5 FMLA Fees Facts

Understanding FMLA Fees: An Overview

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the law itself does not charge fees to employees for taking leave, there are associated costs and considerations that both employers and employees should be aware of. In this article, we will delve into five key facts about FMLA fees and related expenses, helping to clarify the financial aspects of this important employee benefit.

Fact 1: Employer Costs for FMLA Administration

Employers bear the administrative costs of managing FMLA leaves, which can include the expenses of processing leave requests, maintaining required records, and ensuring compliance with FMLA regulations. These costs can vary widely depending on the size of the organization and the complexity of its leave management processes. Some employers may choose to outsource FMLA administration to third-party providers, which can incur additional fees. These fees can range from a few dollars per employee per month for basic services to significantly higher amounts for more comprehensive management solutions.

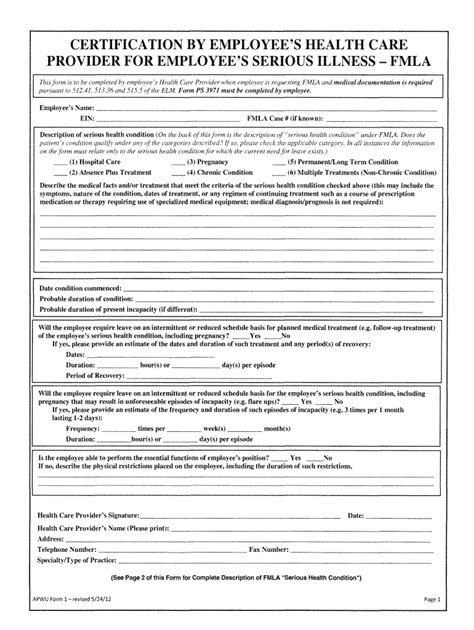

Fact 2: Employee Contributions for Health Insurance

During an FMLA leave, employers are required to continue an employee’s health insurance coverage under the same terms as if the employee had not taken leave. Employees are responsible for making their usual contributions to the cost of this health insurance coverage. If an employee fails to make these payments, the employer can recover the costs directly from the employee or, in some cases, may be able to cancel the coverage. However, the employer must provide the employee with adequate notice and opportunity to make payments before taking such actions. This aspect of FMLA can be considered a “fee” in the sense that it is an ongoing expense that employees must pay even while on leave.

Fact 3: COBRA Fees for Non-FMLA Leaves

While not directly an FMLA fee, it’s worth noting the contrast with leaves taken under the Consolidated Omnibus Budget Reconciliation Act (COBRA), which allows employees to continue health insurance coverage after a qualifying event, such as job loss. Under COBRA, employees may pay up to 102% of the full cost of the health insurance premium. This can be significantly more expensive than the contributions required during an FMLA leave, highlighting the importance of understanding the different types of leave and their associated costs.

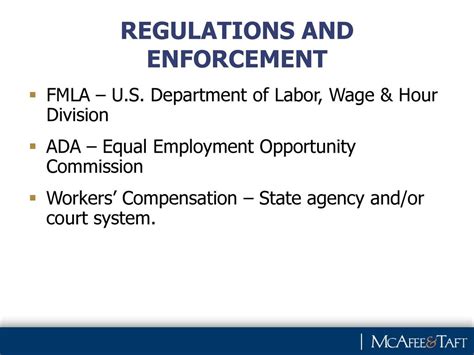

Fact 4: Third-Party Administration Fees

Some employers choose to hire third-party administrators to manage their FMLA processes. These administrators can handle tasks such as eligibility determination, leave approval, and compliance with federal and state regulations. The fees for these services can vary widely depending on the scope of services, the size of the employer, and the complexity of the leave administration. On average, these fees might range from 5 to 20 per employee per year, though this can be higher for more customized services or smaller employers where the cost per employee is distributed over a smaller base.

Fact 5: State and Local Leave Laws

In addition to federal FMLA, some states and local governments have enacted their own family and medical leave laws, which may provide greater benefits or protections than the federal law. These laws can sometimes include fees or taxes to fund paid family leave programs. For example, some states have implemented payroll taxes to fund paid family and medical leave benefits. Employees and employers need to be aware of these laws and their associated costs, as they can significantly impact the financial considerations of taking leave.

📝 Note: Employers and employees should always consult the latest regulations and legal advice to ensure compliance with both federal and local laws regarding family and medical leave.

In summary, while the FMLA itself does not charge fees to employees for taking leave, there are various costs and financial considerations associated with its administration and the continuation of health insurance benefits. Employers must navigate these expenses as part of their overall employee benefits and compliance strategies, and employees should understand their responsibilities and potential costs when taking leave under the FMLA.

What is the primary purpose of the FMLA?

+

The primary purpose of the FMLA is to provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons, balancing the demands of the workplace with the needs of families.

Are employers required to pay employees during FMLA leave?

+

No, the FMLA provides for unpaid leave. However, employees may choose to use accrued paid leave (such as vacation or sick leave) during their FMLA leave, and some employers may offer paid family leave as part of their benefits package.

Can employees take FMLA leave for any medical condition?

+

No, the FMLA covers leaves for certain serious health conditions, as defined by the law. This includes conditions that require inpatient care or continuing treatment by a healthcare provider, among other criteria.