Paperwork

Fax Paperwork to IRS Now

Introduction to Faxing Paperwork to the IRS

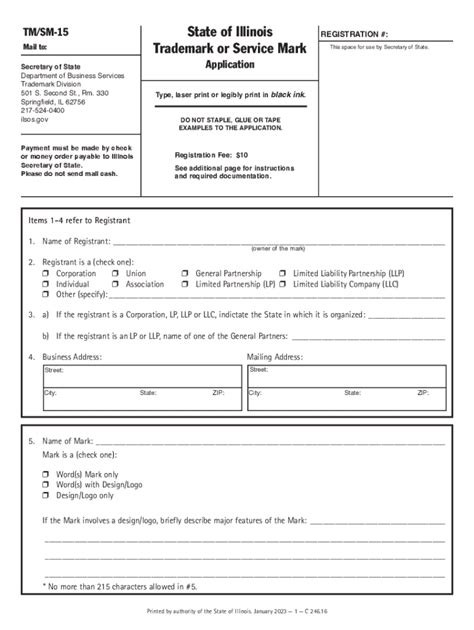

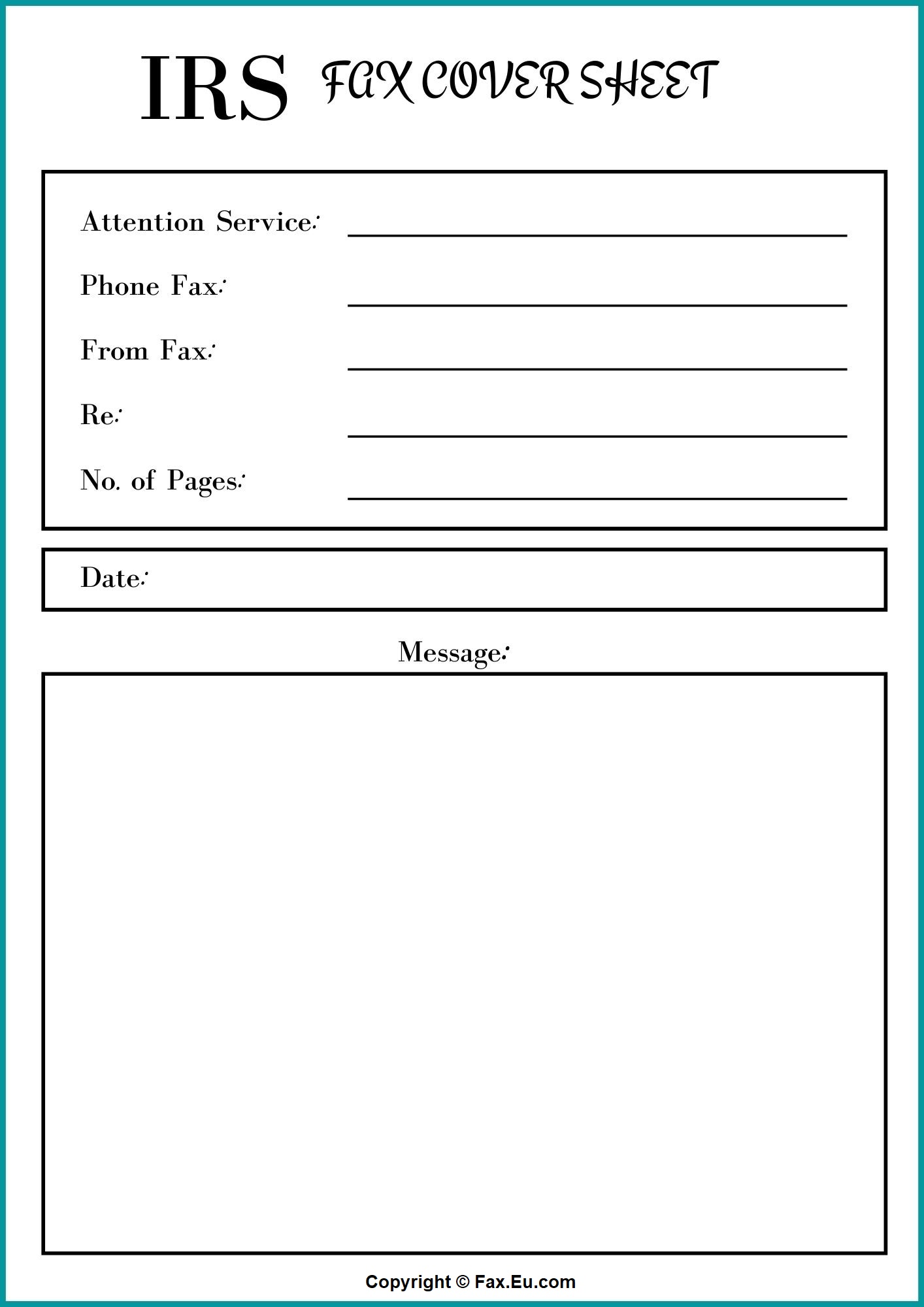

Faxing paperwork to the Internal Revenue Service (IRS) is a convenient way to submit documents required for various tax-related purposes. The IRS accepts faxed documents for a range of applications, including Form 4506 for requesting tax return transcripts, Form 2848 for power of attorney, and Form 8821 for tax information authorization. Before you start the process, ensure you have all the necessary documents and follow the IRS guidelines for faxing to avoid any potential issues or delays.

Understanding the IRS Fax Process

The IRS has specific fax numbers for different types of documents. It’s crucial to use the correct fax number to ensure your documents are processed correctly and efficiently. The IRS provides these fax numbers on their official website and on the instructions for the specific form you are submitting. For example, if you are submitting Form 4506 to request a tax return transcript, you will need to use the fax number provided in the form’s instructions.

Preparation is Key

Before faxing your paperwork, make sure you have filled out the forms accurately and completely. Incomplete forms can lead to processing delays or even rejection of your request. It’s also important to keep a record of the fax transmission confirmation to prove that you sent the documents. This can be useful if there are any issues with the IRS receiving your fax.

Steps to Fax Paperwork to the IRS

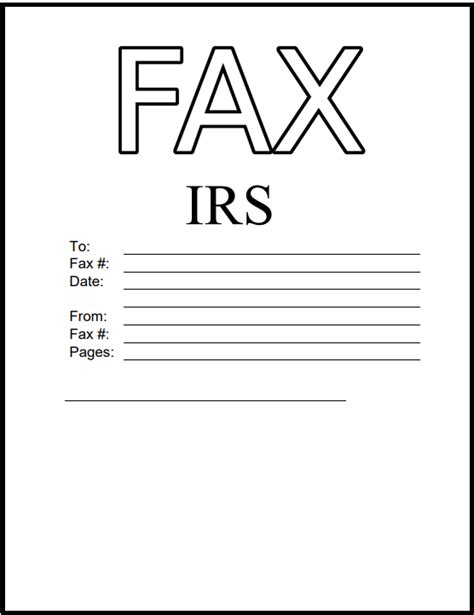

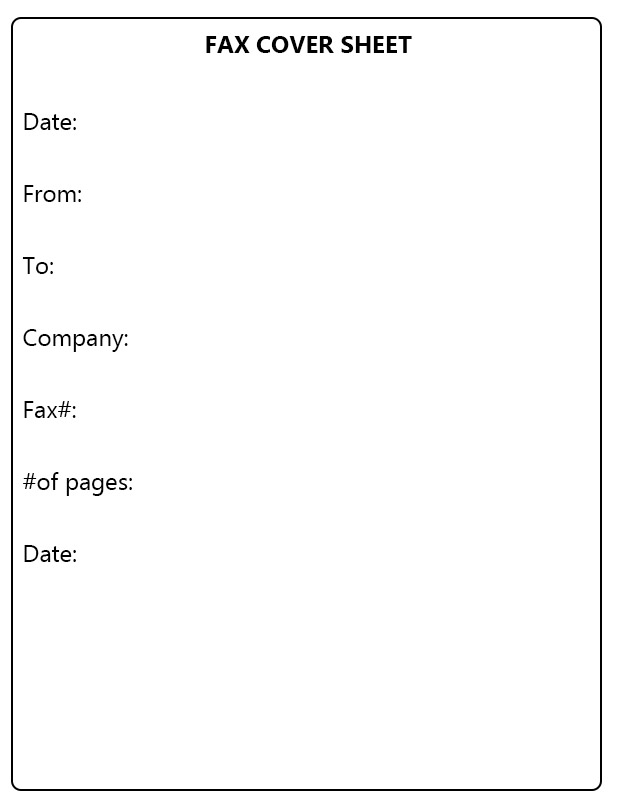

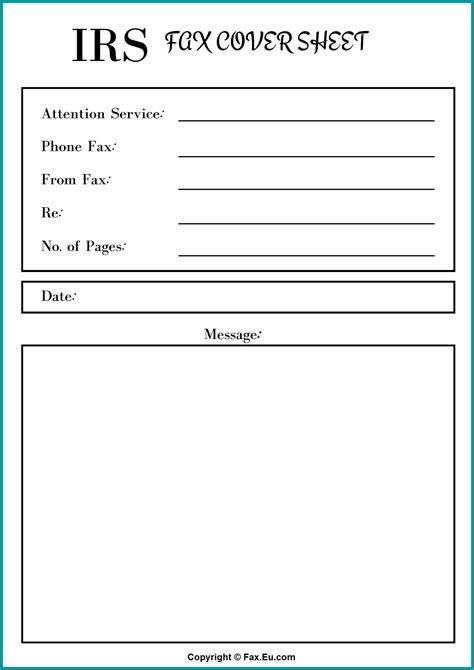

Here are the steps to follow when faxing paperwork to the IRS: - Step 1: Ensure you have the correct fax number for the documents you are submitting. - Step 2: Fill out the forms accurately and completely. Double-check for any errors or omissions. - Step 3: Prepare a cover sheet with your name, the type of document being faxed, and your contact information. - Step 4: Fax the documents to the IRS using the correct fax number. Make sure to include the cover sheet. - Step 5: Keep a record of the fax transmission confirmation for your records.

Common Forms and Their Uses

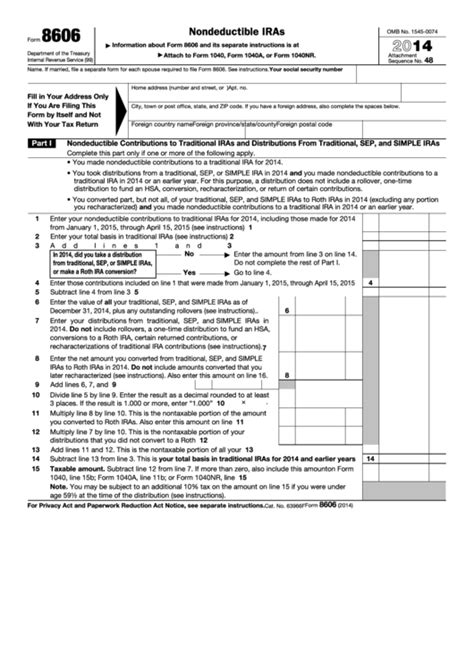

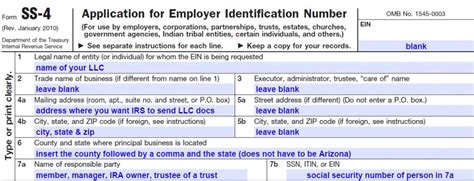

Here are some common forms that can be faxed to the IRS, along with their uses:

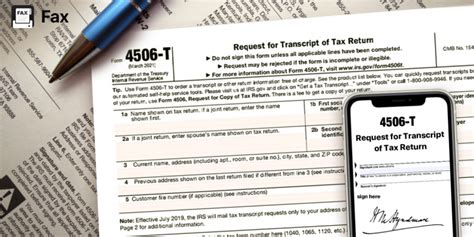

- Form 4506: Request for Copy of Tax Return

- Form 2848: Power of Attorney and Declaration of Representative

- Form 8821: Tax Information Authorization

Security and Privacy

The IRS takes the security and privacy of taxpayer information very seriously. When faxing sensitive documents, ensure you are using a secure fax line to protect your personal and financial information. It’s also a good practice to use a fax machine that is located in a secure area to prevent unauthorized access to your documents.

Processing Time

The processing time for faxed documents can vary depending on the type of document and the workload of the IRS. Generally, it can take several weeks for the IRS to process faxed documents. It’s important to plan ahead and allow sufficient time for processing, especially if you are requesting documents for a specific deadline.

| Form Type | Description | Processing Time |

|---|---|---|

| Form 4506 | Request for Copy of Tax Return | 10-30 days |

| Form 2848 | Power of Attorney and Declaration of Representative | Varies |

| Form 8821 | Tax Information Authorization | Varies |

📝 Note: The processing times are estimates and can vary based on the IRS workload and other factors.

Alternatives to Faxing

While faxing is a convenient method for submitting documents to the IRS, there are alternatives you can consider, especially if you are concerned about security or prefer a more modern approach. The IRS offers electronic submission options for certain forms and documents through their website or through authorized third-party providers. These electronic methods can offer faster processing times and enhanced security features.

Conclusion and Final Thoughts

Faxing paperwork to the IRS is a straightforward process once you understand the requirements and guidelines. By following the steps outlined and taking the necessary precautions to ensure the security and integrity of your documents, you can efficiently submit your paperwork and avoid potential delays. Remember to always check the IRS website for the most current information and guidelines on faxing documents, as procedures and forms can change.

What is the correct fax number to use when submitting Form 4506 to the IRS?

+

The correct fax number for submitting Form 4506 can be found on the IRS website or in the form’s instructions. It’s important to use the correct fax number to ensure your documents are processed correctly.

How long does it take for the IRS to process faxed documents?

+

The processing time for faxed documents can vary depending on the type of document and the workload of the IRS. Generally, it can take several weeks for the IRS to process faxed documents.

Are there any alternatives to faxing paperwork to the IRS?

+

Yes, the IRS offers electronic submission options for certain forms and documents through their website or through authorized third-party providers. These electronic methods can offer faster processing times and enhanced security features.