Add LLC Before Paperwork Completion

Understanding the Importance of Adding LLC Before Paperwork Completion

When starting a new business, one of the most crucial decisions entrepreneurs make is choosing the right business structure. Among the various options available, Limited Liability Companies (LLCs) have gained popularity due to their flexibility and protection of personal assets. Adding “LLC” to a business name is not just a formality; it serves as a significant indicator of the company’s legal status and liability protection. In this article, we will delve into the reasons why adding LLC before paperwork completion is essential and the steps involved in this process.

Why is Adding LLC Important?

Adding “LLC” to a business name is crucial for several reasons: - Legal Compliance: It signifies that the business is registered as a Limited Liability Company, which is a requirement in most states. - Liability Protection: The “LLC” designation informs creditors, clients, and partners that the business owners’ personal assets are protected in case the company incurs debts or liabilities. - Credibility and Trust: Including “LLC” in the business name can enhance credibility with customers, suppliers, and financial institutions, as it indicates a level of professionalism and commitment to legal compliance.

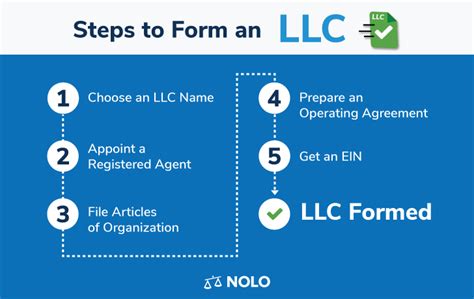

Steps to Add LLC Before Paperwork Completion

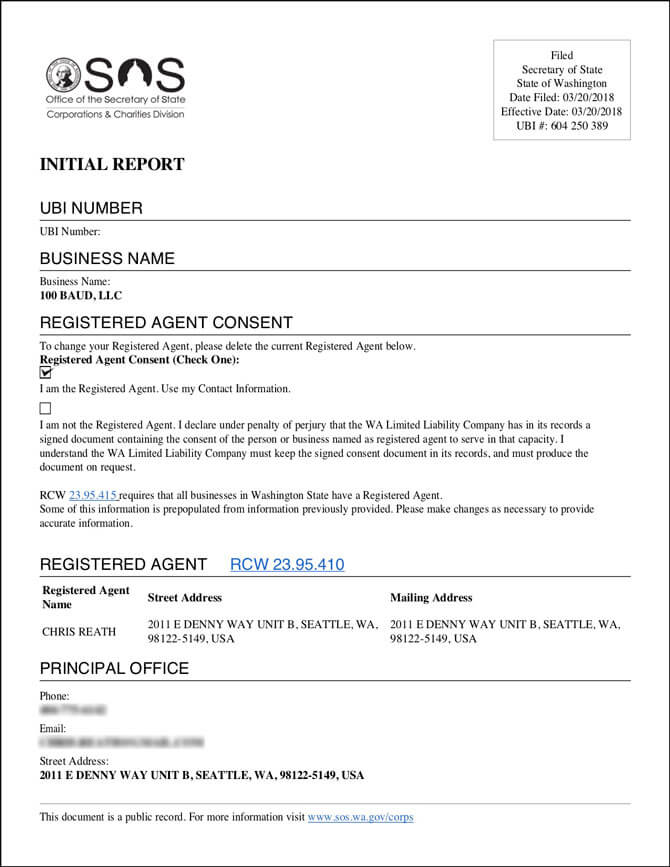

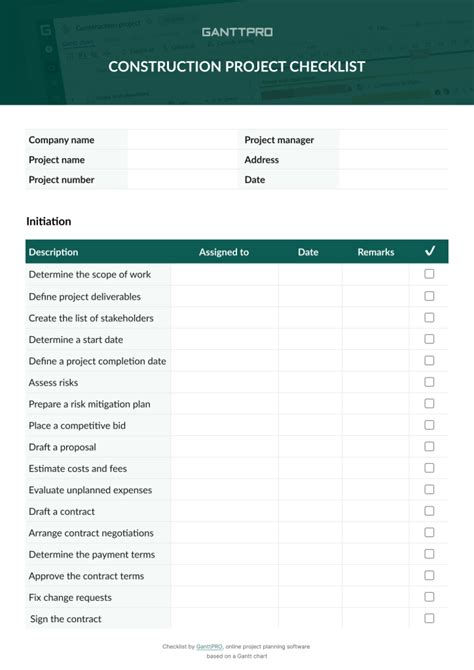

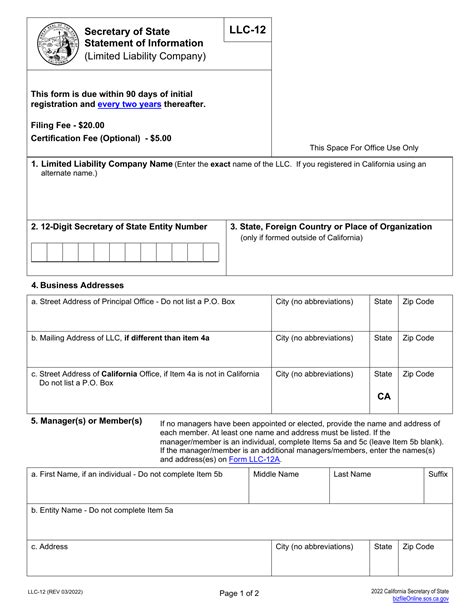

The process of adding “LLC” to a business name involves several steps, including: - Choose a Business Name: Ensure the desired business name is available and complies with the state’s naming requirements. The name must include “LLC” or a variation such as “Limited Liability Company.” - Check Availability: Verify that the name is not already in use by searching the state’s business database. - File Articles of Organization: Submit the articles of organization to the state, which includes the business name, address, and other essential details. - Obtain Necessary Licenses and Permits: Depending on the business type and location, obtain any required licenses and permits. - Register for Taxes: Register the business for federal and state taxes, including obtaining an Employer Identification Number (EIN) from the IRS.

Benefits of Registering as an LLC

Registering a business as an LLC offers numerous benefits, including: - Personal Liability Protection: Owners are not personally responsible for business debts and liabilities. - Tax Flexibility: LLCs can choose between pass-through taxation and corporate taxation. - Flexibility in Ownership and Management: LLCs can have any number of owners (members) and can be managed by the owners or by managers. - Credibility and Professionalism: The “LLC” designation can enhance the business’s image and credibility with customers, suppliers, and financial institutions.

Potential Drawbacks and Considerations

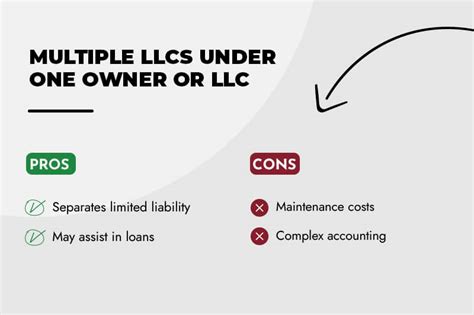

While registering as an LLC offers many advantages, there are also potential drawbacks and considerations to keep in mind: - Formation Costs: Forming an LLC involves costs, including filing fees and potential legal and accounting fees. - Record-Keeping and Compliance: LLCs must maintain accurate records and comply with state regulations, which can be time-consuming and costly. - Tax Complexity: While LLCs offer tax flexibility, the tax implications can be complex and may require professional advice.

💡 Note: It's essential to consult with a legal or accounting professional to ensure compliance with all state and federal regulations and to understand the specific implications of registering as an LLC.

Comparison with Other Business Structures

When deciding on a business structure, it’s crucial to compare the benefits and drawbacks of different options, including: - Sole Proprietorship: Offers minimal protection and flexibility but is simple to establish. - Partnership: Provides personal liability protection for partners but can be complex to manage. - Corporation: Offers strong liability protection and tax benefits but can be formal and rigid. - LLC: Combines the benefits of liability protection, tax flexibility, and management flexibility, making it a popular choice for many entrepreneurs.

| Business Structure | Liability Protection | Taxation | Management Flexibility |

|---|---|---|---|

| Sole Proprietorship | No | Pass-through | Owner-managed |

| Partnership | No | Pass-through | Partner-managed |

| Corporation | Corporate tax | Formal board of directors | |

| LLC | Flexible (pass-through or corporate) | Member-managed or manager-managed |

To summarize, adding “LLC” to a business name before completing paperwork is a critical step in establishing a legitimate and protected business entity. It signifies legal compliance, liability protection, and a level of professionalism that can enhance credibility and trust with stakeholders. By understanding the benefits and potential drawbacks of registering as an LLC and comparing it with other business structures, entrepreneurs can make informed decisions about their business’s future.

What are the primary benefits of registering a business as an LLC?

+

The primary benefits include personal liability protection, tax flexibility, flexibility in ownership and management, and enhanced credibility and professionalism.

How do I choose a business name for my LLC?

+

Choose a name that is unique, memorable, and complies with your state’s naming requirements. Ensure the name is available by searching the state’s business database.

What are the potential drawbacks of registering as an LLC?

+

Potential drawbacks include formation costs, record-keeping and compliance requirements, and tax complexity. It’s essential to consult with a legal or accounting professional to navigate these challenges.