5 Must Have Documents

Introduction to Essential Documents

When it comes to personal finance and legal matters, having the right documents in place can make a significant difference. These documents not only help in organizing your finances and protecting your assets but also ensure that your wishes are respected in case of an emergency or upon your passing. In this article, we will discuss the 5 must-have documents that everyone should consider having.

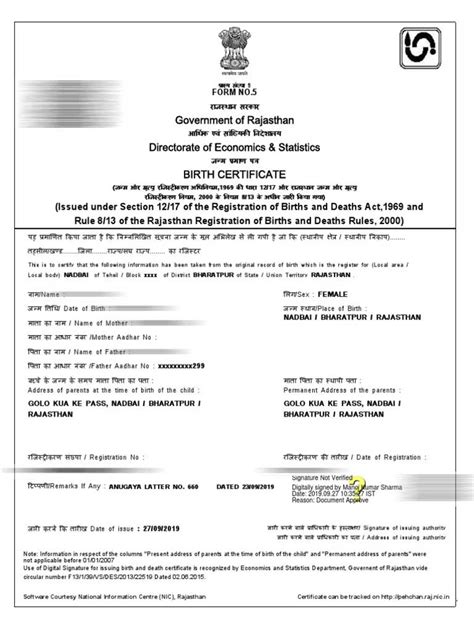

1. Last Will and Testament

A Last Will and Testament is a document that outlines how you want your assets to be distributed after your death. It is a crucial document that ensures your wishes are respected and your loved ones are taken care of. Without a will, the distribution of your assets will be determined by the laws of your state, which may not align with your desires. A will typically includes: * Appointment of an executor: The person responsible for carrying out the instructions in your will. * Distribution of assets: How you want your assets, such as property, investments, and personal belongings, to be distributed among your beneficiaries. * Guardianship: The appointment of a guardian for your minor children, if applicable.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone you trust the authority to act on your behalf in financial and legal matters. This document is essential in case you become incapacitated or unable to make decisions for yourself. There are different types of POA, including: * Durable Power of Attorney: Remains in effect even if you become incapacitated. * Springing Power of Attorney: Takes effect only when you become incapacitated. * Limited Power of Attorney: Grants authority for a specific purpose or period.

3. Advance Directive

An Advance Directive, also known as a Living Will, is a document that outlines your medical wishes in case you become incapacitated or unable to communicate. This document ensures that your healthcare wishes are respected and that you receive the medical treatment you desire. An Advance Directive typically includes: * Do Not Resuscitate (DNR) order: Instructions regarding cardiopulmonary resuscitation (CPR). * Life-sustaining treatments: Instructions regarding the use of life-sustaining treatments, such as ventilators or dialysis. * Organ donation: Instructions regarding organ donation.

4. Insurance Policies

Insurance policies, such as life insurance, disability insurance, and health insurance, are essential documents that provide financial protection for you and your loved ones. These policies can help: * Replace income: In case of death or disability. * Cover medical expenses: In case of illness or injury. * Provide financial support: For your loved ones in case of death or disability.

5. Estate Inventory

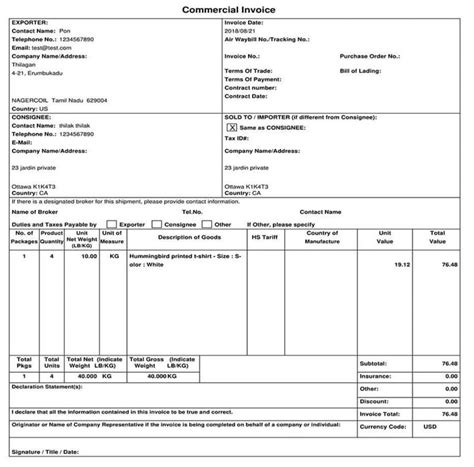

An Estate Inventory is a document that lists all your assets, debts, and other important information. This document is essential for estate planning and can help your executor or beneficiaries manage your estate after your passing. An Estate Inventory typically includes: * Assets: Such as property, investments, and personal belongings. * Debts: Such as mortgages, credit cards, and loans. * Other important information: Such as passwords, safe combinations, and location of important documents.

💡 Note: It is essential to review and update these documents regularly to ensure they remain relevant and effective.

When it comes to creating and managing these documents, it is crucial to: * Seek professional advice: From an attorney or financial advisor. * Keep documents up to date: Review and update documents regularly. * Store documents safely: In a secure location, such as a safe or a secure online storage service.

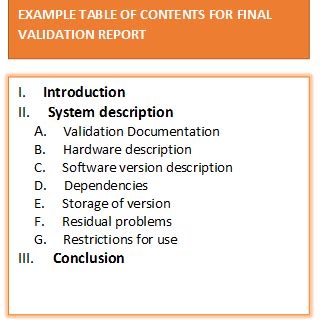

| Document | Purpose |

|---|---|

| Last Will and Testament | Outlines the distribution of assets after death |

| Power of Attorney | Grants authority to act on behalf of the individual |

| Advance Directive | Outlines medical wishes in case of incapacitation |

| Insurance Policies | Provides financial protection for the individual and their loved ones |

| Estate Inventory | Lists all assets, debts, and other important information |

In summary, having the right documents in place is essential for personal finance, legal matters, and estate planning. The 5 must-have documents, including a Last Will and Testament, Power of Attorney, Advance Directive, Insurance Policies, and Estate Inventory, can provide peace of mind and financial security for you and your loved ones. It is crucial to seek professional advice, keep documents up to date, and store documents safely to ensure they remain effective and relevant.

What is the purpose of a Last Will and Testament?

+

A Last Will and Testament is a document that outlines how you want your assets to be distributed after your death.

What is the difference between a Power of Attorney and an Advance Directive?

+

A Power of Attorney grants authority to act on behalf of the individual in financial and legal matters, while an Advance Directive outlines medical wishes in case of incapacitation.

Why is it important to review and update estate documents regularly?

+

Reviewing and updating estate documents regularly ensures they remain relevant and effective, and can help prevent disputes and ensure that your wishes are respected.