5 Repo Paperwork Tips

Introduction to Repo Paperwork

Repo paperwork, short for repurchase agreement paperwork, is a crucial aspect of the financial industry, particularly in the realm of securities lending and borrowing. A repurchase agreement is a financial transaction in which one party sells securities to another party with an agreement to repurchase them at a later date, often with a fixed price. This process involves a significant amount of paperwork to ensure that both parties are protected and that the transaction is executed smoothly. In this article, we will delve into the world of repo paperwork, exploring its importance, the key components involved, and providing valuable tips for navigating this complex financial terrain.

Understanding the Importance of Repo Paperwork

The importance of thorough and accurate repo paperwork cannot be overstated. It serves as the foundation upon which repurchase agreements are built, providing a legal framework that outlines the terms and conditions of the transaction, including the type of securities involved, the sale and repurchase prices, the timing of the repurchase, and the obligations of each party. Without proper paperwork, parties to a repurchase agreement could find themselves exposed to unforeseen risks, including disputes over the terms of the agreement, misunderstandings about the securities being sold and repurchased, and difficulties in resolving issues that may arise during the term of the agreement.

Key Components of Repo Paperwork

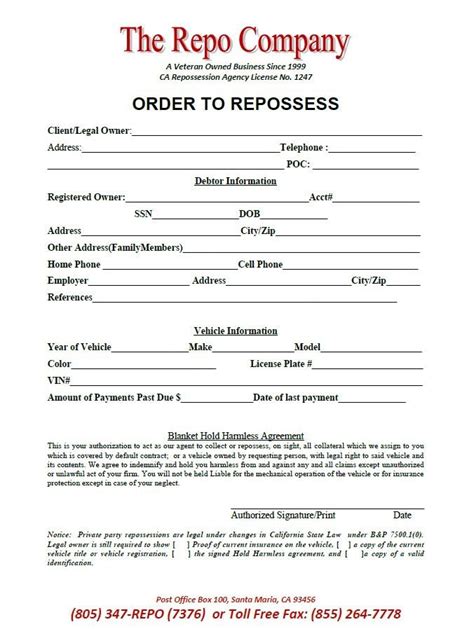

Repo paperwork typically includes several key components, each designed to address specific aspects of the repurchase agreement. These components may include: - Master Repurchase Agreement: This is the primary document that outlines the general terms and conditions under which the parties will enter into repurchase transactions. It is often drafted based on standard templates provided by industry associations but may be customized to fit the specific needs of the parties involved. - Confirmation: After each trade, a confirmation is issued, detailing the specific terms of that particular transaction, such as the type and quantity of securities, the sale and repurchase prices, and the settlement dates. - Margin Call Provisions: These provisions outline the procedures for when the value of the securities sold under the agreement fluctuates, requiring one party to provide additional collateral (margin) to the other to maintain the agreed-upon level of protection against potential losses. - Default and Termination Provisions: These clauses specify the circumstances under which the agreement may be terminated and the procedures for handling defaults by either party, ensuring that both parties understand their rights and obligations in such situations.

5 Tips for Managing Repo Paperwork Effectively

Managing repo paperwork effectively is crucial for minimizing risks and ensuring that repurchase agreements are executed efficiently. Here are five tips for doing so: 1. Ensure Thorough Understanding: It is essential for all parties involved to have a thorough understanding of the terms and conditions outlined in the repo paperwork. This includes not just the legal and financial teams but also the operational staff who will be responsible for executing the transactions. 2. Use Standardized Templates: Utilizing standardized templates for master repurchase agreements and confirmations can help streamline the process and reduce the risk of errors or omissions. These templates are often provided by industry associations and can be tailored to meet the specific needs of the parties. 3. Automate Where Possible: Leveraging technology to automate aspects of repo paperwork, such as generating confirmations or tracking margin calls, can significantly reduce administrative burdens and minimize the potential for human error. 4. Maintain Accurate Records: Keeping accurate, detailed, and easily accessible records of all repo transactions and related paperwork is vital. This not only aids in the smooth operation of current agreements but also provides valuable information for auditing and compliance purposes. 5. Regularly Review and Update: Financial regulations and market conditions are subject to change, and repo paperwork should be regularly reviewed and updated to ensure compliance with current laws and standards. This also provides an opportunity to refine processes and improve efficiency based on lessons learned from past transactions.

Implementing Effective Repo Paperwork Management

Implementing effective repo paperwork management involves a combination of understanding the legal and financial aspects of repurchase agreements, utilizing appropriate technology, and maintaining meticulous records. By following the tips outlined above and staying informed about best practices in the industry, financial institutions can navigate the complexities of repo paperwork with greater ease and confidence.

| Component | Description |

|---|---|

| Master Repurchase Agreement | Outlines general terms and conditions |

| Confirmation | Details specific terms of each transaction |

| Margin Call Provisions | Specifies procedures for handling value fluctuations |

| Default and Termination Provisions | Outlines circumstances and procedures for agreement termination |

📝 Note: Regular review of repo paperwork is essential to ensure it remains compliant with changing financial regulations and market conditions.

In summary, the management of repo paperwork is a critical aspect of repurchase agreements, requiring a thorough understanding of the components involved, the effective use of technology, and a commitment to maintaining accurate and up-to-date records. By adopting best practices and staying abreast of industry developments, financial institutions can navigate the complexities of repo paperwork with greater ease, minimize risks, and maximize the benefits of repurchase agreements.

What is a repurchase agreement?

+

A repurchase agreement, or repo, is a financial transaction in which one party sells securities to another party with an agreement to repurchase them at a later date, often with a fixed price.

Why is repo paperwork important?

+

Repo paperwork is crucial because it provides a legal framework that outlines the terms and conditions of the transaction, protecting both parties and ensuring the transaction is executed smoothly.

What are the key components of repo paperwork?

+

The key components include the Master Repurchase Agreement, confirmation, margin call provisions, and default and termination provisions.