Paperwork

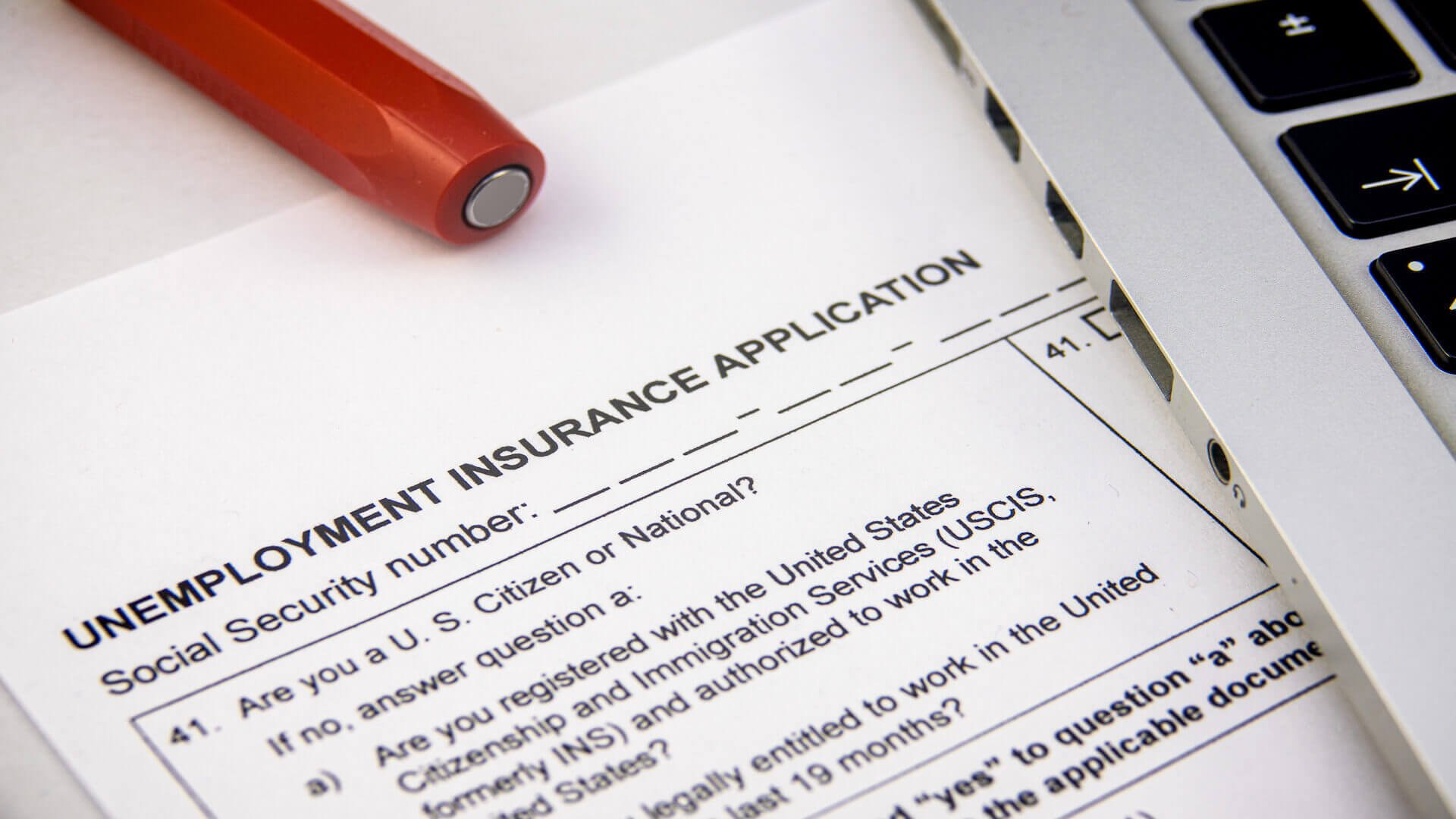

Unemployment Paperwork for Tax Filing

Understanding Unemployment Benefits and Tax Filing

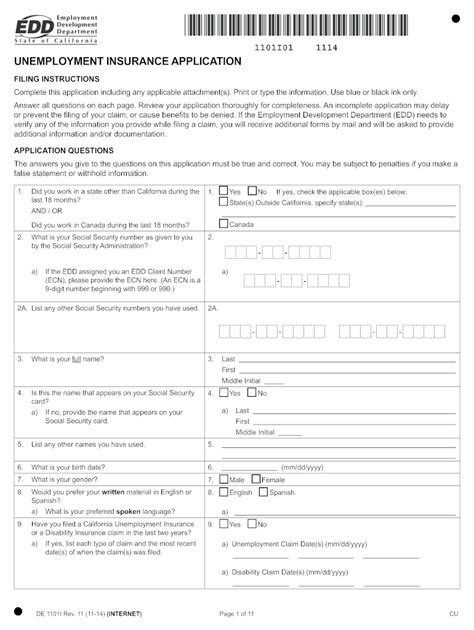

When individuals lose their jobs, they often rely on unemployment benefits to support themselves until they find new employment. However, these benefits are considered taxable income by the government. As a result, it’s essential to understand the relationship between unemployment benefits and tax filing. In this article, we’ll delve into the world of unemployment paperwork for tax filing, exploring the key concepts, requirements, and best practices for navigating this complex process.

The Taxation of Unemployment Benefits

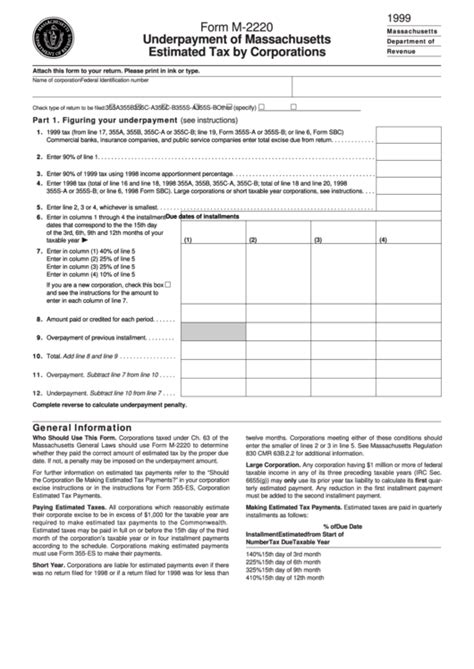

Unemployment benefits are subject to federal income tax and may also be taxable at the state level. The taxation of these benefits can be a significant burden for individuals who are already struggling financially. To make matters more complicated, the taxation of unemployment benefits can vary depending on the individual’s overall income, filing status, and other factors. It’s crucial to understand that unemployment benefits are reported on a Form 1099-G, which is issued by the state or federal government.

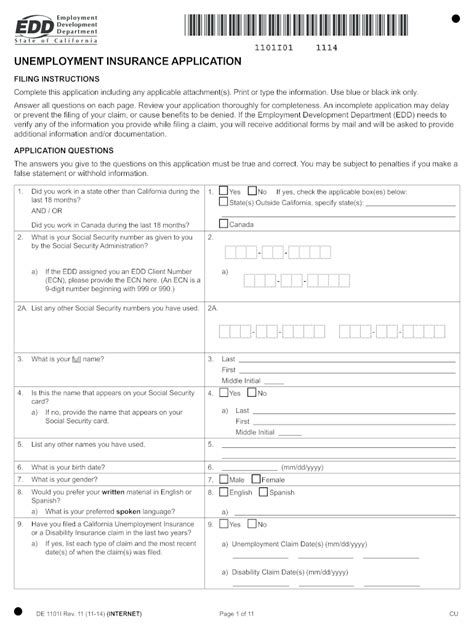

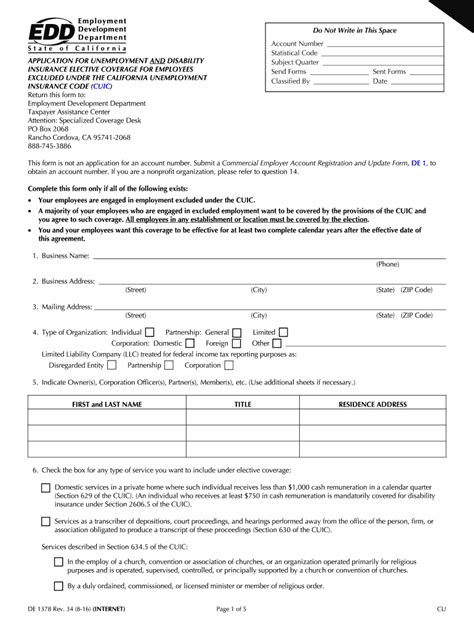

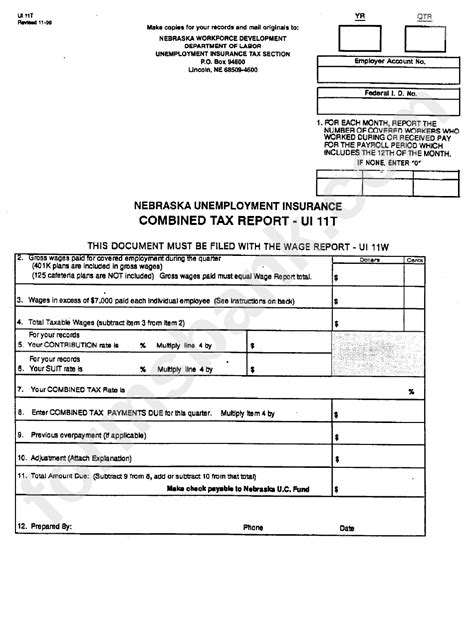

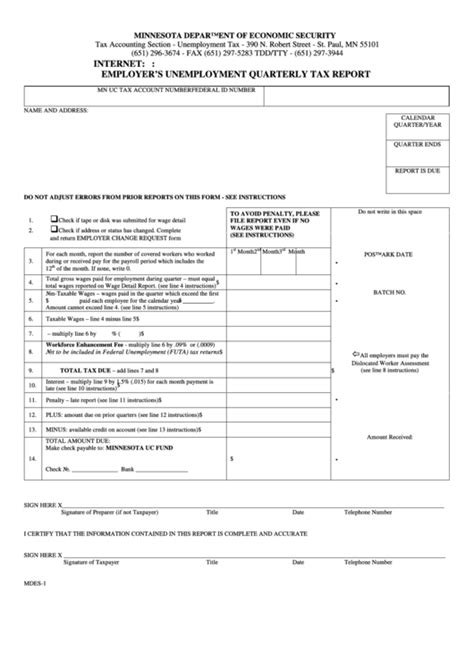

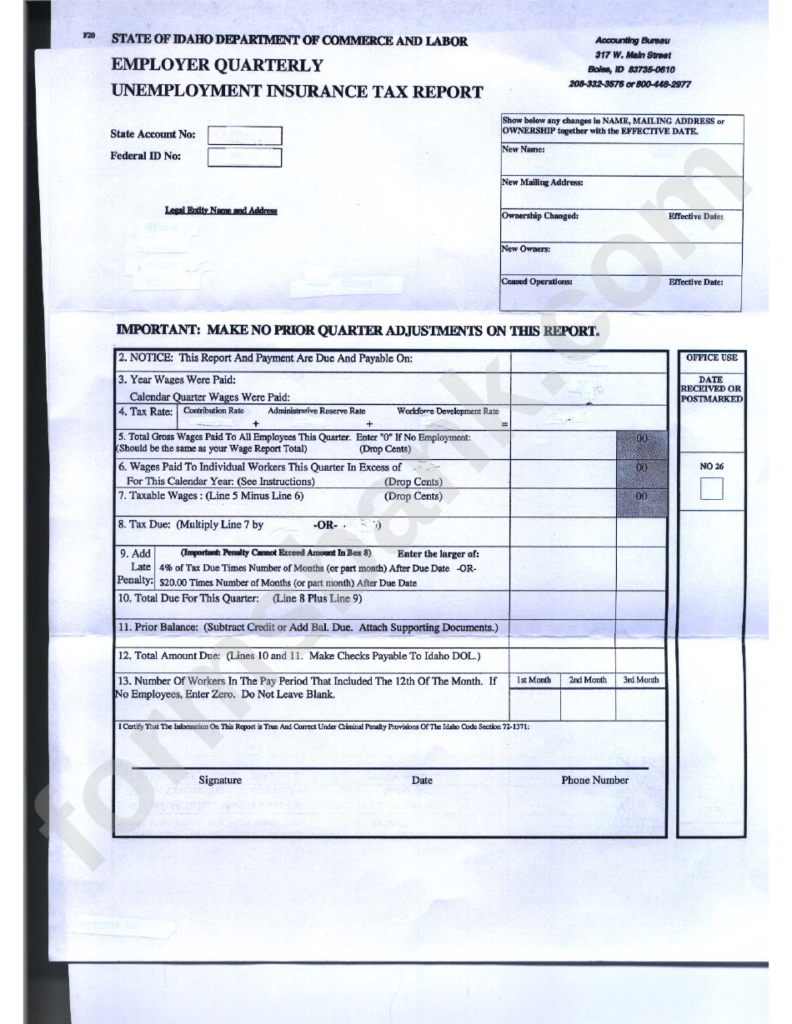

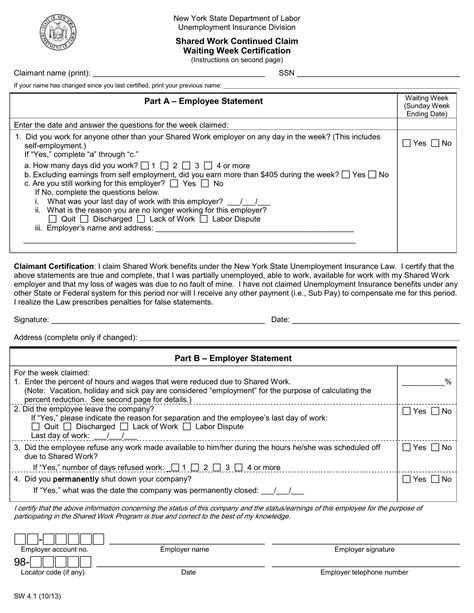

Gathering Necessary Documents

To accurately report unemployment benefits on tax returns, individuals need to gather the necessary documents. These may include: * Form 1099-G, which shows the total amount of unemployment benefits received * Form W-2, which reports any wages earned during the tax year * Other income statements, such as interest statements or dividend statements * Deduction records, such as charitable contributions or medical expenses It’s essential to keep accurate records of all income and expenses to ensure accurate tax reporting.

Reporting Unemployment Benefits on Tax Returns

When reporting unemployment benefits on tax returns, individuals need to follow specific guidelines. The benefits are reported on Line 7 of Form 1040, and the individual must also complete Schedule 1 to report the benefits. It’s essential to accurately report the benefits to avoid any potential penalties or audits.

Claiming Deductions and Credits

While unemployment benefits are taxable, individuals may be eligible for deductions and credits that can help reduce their tax liability. Some common deductions and credits include: * Earned Income Tax Credit (EITC): A refundable credit for low-income working individuals * Child Tax Credit: A credit for families with qualifying children * Mortgage Interest Deduction: A deduction for homeowners who pay mortgage interest * Charitable Contribution Deduction: A deduction for donations to qualified charitable organizations Individuals should consult with a tax professional to determine which deductions and credits they may be eligible for.

Tax Filing Options

Individuals have several options for filing their tax returns, including: * E-filing: Electronic filing through the IRS website or tax software * Paper filing: Mailing a paper return to the IRS * Tax preparation services: Hiring a tax professional to prepare and file the return E-filing is generally the fastest and most convenient option, but individuals should choose the method that best suits their needs.

📝 Note: It's essential to file tax returns accurately and on time to avoid any potential penalties or audits.

Avoiding Common Mistakes

When filing tax returns, individuals should be aware of common mistakes that can lead to delays or penalties. Some common mistakes include: * Inaccurate reporting of income: Failing to report all income, including unemployment benefits * Incorrect deductions: Claiming deductions that are not eligible or exceeding deduction limits * Missing signatures: Failing to sign the tax return or attachments * Inadequate records: Failing to keep accurate records of income and expenses Individuals should double-check their returns for accuracy and completeness before filing.

Conclusion and Next Steps

In conclusion, navigating the complex world of unemployment paperwork for tax filing requires attention to detail and a thorough understanding of tax laws and regulations. By gathering necessary documents, reporting unemployment benefits accurately, and claiming eligible deductions and credits, individuals can minimize their tax liability and avoid potential penalties. As individuals move forward with their tax filing, they should remember to stay organized, seek professional help when needed, and prioritize accuracy and completeness in their tax returns.

What is the deadline for filing tax returns?

+

The deadline for filing tax returns is typically April 15th of each year, but it may be extended in certain circumstances.

Can I claim deductions for job search expenses?

+

Yes, individuals may be eligible to claim deductions for job search expenses, such as resume preparation, travel, and job placement agency fees.

How do I report unemployment benefits on my tax return?

+

Unemployment benefits are reported on Line 7 of Form 1040, and individuals must also complete Schedule 1 to report the benefits.