5 FMLA Fee Facts

Introduction to FMLA Fee Facts

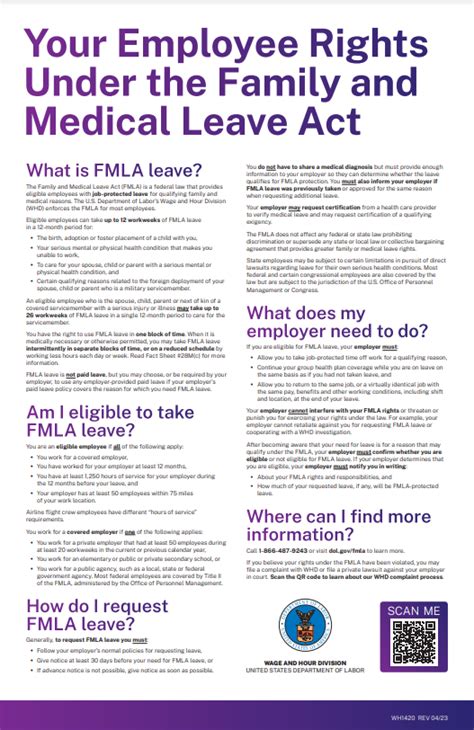

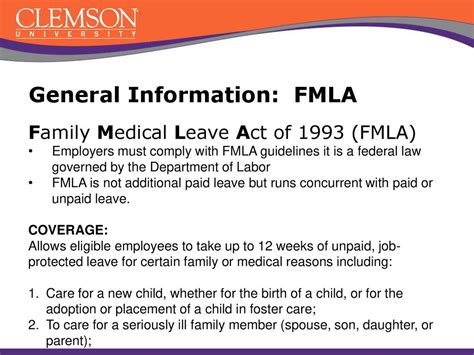

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the FMLA itself does not require employers to pay employees during their leave, there are various fees associated with administering the law. Understanding these fees is crucial for employers to ensure compliance and for employees to know their rights. In this article, we will delve into 5 key FMLA fee facts that are essential for both employers and employees.

Understanding FMLA Administration Fees

Employers often incur costs when administering the FMLA, including the time spent by HR personnel to manage leave requests, communicate with employees, and ensure compliance with the law. These administration fees can be significant, especially for small businesses with limited HR resources. It’s essential for employers to factor these costs into their overall benefits package and to explore ways to streamline their FMLA administration processes to minimize expenses.

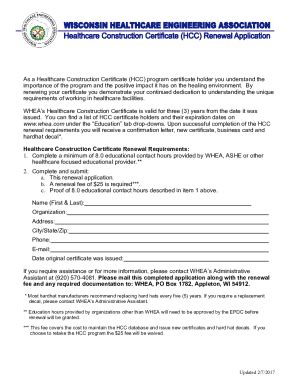

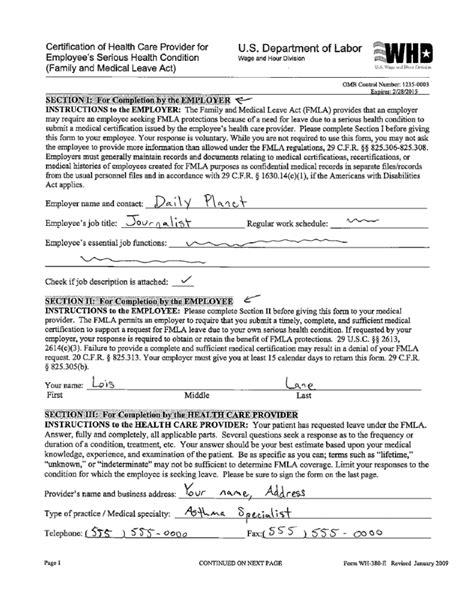

Medical Certification Fees

One of the fees directly associated with the FMLA is the cost of obtaining medical certification. When an employee requests FMLA leave for a serious health condition, the employer may require a medical certification from a healthcare provider to substantiate the need for leave. The employee is responsible for the cost of obtaining this certification, which can include doctor’s fees for completing the certification form. Employers should be aware of these requirements and communicate them clearly to employees to avoid any misunderstandings.

Temporary Replacement Fees

While the FMLA does not require employers to pay employees during their leave, employers may incur costs associated with finding temporary replacements for employees on leave. These fees can include recruitment costs, training expenses for temporary staff, and potentially higher wages for contract workers. Employers should consider these costs when planning for employee leaves and explore strategies to minimize disruption to their operations, such as cross-training existing staff or using temporary employment agencies.

Tax Implications and Fees

There are also tax implications and potential fees associated with the FMLA, particularly for employers who choose to offer paid family leave as part of their benefits package. The Tax Cuts and Jobs Act of 2017 introduced a tax credit for employers that provide paid family and medical leave, which can help offset the costs of offering such benefits. Understanding these tax implications is crucial for employers to maximize their benefits and minimize their tax liabilities.

Compliance and Penalty Fees

Finally, employers must be aware of the potential fees and penalties associated with non-compliance with the FMLA. Failure to provide eligible employees with their FMLA rights can result in legal action, including lawsuits and fines from the U.S. Department of Labor. Compliance with the FMLA is essential to avoid these costs, and employers should invest in training for their HR personnel and managers to ensure they understand their obligations under the law.

📝 Note: Employers should regularly review their FMLA policies and procedures to ensure compliance and minimize the risk of legal action.

In summary, the administration of the FMLA involves various fees that employers and employees should be aware of. From administration and medical certification fees to temporary replacement and compliance costs, understanding these expenses is key to navigating the complexities of the FMLA. By being informed and proactive, employers can ensure compliance, minimize costs, and support their employees during times of need.

What is the purpose of the FMLA?

+

The Family and Medical Leave Act (FMLA) is designed to provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons, balancing the demands of the workplace with the needs of families and personal health.

Who pays for the medical certification required for FMLA leave?

+

The employee is responsible for the cost of obtaining medical certification to substantiate the need for FMLA leave.

Are employers required to pay employees during FMLA leave?

+

No, the FMLA does not require employers to pay employees during their leave. However, employers may choose to offer paid family leave as part of their benefits package, and there may be tax implications and credits associated with such benefits.