PPO Service Without Paperwork

Introduction to PPO Service

The era of digital transformation has revolutionized the way businesses operate, and the insurance industry is no exception. One of the significant advancements in this sector is the introduction of Paperless PPO (Preferred Provider Organization) services. Traditional PPO services often involve a plethora of paperwork, which can be time-consuming and inefficient. However, with the advent of digital technology, it is now possible to enjoy PPO services without the hassle of paperwork.

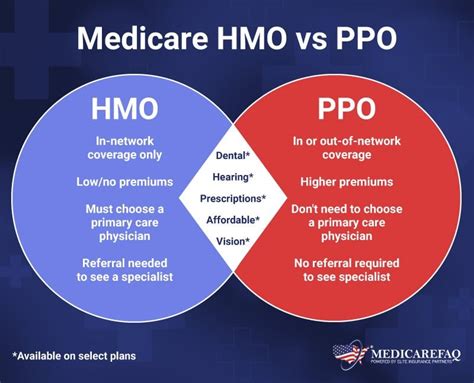

Understanding PPO Services

Before diving into the details of paperless PPO services, it’s essential to understand what PPO services entail. A PPO is a type of health insurance plan that allows policyholders to receive medical care from a network of participating providers. These providers have agreed to offer discounted services to the insurance company’s clients. The primary benefit of PPO services is that they provide policyholders with a wide range of options for medical care, including the freedom to choose their preferred healthcare provider.

Benefits of Paperless PPO Services

The introduction of paperless PPO services has numerous benefits for both policyholders and insurance providers. Some of the advantages of paperless PPO services include: * Increased Efficiency: Paperless PPO services eliminate the need for manual paperwork, which can be time-consuming and prone to errors. Digital documentation and automated processes streamline the claims process, reducing the time it takes to settle claims. * Reduced Costs: Paperless PPO services minimize the need for physical storage and paperwork, resulting in significant cost savings for insurance providers. These savings can be passed on to policyholders in the form of lower premiums. * Enhanced Security: Digital documentation and automated processes reduce the risk of data breaches and unauthorized access to sensitive information. * Improved Accuracy: Paperless PPO services minimize the risk of errors and inaccuracies associated with manual paperwork.

How Paperless PPO Services Work

Paperless PPO services utilize digital technology to facilitate the claims process and other administrative tasks. Here’s an overview of how paperless PPO services work: * Digital Documentation: Policyholders can upload their medical bills and other relevant documents to the insurance provider’s online portal. * Automated Claims Processing: The insurance provider’s system reviews the uploaded documents and processes the claims automatically. * Electronic Payments: Once the claim is approved, the insurance provider makes payments to the policyholder or the healthcare provider electronically.

Key Features of Paperless PPO Services

Some of the key features of paperless PPO services include: * Online Portal: A user-friendly online portal where policyholders can upload documents, track claims, and access their policy information. * Mobile App: A mobile app that allows policyholders to access their policy information and upload documents on-the-go. * Automated Reminders: The system sends automated reminders to policyholders about upcoming payments, claims status, and other important notifications. * Real-time Updates: Policyholders can track the status of their claims in real-time, reducing the need for phone calls and emails.

Advantages for Policyholders

Paperless PPO services offer numerous advantages for policyholders, including: * Convenience: Policyholders can access their policy information and upload documents from anywhere, at any time. * Speed: Automated claims processing and electronic payments reduce the time it takes to settle claims. * Accuracy: Digital documentation and automated processes minimize the risk of errors and inaccuracies. * Cost Savings: Policyholders can enjoy lower premiums due to the reduced administrative costs associated with paperless PPO services.

Challenges and Limitations

While paperless PPO services offer numerous benefits, there are also some challenges and limitations to consider: * Technical Issues: Technical issues, such as system downtime or glitches, can disrupt the claims process. * Security Concerns: The risk of data breaches and cyber attacks is a concern for paperless PPO services. * Regulatory Compliance: Insurance providers must ensure that their paperless PPO services comply with relevant regulations and laws.

📝 Note: Insurance providers must implement robust security measures to protect sensitive policyholder information and ensure compliance with regulatory requirements.

Future of Paperless PPO Services

The future of paperless PPO services looks promising, with advancements in digital technology and artificial intelligence expected to further streamline the claims process and improve policyholder experience. Some of the trends that are expected to shape the future of paperless PPO services include: * Artificial Intelligence: AI-powered chatbots and virtual assistants are expected to play a key role in improving policyholder engagement and claims processing. * Blockchain Technology: Blockchain technology is expected to enhance the security and transparency of paperless PPO services. * Personalized Medicine: Paperless PPO services are expected to play a key role in personalized medicine, enabling policyholders to access tailored healthcare services and treatments.

In summary, paperless PPO services offer numerous benefits for both policyholders and insurance providers, including increased efficiency, reduced costs, and enhanced security. While there are challenges and limitations to consider, the future of paperless PPO services looks promising, with advancements in digital technology and artificial intelligence expected to further improve the policyholder experience.

What is a PPO service?

+

A PPO service is a type of health insurance plan that allows policyholders to receive medical care from a network of participating providers.

How do paperless PPO services work?

+

Paperless PPO services utilize digital technology to facilitate the claims process and other administrative tasks, including digital documentation, automated claims processing, and electronic payments.

What are the benefits of paperless PPO services?

+

The benefits of paperless PPO services include increased efficiency, reduced costs, enhanced security, and improved accuracy.