Sole Proprietor Business Legal Paperwork Required

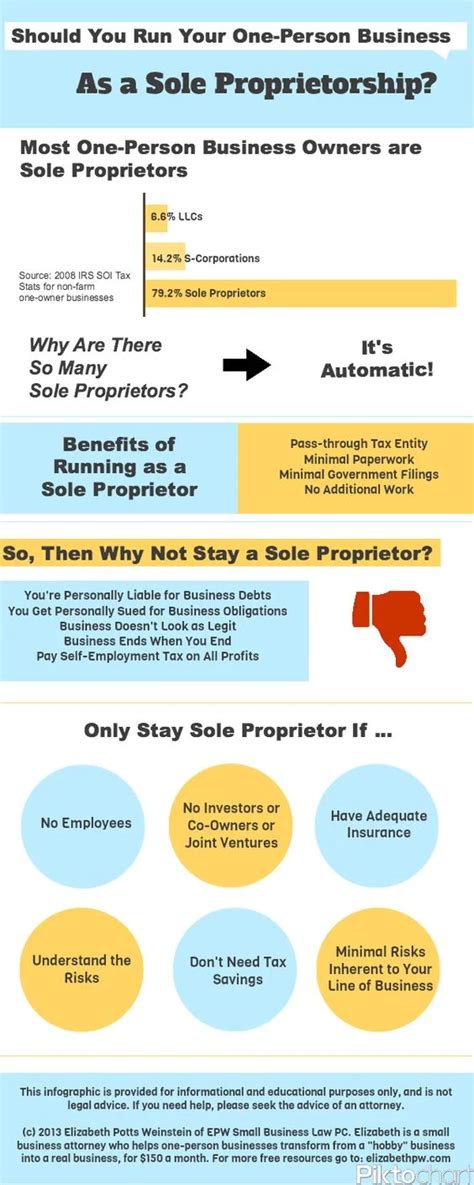

Introduction to Sole Proprietorship

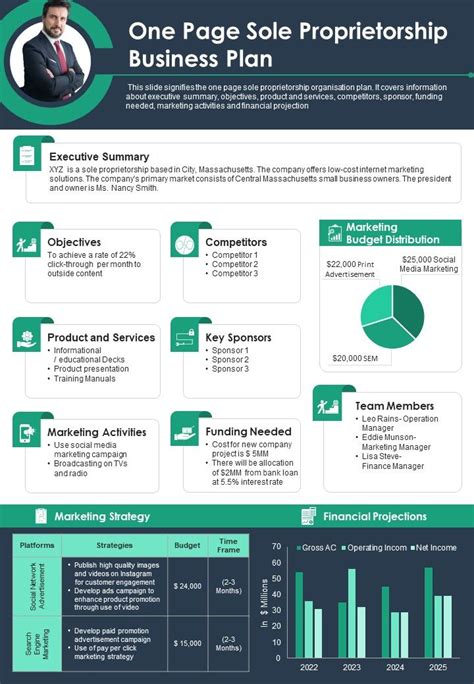

When starting a business, one of the most common forms of ownership is a sole proprietorship. This type of business structure is owned and operated by one individual, who is entitled to all the profits and is also responsible for all the liabilities. A sole proprietorship is the simplest and most straightforward way to start a business, as it requires minimal legal paperwork and regulatory compliance. However, it is still essential to understand the necessary legal requirements to ensure the business is properly established and operated.

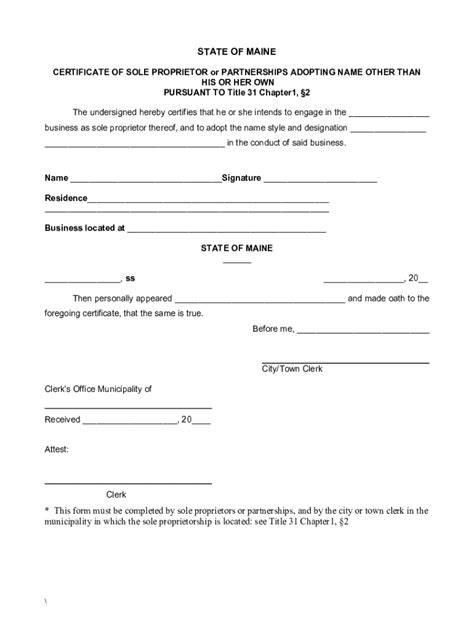

Business Name and Registration

The first step in setting up a sole proprietorship is to choose a business name. The name should be unique and comply with the state’s naming requirements. It is also recommended to check if the desired name is available as a web domain and social media handle. Once the name is chosen, the business must be registered with the state government. This typically involves filing a doing business as (DBA) statement, also known as a fictitious business name statement, with the county clerk’s office. The DBA statement informs the public that the business is being operated under a name that is different from the owner’s personal name.

Obtaining Licenses and Permits

Depending on the type of business and its location, a sole proprietorship may need to obtain various licenses and permits. These can include: * Business license: required by the state or local government to operate a business * Zoning permit: required to ensure the business is operating in a designated area * Health department permit: required for businesses that handle food or provide healthcare services * Environmental permit: required for businesses that generate hazardous waste or pollutants It is essential to research the specific licensing requirements for the business and obtain all necessary permits before commencing operations.

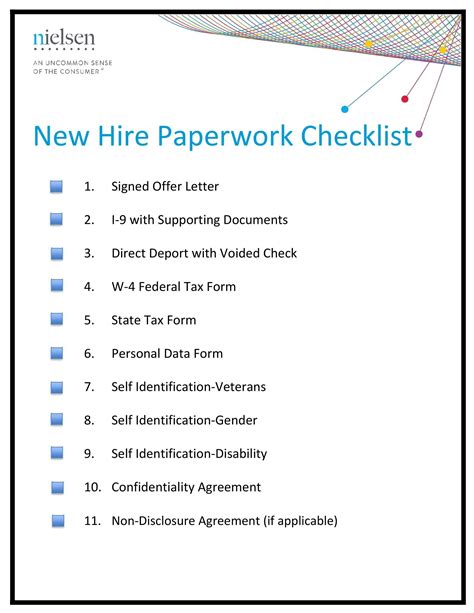

Tax Registration and Obligations

As a sole proprietor, the business income is reported on the owner’s personal tax return. However, the business may still need to register for taxes and obtain an Employer Identification Number (EIN) from the IRS. The EIN is used to identify the business for tax purposes and is required for: * Opening a business bank account * Hiring employees * Obtaining credit The business may also need to register for state and local taxes, such as sales tax or payroll tax.

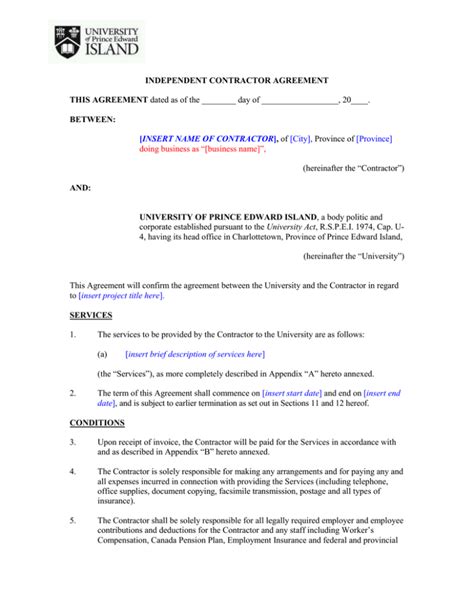

Other Legal Requirements

In addition to the above requirements, a sole proprietorship may need to comply with other legal obligations, such as: * Insurance requirements: liability insurance, property insurance, or workers’ compensation insurance * Contract requirements: contracts with suppliers, customers, or independent contractors * Intellectual property protection: trademarks, copyrights, or patents It is essential to consult with an attorney or business advisor to ensure the business is compliant with all applicable laws and regulations.

| Legal Requirement | Description |

|---|---|

| Business Name Registration | Registering the business name with the state government |

| Licenses and Permits | Obtaining necessary licenses and permits to operate the business |

| Tax Registration | Registering for taxes and obtaining an EIN |

| Insurance Requirements | Obtaining necessary insurance coverage |

💡 Note: It is essential to consult with an attorney or business advisor to ensure the business is compliant with all applicable laws and regulations.

To ensure the business is properly established and operated, it is crucial to understand the necessary legal requirements and comply with all applicable laws and regulations. By following these steps and consulting with professionals, a sole proprietorship can minimize the risk of legal issues and focus on growing and succeeding.

In the end, starting a sole proprietorship requires careful planning and attention to detail. By understanding the necessary legal paperwork and regulatory compliance, business owners can ensure their business is properly established and operated, and they can focus on achieving their goals and objectives. With the right foundation in place, a sole proprietorship can thrive and become a successful and profitable business.

What is the main difference between a sole proprietorship and other business structures?

+

The main difference is that a sole proprietorship is owned and operated by one individual, who is entitled to all the profits and is also responsible for all the liabilities.

Do I need to register my sole proprietorship with the state government?

+

Yes, you need to register your business name with the state government by filing a doing business as (DBA) statement.

What licenses and permits do I need to obtain for my sole proprietorship?

+

The licenses and permits required vary depending on the type of business and its location. You may need to obtain a business license, zoning permit, health department permit, or environmental permit.