5 COBRA Tips

Introduction to COBRA

The Consolidated Omnibus Budget Reconciliation Act, commonly referred to as COBRA, is a federal law that allows certain employees and their families to continue their health insurance coverage after a job loss or other qualifying event. Understanding COBRA is crucial for individuals who find themselves in situations where they might lose their health insurance due to circumstances such as job termination, reduction in work hours, or other life changes. In this article, we will delve into 5 key tips related to COBRA, helping you navigate the process with ease.

Tip 1: Understanding Eligibility

To be eligible for COBRA, an individual must have been covered under the employer’s health plan on the day before the qualifying event. Qualifying events include the employee’s termination of employment (unless it was due to gross misconduct), a reduction in work hours, the employee’s death, divorce or legal separation from the covered employee, or the employee becoming entitled to Medicare. It’s essential to review the specifics of your company’s health plan and understand the types of qualifying events that apply. Additionally, COBRA applies to employers with 20 or more employees, so it’s crucial to verify if your employer meets this criterion.

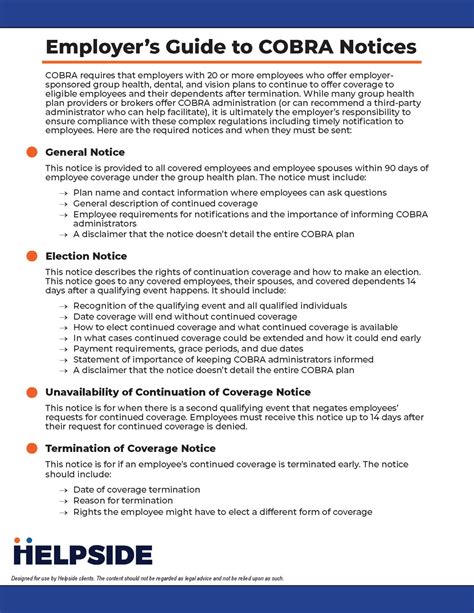

Tip 2: Notification and Enrollment Process

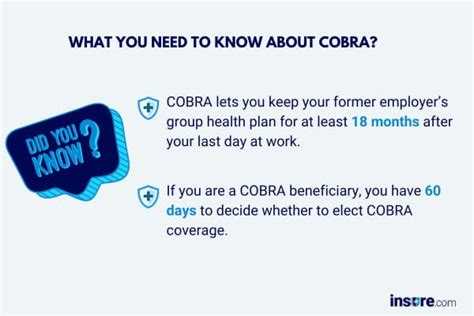

The employer is typically responsible for notifying the plan administrator of a qualifying event. The plan administrator then informs the qualified beneficiaries (the employee and their dependents) about their right to elect COBRA coverage. The notification must be provided within specific timeframes (usually 44 days after the qualifying event or the date coverage would otherwise end). Once notified, beneficiaries have 60 days to decide whether to elect COBRA coverage. This election period starts from the date of the notification or the date coverage would otherwise end, whichever is later. It’s vital to understand these timelines to avoid missing the opportunity to continue health insurance coverage.

Tip 3: Cost Considerations

One of the critical aspects of COBRA is the cost. Under COBRA, the individual may be required to pay up to 102% of the premium for their coverage, which includes the portion of the premium the employer previously paid. This can be significantly higher than what the individual was paying while employed. It’s essential to weigh the costs of COBRA against other health insurance options available, such as Affordable Care Act (ACA) marketplace plans, spouse’s employer-sponsored plan, or short-term limited-duration insurance (STLDI) plans. Sometimes, these alternatives might offer more affordable options with similar or even better coverage.

Tip 4: Duration of Coverage

The duration of COBRA coverage varies based on the qualifying event. For most events, such as job termination or reduction in work hours, coverage can last up to 18 months. However, in cases of the employee’s death, divorce, or the employee becoming entitled to Medicare, coverage for the spouse and dependent children can last up to 36 months. It’s crucial to understand how long you can remain on COBRA to plan accordingly for your future health insurance needs. Additionally, certain events (like getting a new job with health coverage or becoming eligible for Medicare) can terminate COBRA coverage prematurely.

Tip 5: Alternatives and Next Steps

Given the potential high cost of COBRA, exploring alternative health insurance options is wise. The ACA marketplace offers plans with financial assistance for those who qualify, based on income. Spouses or partners may also have the option to add family members to their employer-sponsored plans. Short-term health insurance can provide temporary coverage but typically lacks the comprehensive benefits of major medical plans and may not be renewable. Understanding these alternatives and their implications can help in making an informed decision about whether to elect COBRA or pursue another path.

| COBRA Aspect | Description |

|---|---|

| Eligibility | Covered under the employer's health plan on the day before the qualifying event. |

| Notification | Employer notifies the plan administrator, who then informs the qualified beneficiaries. |

| Cost | Up to 102% of the premium for coverage. |

| Duration | Up to 18 months for most qualifying events, up to 36 months for certain events. |

| Alternatives | ACA marketplace plans, spouse's employer-sponsored plan, STLDI plans. |

📝 Note: It's crucial to review and understand the specifics of your employer's health plan and the details of COBRA coverage to make informed decisions about your health insurance.

In summary, navigating the world of COBRA and health insurance after a job change or qualifying event requires careful consideration of eligibility, notification processes, costs, duration of coverage, and alternative health insurance options. By understanding these aspects, individuals can make better decisions about their health insurance coverage, ensuring they and their families remain protected during times of transition.

What is the main purpose of COBRA?

+

The main purpose of COBRA is to allow certain employees and their families to continue their health insurance coverage after a job loss or other qualifying event.

How long does COBRA coverage last?

+

COBRA coverage can last up to 18 months for most qualifying events and up to 36 months for certain events like the employee’s death, divorce, or becoming entitled to Medicare.

What are the alternatives to COBRA coverage?

+

Alternatives to COBRA include Affordable Care Act (ACA) marketplace plans, spouse’s employer-sponsored plan, and short-term limited-duration insurance (STLDI) plans.