5 Ways Claim PPI

Introduction to PPI Claims

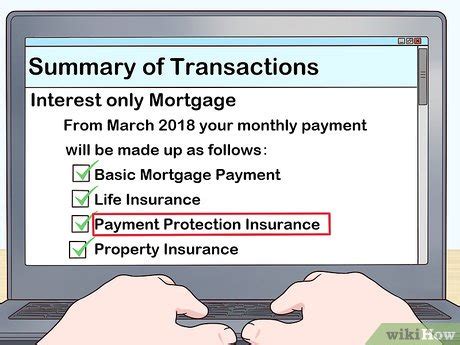

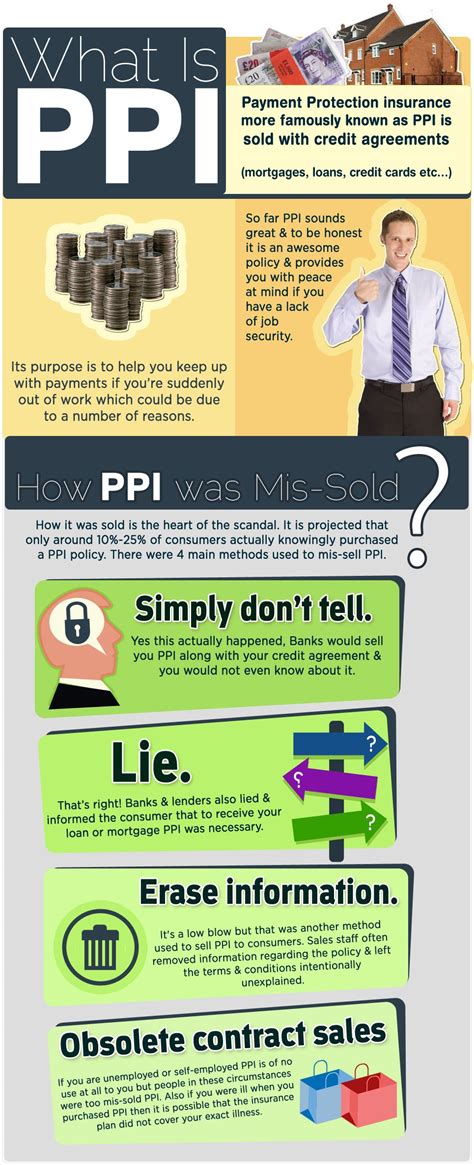

Payment Protection Insurance (PPI) was widely sold by banks and other financial institutions alongside loans, credit cards, and mortgages. The intention behind PPI was to cover repayments if the policyholder became unable to work due to illness, injury, or redundancy. However, it was often mis-sold, leaving many consumers with policies they didn’t need or couldn’t use. The mis-selling of PPI has led to a massive scandal in the financial industry, with billions of pounds being paid out in compensation. If you believe you were mis-sold PPI, here are 5 ways to claim it back.

Understanding Your Eligibility

Before proceeding with a claim, it’s essential to understand if you’re eligible. You might be eligible for a PPI claim if you were sold PPI alongside a financial product without your knowledge, if the seller did not properly explain the terms and conditions, or if you were told it was compulsory. Additionally, if you were not informed that the policy had a cooling-off period or if the seller failed to check if the policy was suitable for your needs, you could be eligible for a claim.

Method 1: Claim Directly from the Bank

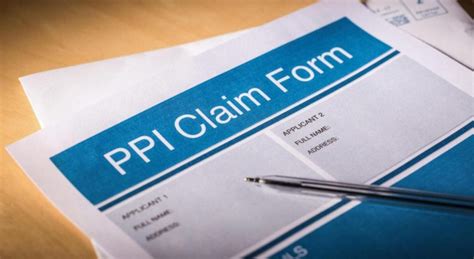

One of the most straightforward ways to claim PPI is directly from the bank or financial institution that sold it to you. Start by gathering all relevant documents, including loan or credit agreements, statements showing PPI payments, and any correspondence related to the PPI policy. You’ll need to write to the bank, explaining why you believe the PPI was mis-sold and including all supporting evidence. The bank will then investigate your claim and may request additional information.

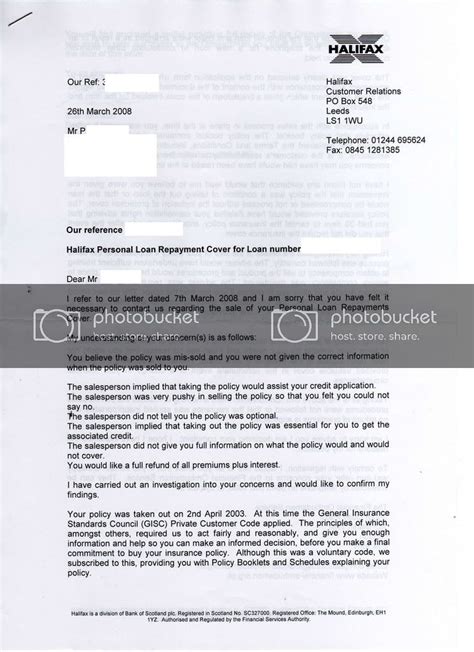

Method 2: Use a Claims Management Company

If the thought of dealing directly with the bank seems daunting, or if your initial claim is rejected, you might consider using a claims management company. These companies specialize in handling PPI claims and can guide you through the process. However, be cautious of fees, as some companies may charge a significant portion of your compensation. Ensure you understand the terms, including any fees, before proceeding.

Method 3: Claim through the Financial Ombudsman Service (FOS)

If your claim is rejected by the bank, or if you’re not satisfied with the response, you can take your complaint to the Financial Ombudsman Service (FOS). The FOS is an independent service that can help resolve disputes between consumers and financial institutions. They will investigate your claim and make a decision based on what is fair and reasonable. Their service is free, making it a more cost-effective option compared to using a claims management company.

Method 4: Use a Template Letter

For those who prefer a more DIY approach, using a template letter can be an effective way to initiate a PPI claim. These letters are readily available online and can be customized to include your personal details and the specifics of your claim. They provide a clear structure for expressing your grievance and can help ensure you include all necessary information. After customizing the letter, send it to the bank and wait for their response.

Method 5: Contact the Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) is the regulatory body overseeing the financial services industry in the UK. While they cannot handle individual claims, they can provide guidance on how to proceed with a PPI claim and offer information on your rights as a consumer. They also have a deadline for making PPI claims, which is useful to know to ensure your claim is submitted on time.

📝 Note: Always keep detailed records of your claim, including dates of correspondence and the content of discussions. This will be invaluable if your claim is disputed or needs to be escalated.

In summary, claiming back mis-sold PPI requires understanding your eligibility, choosing the right method for your situation, and being prepared to provide detailed evidence. Whether you decide to claim directly from the bank, use a claims management company, go through the FOS, use a template letter, or seek guidance from the FCA, the key is to be persistent and thorough in your approach.

What is the deadline for making a PPI claim?

+

The deadline for making a PPI claim was August 29, 2019. However, claims can still be made if they are directly related to a complaint about the sale of PPI on or before this date, or if the claimant has been directly affected by the misselling of PPI.

How long does a PPI claim take to process?

+

The time it takes for a PPI claim to be processed can vary significantly. Claims handled directly by banks can take a few weeks to several months. If the claim is escalated to the FOS, it may take longer due to the high volume of complaints they handle.

What evidence do I need to support my PPI claim?

+

To support your PPI claim, you’ll need documents such as the original loan or credit agreement, statements showing PPI payments, and any correspondence related to the PPI policy. If these documents are not available, you can still make a claim, and the bank or FOS will investigate based on the information they have.