Shareholders on Company Paperwork

Understanding Shareholders and Their Role in Company Paperwork

When it comes to the financial and legal aspects of a company, shareholders play a crucial role. They are the owners of the company, and their names are typically listed on various company documents. In this blog post, we will delve into the world of shareholders and explore their significance in company paperwork.

Who Are Shareholders?

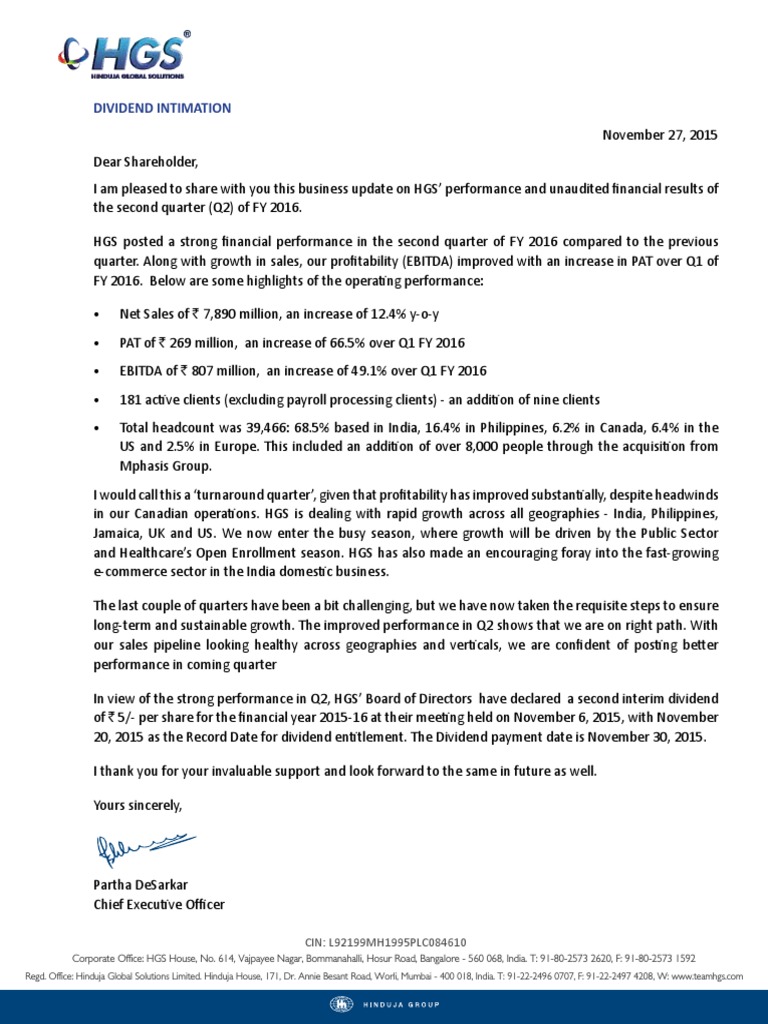

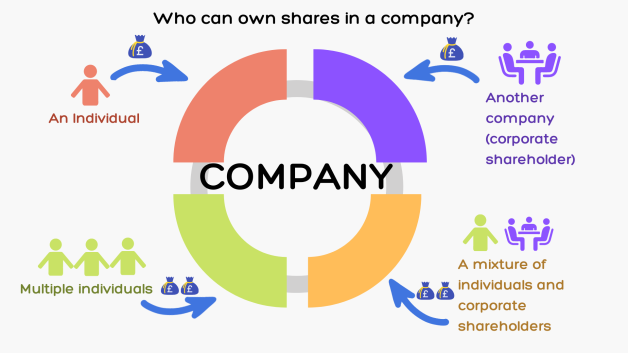

Shareholders, also known as stockholders, are individuals or organizations that own shares of a company’s stock. They can be institutional investors, such as pension funds or mutual funds, or individual investors, like private citizens. Shareholders have a vested interest in the company’s performance and are entitled to receive a portion of the company’s profits in the form of dividends.

Types of Shareholders

There are several types of shareholders, including: * Common shareholders: They own common stock and have voting rights. * Preferred shareholders: They own preferred stock and have priority over common shareholders when it comes to receiving dividends and assets in the event of liquidation. * Majority shareholders: They own more than 50% of the company’s outstanding shares and have significant control over the company’s decisions. * Minority shareholders: They own less than 50% of the company’s outstanding shares and may have limited voting power.

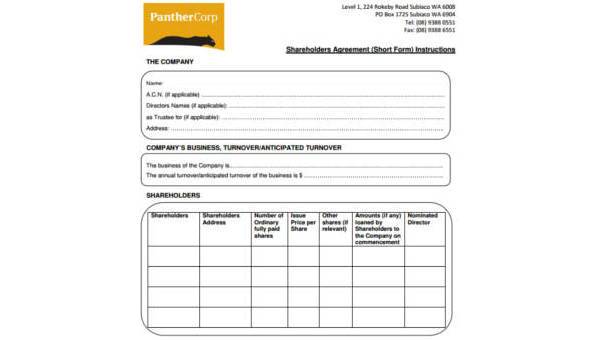

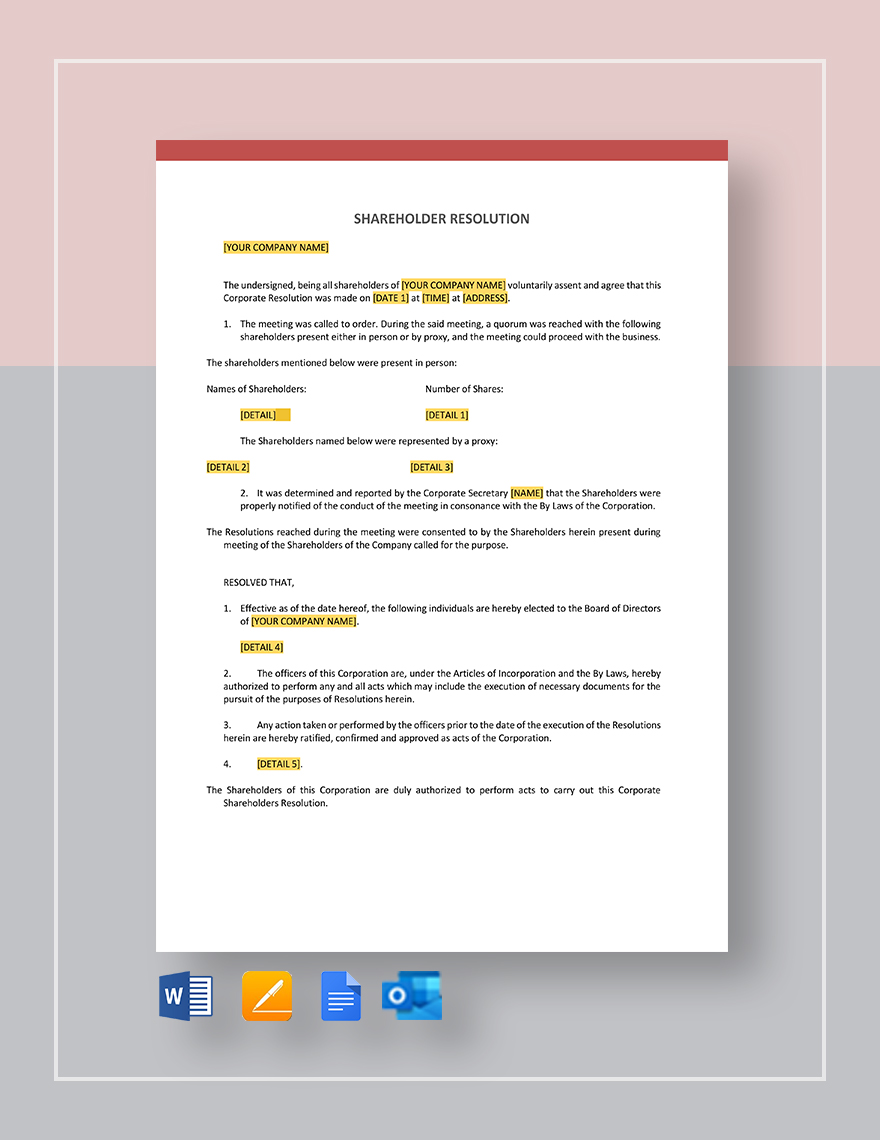

Shareholder Information on Company Paperwork

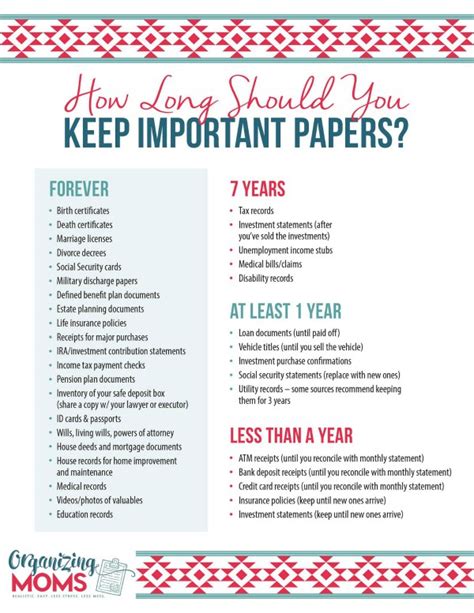

Shareholder information is typically listed on various company documents, such as: * Articles of Incorporation: This document outlines the company’s purpose, structure, and ownership. * Bylaws: This document outlines the company’s rules and procedures for governance and operations. * Stock certificates: These certificates represent ownership of a specific number of shares. * Shareholder agreements: These agreements outline the rights and obligations of shareholders.

📝 Note: It is essential to keep accurate and up-to-date records of shareholder information to ensure compliance with regulatory requirements and to prevent disputes.

Importance of Accurate Shareholder Records

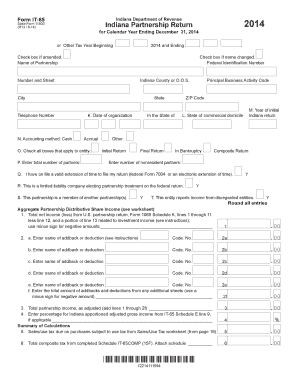

Maintaining accurate and complete shareholder records is crucial for several reasons: * Compliance with regulations: Companies must comply with various laws and regulations, such as securities laws and tax laws. * Prevention of disputes: Accurate records can help prevent disputes among shareholders and between shareholders and the company. * Facilitation of transactions: Accurate records can facilitate the transfer of shares and other transactions.

Best Practices for Managing Shareholder Information

To ensure accurate and efficient management of shareholder information, companies should: * Use a centralized database: This can help to keep track of shareholder information and ensure that it is up-to-date. * Implement robust security measures: This can help to protect sensitive shareholder information from unauthorized access. * Regularly review and update records: This can help to ensure that shareholder information is accurate and complete.

Challenges and Opportunities

Managing shareholder information can be challenging, especially for large companies with complex ownership structures. However, there are also opportunities for companies to leverage technology and best practices to improve the efficiency and accuracy of shareholder record-keeping.

| Challenge | Opportunity |

|---|---|

| Complex ownership structures | Use of technology to simplify record-keeping |

| Inaccurate or incomplete records | Implementation of robust security measures to protect shareholder information |

| Compliance with regulations | Use of centralized databases to facilitate compliance |

In summary, shareholders play a vital role in company paperwork, and accurate management of shareholder information is essential for compliance, prevention of disputes, and facilitation of transactions. By implementing best practices and leveraging technology, companies can improve the efficiency and accuracy of shareholder record-keeping.

To wrap things up, it’s clear that shareholders are a crucial aspect of a company’s structure and operations. By understanding the different types of shareholders, the importance of accurate shareholder records, and the best practices for managing shareholder information, companies can ensure that they are well-equipped to handle the challenges and opportunities that come with managing shareholder information.

What is the difference between a common shareholder and a preferred shareholder?

+

Common shareholders own common stock and have voting rights, while preferred shareholders own preferred stock and have priority over common shareholders when it comes to receiving dividends and assets in the event of liquidation.

Why is it important to keep accurate shareholder records?

+

Accurate shareholder records are essential for compliance with regulations, prevention of disputes, and facilitation of transactions.

What are some best practices for managing shareholder information?

+

Some best practices for managing shareholder information include using a centralized database, implementing robust security measures, and regularly reviewing and updating records.