentage |

|---|---|

| Payroll costs | 60% |

| Mortgage interest, rent, and utilities | 40% |

Tips for a Smooth Application Process

To ensure a smooth application process, businesses should: * Gather all necessary documents before submitting the application * Review and understand the eligibility criteria and required documents * Complete the application forms accurately and thoroughly * Submit the application through an approved lender or the SBA’s online platform * Follow up with the lender or SBA to confirm receipt of the application and to address any issues

💡 Note: Businesses should consult with their accountant or financial advisor to ensure they meet the eligibility criteria and have the necessary documents to support their application.

As the PPP loan program continues to evolve, it is essential for businesses to stay informed about the latest developments and requirements. By understanding the PPP loan paperwork requirements and following the tips outlined above, businesses can increase their chances of a successful application and forgiveness.

In the end, the key to a successful PPP loan application lies in thorough preparation, accurate documentation, and a clear understanding of the program’s requirements and eligibility criteria. By taking the time to gather the necessary documents and complete the application forms accurately, businesses can navigate the application process with confidence and secure the funding they need to thrive during these challenging times.

What is the primary purpose of the Paycheck Protection Program (PPP)?

+

The primary purpose of the PPP is to provide loans to small businesses and other eligible entities to help them maintain their payroll and cover certain expenses during the COVID-19 pandemic.

What are the required documents for a PPP loan application?

+

The required documents typically include business tax returns, payroll documentation, employee count and compensation, and business identification.

How is the loan amount calculated for a PPP loan?

+

The loan amount is calculated based on the business’s average monthly payroll costs, multiplied by 2.5.