Hire Employee in WY Paperwork

Introduction to Hiring Employees in Wyoming

When it comes to hiring employees in Wyoming, there are several steps and paperwork requirements that employers must follow. This process can seem daunting, but with the right guidance, it can be navigated efficiently. Understanding the legal and administrative aspects of hiring is crucial for both the employer and the employee. In this article, we will delve into the specifics of the paperwork required for hiring an employee in Wyoming, ensuring that all parties involved are well-informed and compliant with state and federal regulations.

Pre-Hire Paperwork and Procedures

Before the actual hiring process begins, there are several pre-hire paperwork and procedures that need to be addressed. These include: - Job Description: Clearly outlining the job’s responsibilities, requirements, and expectations. - Job Posting: Advertisements for the job, which must comply with equal employment opportunity laws. - Application Forms: Designed to gather relevant information from applicants without infringing on their rights. - Interview Process: Conducted fairly and without discrimination, focusing on the applicant’s qualifications and fit for the role.

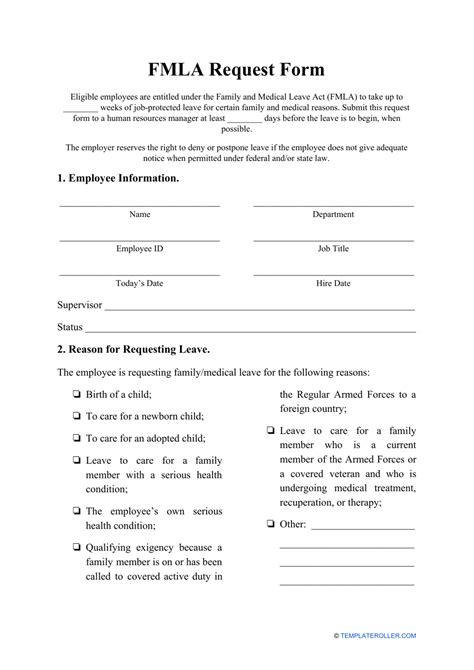

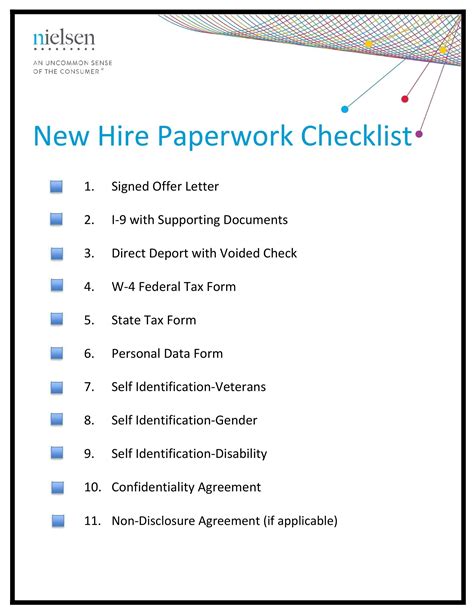

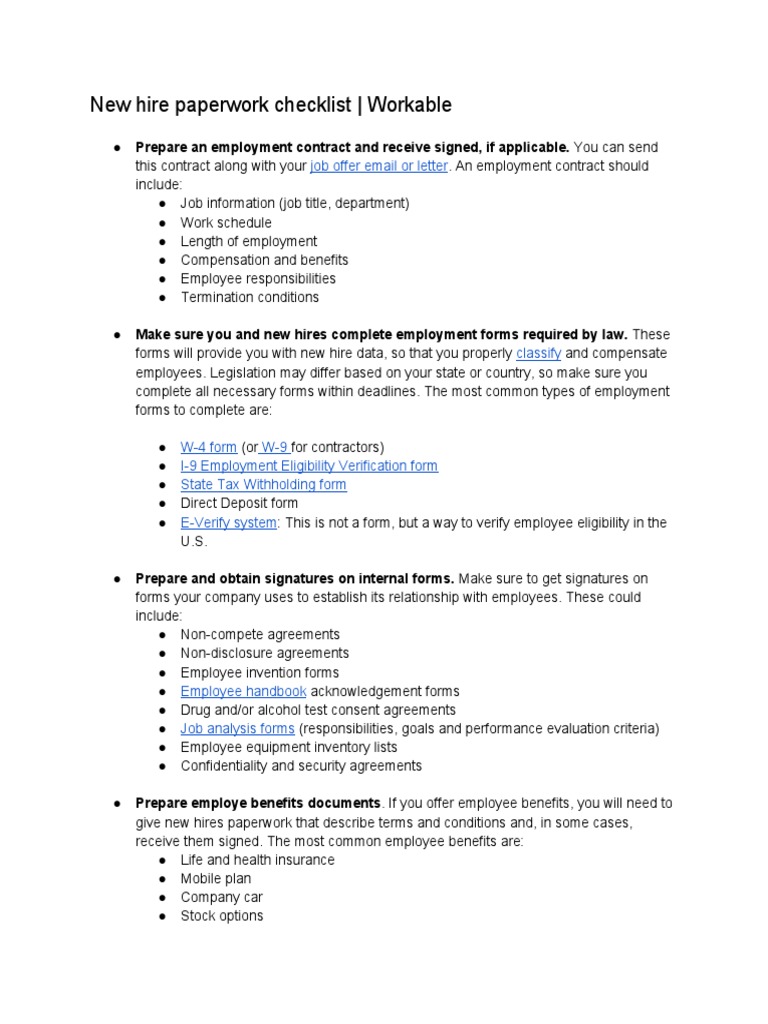

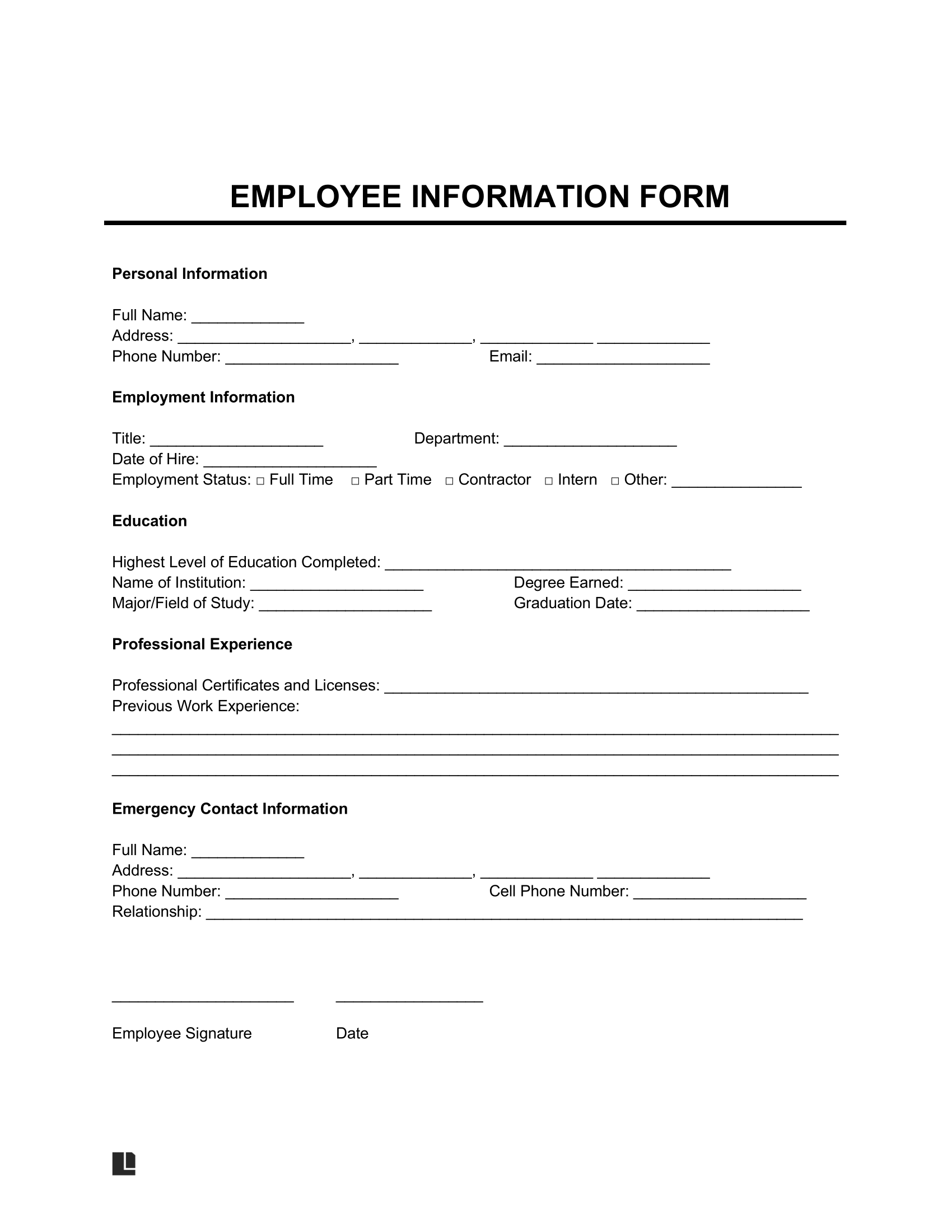

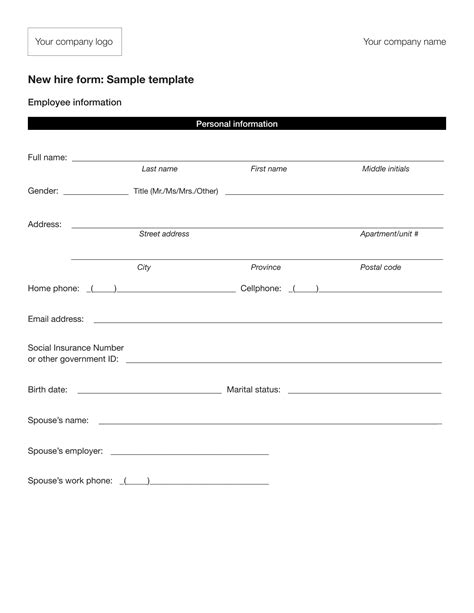

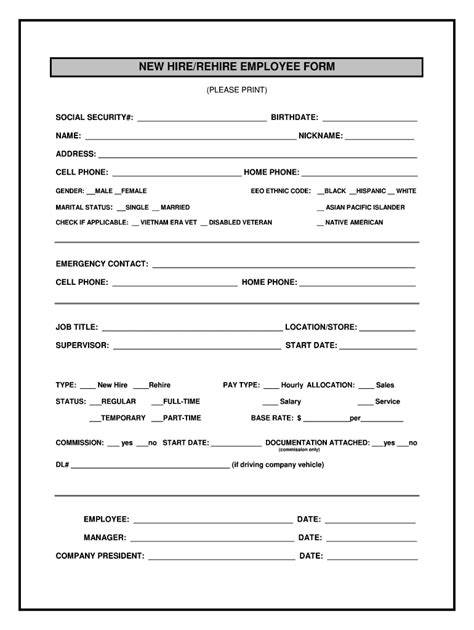

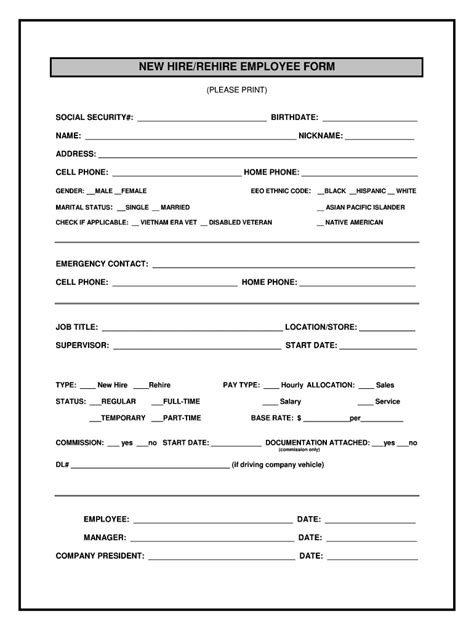

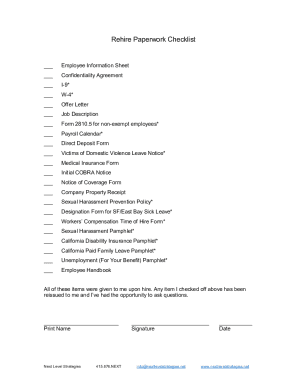

New Hire Paperwork

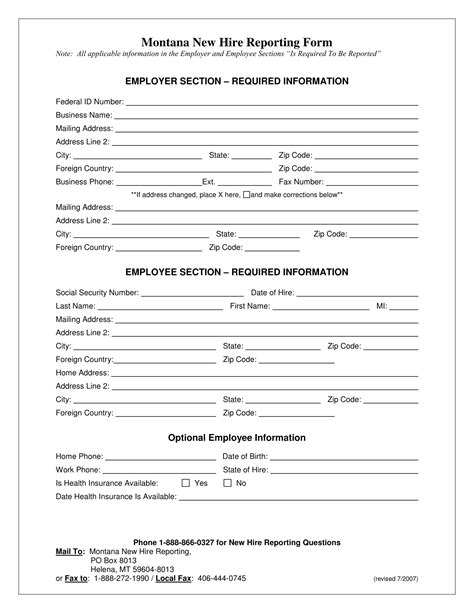

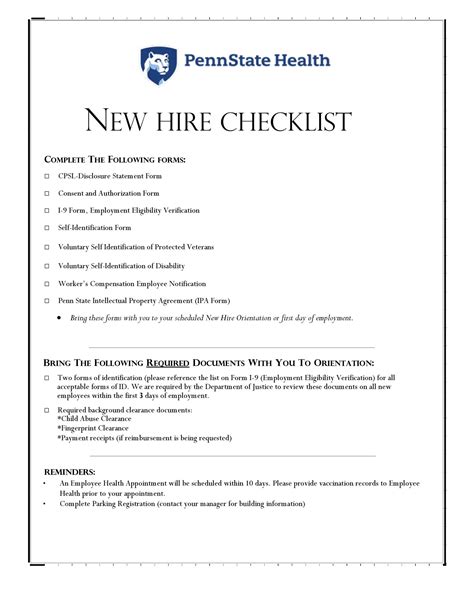

Once a candidate is selected for the position, the new hire paperwork comes into play. This is a critical step as it involves the collection and processing of personal and employment-related information. Key documents and forms include: - W-4 Form: For federal income tax withholding. - I-9 Form: To verify the employee’s identity and employment authorization. - Wyoming New Hire Reporting Form: For reporting new hires to the state. - Benefits Enrollment Forms: If the employer offers health insurance, retirement plans, or other benefits. - Employee Handbook Acknowledgement: Confirming that the employee has received and understood the company’s policies and procedures.

Employer Obligations and Compliance

Employers in Wyoming have several obligations and compliance requirements to adhere to, including: - Workers’ Compensation Insurance: Mandatory for most employers to cover work-related injuries or illnesses. - Unemployment Insurance: Contributions are required from employers to fund unemployment benefits. - Federal and State Labor Laws: Compliance with laws regarding minimum wage, overtime, and working conditions. - Poster Requirements: Displaying required posters in the workplace, informing employees of their rights under various labor laws.

Tax Compliance for Employers

Tax compliance is another vital aspect of hiring employees. Employers must: - Obtain an Employer Identification Number (EIN) from the IRS. - Register with the Wyoming Department of Employment for unemployment insurance. - Comply with federal and state tax withholding and reporting requirements. - File quarterly tax returns and annual reports as required.

Best Practices for Employee Onboarding

A well-structured onboarding process is essential for integrating new employees into the organization efficiently. Best practices include: - Comprehensive Orientation: Providing a thorough introduction to the company, its culture, and the job expectations. - Training and Support: Offering necessary training and ongoing support to ensure the employee’s success in their role. - Regular Feedback: Encouraging open communication and providing regular feedback to help the employee grow and adapt.

📝 Note: Employers should maintain accurate and detailed records of all hiring processes, including applications, interviews, and onboarding documentation, to ensure compliance with legal requirements and to protect against potential disputes or audits.

Wyoming Labor Laws and Regulations

Understanding Wyoming labor laws and regulations is critical for employers. This includes knowledge of: - Minimum Wage: Wyoming follows the federal minimum wage. - Overtime: Paying overtime to non-exempt employees as mandated by federal law. - Leave Laws: Compliance with federal and state leave laws, including FMLA and any applicable state-specific leave requirements. - Workplace Safety: Maintaining a safe work environment and complying with OSHA regulations.

| Document/Form | Purpose |

|---|---|

| W-4 Form | Federal Income Tax Withholding |

| I-9 Form | Verify Identity and Employment Authorization |

| Wyoming New Hire Reporting Form | Report New Hires to the State |

In essence, hiring an employee in Wyoming involves a thorough process that includes pre-hire preparations, new hire paperwork, and ongoing compliance with labor laws and tax requirements. By understanding and adhering to these requirements, employers can ensure a smooth and legal hiring process, setting the stage for a positive and productive employment relationship.

As we summarize the key points regarding the process of hiring an employee in Wyoming, it’s clear that compliance, thorough documentation, and a well-structured onboarding process are essential. Employers must be diligent in their obligations, from the initial job posting to the ongoing management of employee records and benefits. This not only helps in avoiding legal issues but also in fostering a positive work environment. The journey of hiring and managing employees is complex, but with the right approach, it can be navigated effectively, benefiting both the employer and the employee.

What is the minimum wage in Wyoming?

+

Wyoming follows the federal minimum wage, which is subject to change, so it’s essential to check the current rate.

Do I need to register with the state for unemployment insurance?

+

Yes, most employers in Wyoming are required to contribute to the state’s unemployment insurance fund.

How do I report new hires to the state of Wyoming?

+

You will need to submit a new hire report to the Wyoming Department of Employment, which can usually be done online or by mail, using the Wyoming New Hire Reporting Form.