5 EDD Filing Tips

Understanding the Importance of EDD Filing

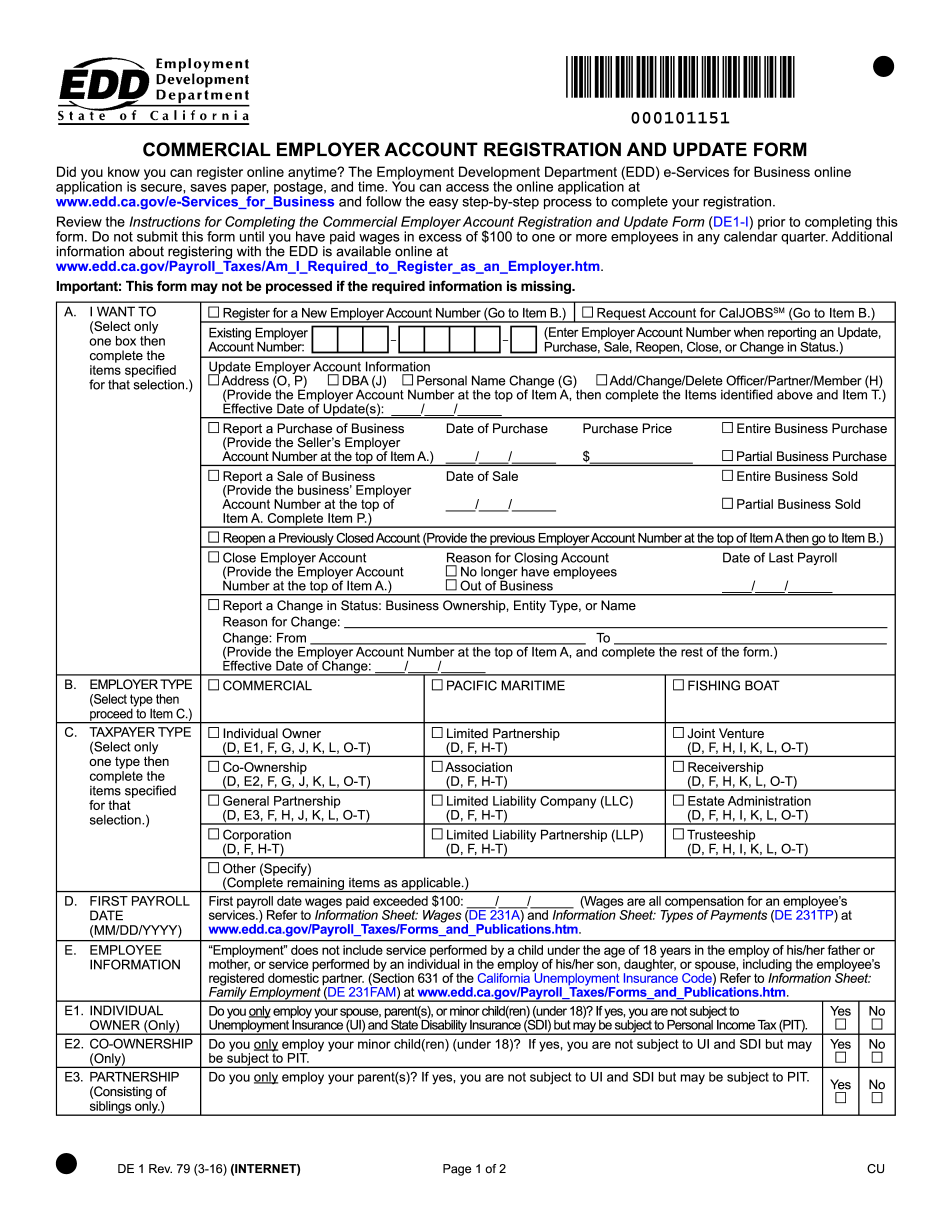

The Employment Development Department (EDD) filing is a critical process for employers in California, as it involves reporting employee wages and paying taxes on those wages. The EDD uses this information to determine eligibility for benefits such as unemployment insurance, disability insurance, and paid family leave. In this blog post, we will provide 5 essential tips for accurate and efficient EDD filing, helping employers navigate the process with ease.

Tip 1: Accurate Employee Information

To ensure smooth EDD filing, it is crucial to maintain accurate and up-to-date employee information. This includes names, social security numbers, dates of birth, and hire dates. Employers should verify this information regularly to prevent errors and potential penalties. A well-organized system for tracking employee data can help employers stay on top of their EDD filing obligations.

Tip 2: Timely Quarterly Reporting

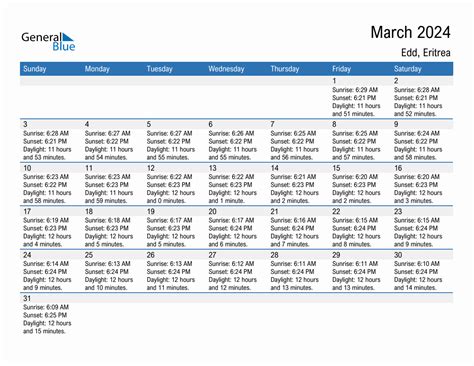

EDD filing requires employers to submit quarterly reports, which include employee wage information and tax payments. The deadlines for these reports are:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

Tip 3: Calculating Tax Rates and Payments

Calculating the correct tax rates and payments is vital for accurate EDD filing. Employers must determine their unemployment insurance tax rate, disability insurance tax rate, and employment training tax rate. The tax rates and payments will depend on the employer’s industry, number of employees, and other factors. Employers can use the EDD’s online resources or consult with a tax professional to ensure accurate calculations.

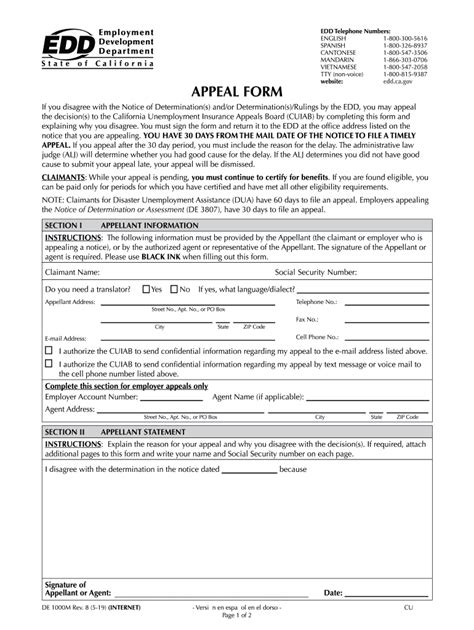

Tip 4: Electronic Filing Options

The EDD offers electronic filing options, which can simplify the filing process and reduce errors. Employers can use the EDD’s online portal, e-Services for Business, to submit quarterly reports and make tax payments. Electronic filing options include:

- e-Filing: submitting reports and payments online

- e-Pay: making tax payments online

- e-File and e-Pay: combining reporting and payment in a single online process

Tip 5: Record Keeping and Audits

Accurate record keeping is essential for EDD filing, as it helps employers prepare for audits and demonstrations of compliance. Employers should maintain detailed records of:

- Employee wage information

- Tax payments and rates

- Quarterly reports and submissions

- Communication with the EDD

📝 Note: Employers should regularly review and update their record-keeping systems to ensure accuracy and compliance with EDD regulations.

Additional Resources

The EDD provides various resources to help employers with the filing process, including:

| Resource | Description |

|---|---|

| e-Services for Business | Online portal for submitting quarterly reports and making tax payments |

| EDD Website | Comprehensive resource for EDD filing information, forms, and FAQs |

| Employer Assistance | Phone and email support for employers with EDD filing questions and concerns |

In summary, accurate and efficient EDD filing is crucial for employers in California. By following these 5 essential tips, employers can ensure compliance with EDD regulations, avoid penalties, and maintain a smooth filing process. By understanding the importance of accurate employee information, timely quarterly reporting, calculating tax rates and payments, electronic filing options, and record keeping, employers can navigate the EDD filing process with confidence.

What is the deadline for submitting quarterly reports?

+

The deadlines for submitting quarterly reports are April 30th for the first quarter, July 31st for the second quarter, October 31st for the third quarter, and January 31st for the fourth quarter.

How can I calculate my unemployment insurance tax rate?

+

You can calculate your unemployment insurance tax rate using the EDD’s online resources or by consulting with a tax professional. The tax rate will depend on your industry, number of employees, and other factors.

What are the benefits of electronic filing?

+

The benefits of electronic filing include simplified reporting, reduced errors, and faster processing times. Employers can use the EDD’s online portal, e-Services for Business, to submit quarterly reports and make tax payments electronically.