5 Forms for 1099 Hire

Understanding the Forms Required for 1099 Hires

When it comes to hiring independent contractors, also known as 1099 hires, it’s essential to understand the various forms required for tax purposes and compliance. The Internal Revenue Service (IRS) has specific requirements for reporting income and taxes for these types of workers. In this article, we will delve into the five primary forms associated with 1099 hires, their purposes, and the steps to complete them accurately.

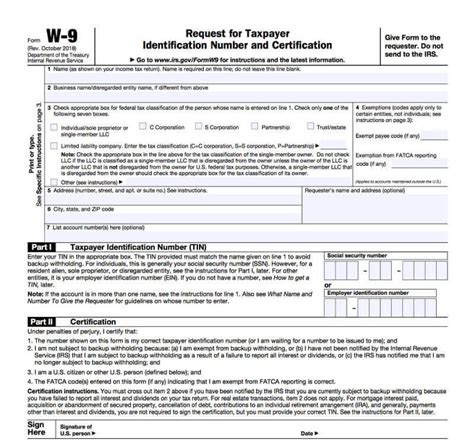

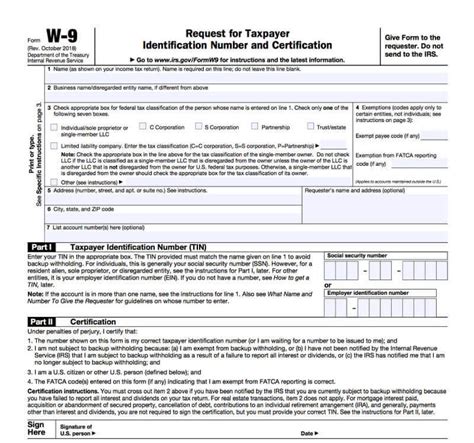

Form W-9: Request for Taxpayer Identification Number and Certification

The Form W-9 is the first step in the process of hiring a 1099 worker. This form is used to request the taxpayer identification number (TIN) and certification from the independent contractor. The TIN can be either a Social Security Number (SSN) or an Employer Identification Number (EIN), depending on the type of entity the contractor represents. It’s crucial to obtain a completed W-9 form from each contractor before starting work to avoid any potential penalties or fines.

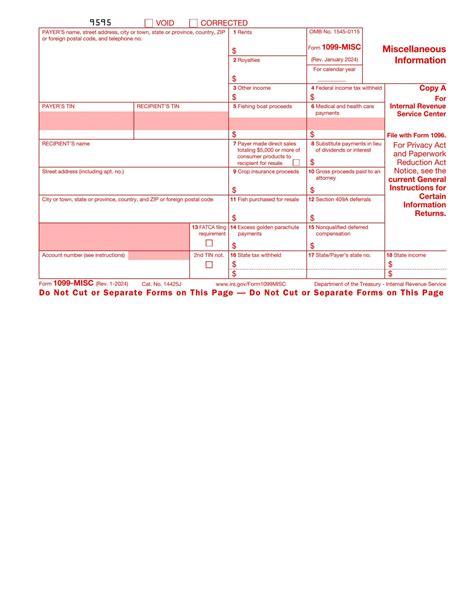

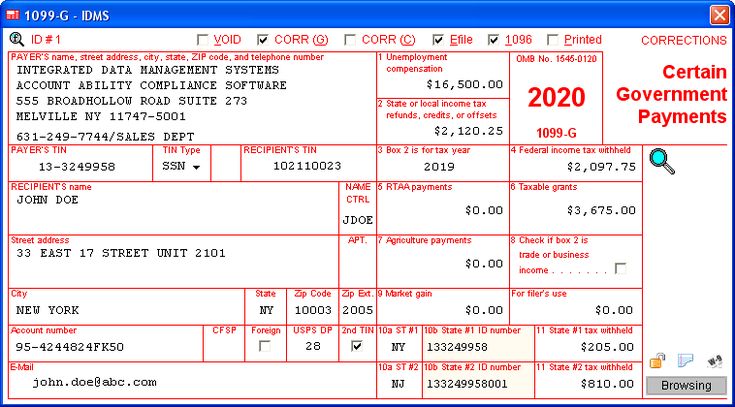

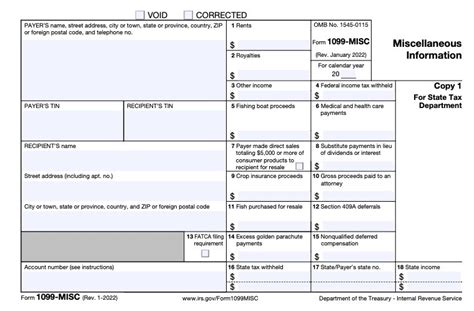

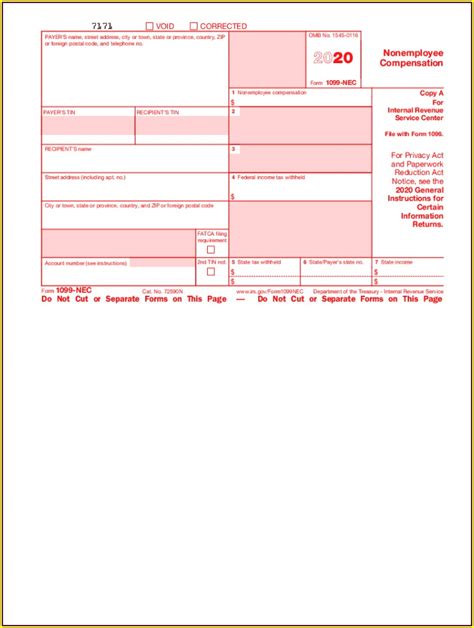

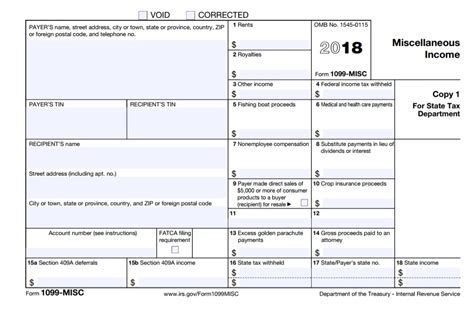

Form 1099-MISC: Miscellaneous Income

The Form 1099-MISC is used to report miscellaneous income paid to non-employees, such as independent contractors. This form is required if the total amount paid to a contractor in a calendar year exceeds $600. The payer must provide a copy of the 1099-MISC form to the contractor by January 31st of each year and file a copy with the IRS by February 28th. The form includes various boxes to report different types of income, such as rents, royalties, and non-employee compensation.

Form 1096: Annual Summary and Transmittal of U.S. Information Returns

The Form 1096 is an annual summary and transmittal form used to report information returns, including the 1099-MISC forms. This form is required if a business has issued 1099-MISC forms to contractors and must be filed with the IRS by February 28th of each year. The form summarizes the total amount of miscellaneous income reported on all 1099-MISC forms.

Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding

The Form W-8BEN is used to certify the foreign status of a beneficial owner for purposes of United States tax withholding. This form is required if a business hires a foreign independent contractor. The contractor must provide a completed W-8BEN form to the payer, which will determine the amount of tax withholding required.

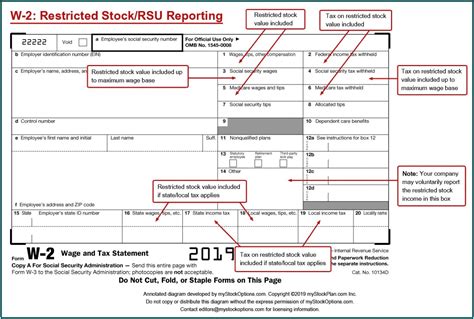

Form 941: Employer’s Quarterly Federal Tax Return

Although not directly related to 1099 hires, Form 941 is an essential form for businesses that hire both employees and independent contractors. This form is used to report employment taxes, including Social Security and Medicare taxes, and must be filed quarterly. However, for 1099 hires, the business is not required to withhold or pay employment taxes, but it’s essential to understand the distinction between employee and non-employee workers.

💡 Note: It's crucial to accurately classify workers as either employees or independent contractors to avoid any potential penalties or fines. Misclassification can lead to severe consequences, including back taxes, interest, and penalties.

To summarize, the five primary forms associated with 1099 hires are: * Form W-9: Request for Taxpayer Identification Number and Certification * Form 1099-MISC: Miscellaneous Income * Form 1096: Annual Summary and Transmittal of U.S. Information Returns * Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding * Form 941: Employer’s Quarterly Federal Tax Return (indirectly related)

In conclusion, understanding the forms required for 1099 hires is essential for businesses to ensure compliance with tax laws and regulations. By accurately completing and filing these forms, businesses can avoid potential penalties and fines. It’s also crucial to classify workers correctly to avoid misclassification consequences.

What is the purpose of Form W-9?

+

The purpose of Form W-9 is to request the taxpayer identification number (TIN) and certification from an independent contractor.

Who must file Form 1099-MISC?

+

A business must file Form 1099-MISC if the total amount paid to a contractor in a calendar year exceeds $600.

What is the deadline for filing Form 1096?

+

The deadline for filing Form 1096 is February 28th of each year.