Paperwork

Quicken Loans Rocket Mortgage Paperwork

Introduction to Quicken Loans Rocket Mortgage

Quicken Loans Rocket Mortgage is a type of mortgage offered by Quicken Loans, one of the largest mortgage lenders in the United States. This mortgage option allows borrowers to apply for a mortgage online and receive a decision in a matter of minutes. The Rocket Mortgage platform uses advanced technology to verify income, employment, and creditworthiness, making the mortgage application process faster and more efficient.

Benefits of Quicken Loans Rocket Mortgage

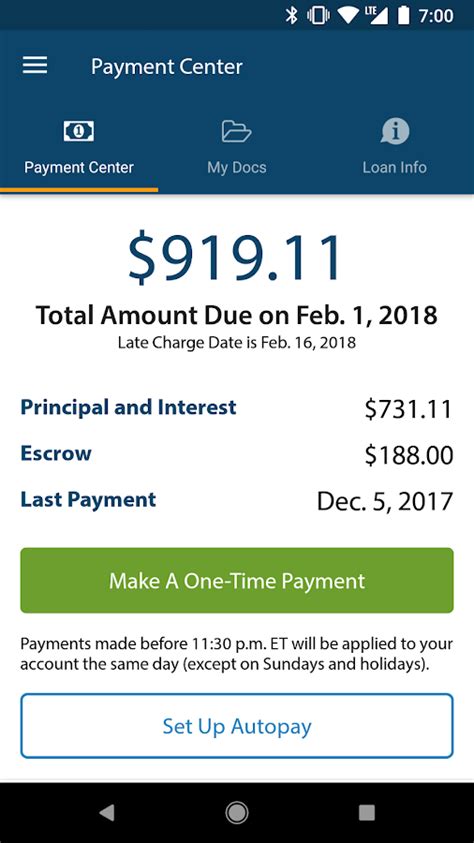

There are several benefits to using Quicken Loans Rocket Mortgage, including: * Faster application process: The online application process can be completed in as little as 10 minutes. * Convenient: Borrowers can apply for a mortgage from the comfort of their own homes, 24⁄7. * Competitive rates: Quicken Loans offers competitive interest rates and terms. * Personalized service: Borrowers have access to a dedicated mortgage banker who can guide them through the process.

Quicken Loans Rocket Mortgage Paperwork

While the Rocket Mortgage platform is designed to be fast and efficient, there is still some paperwork involved in the mortgage application process. Borrowers will need to provide certain documents, including: * Identification: A valid government-issued ID, such as a driver’s license or passport. * Income verification: Pay stubs, W-2 forms, and tax returns. * Employment verification: A letter from the borrower’s employer or a copy of their business license. * Credit reports: Quicken Loans will pull the borrower’s credit reports from the three major credit bureaus.

📝 Note: Borrowers may need to provide additional documentation, such as bank statements or proof of assets, depending on their individual circumstances.

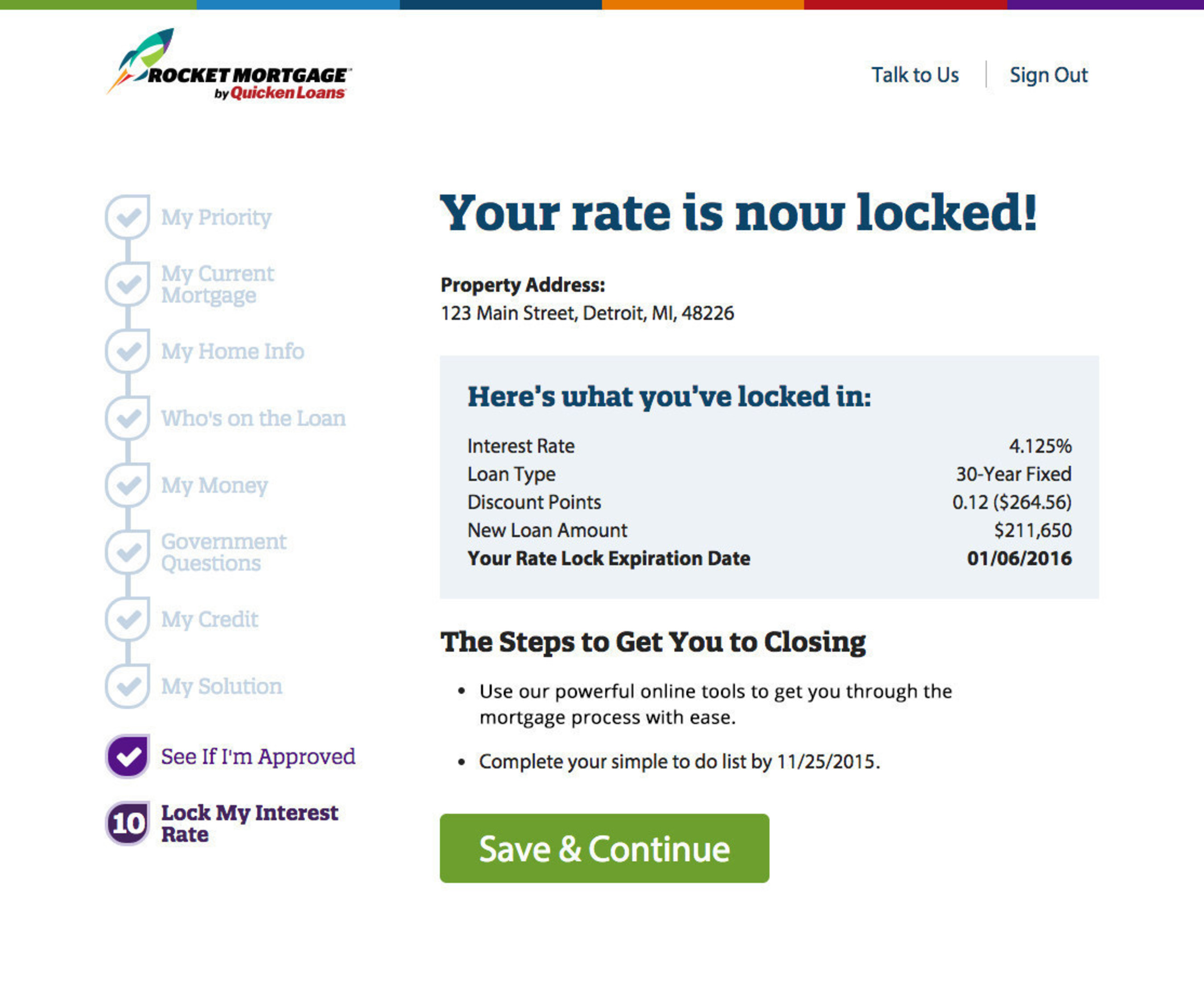

Steps to Apply for Quicken Loans Rocket Mortgage

To apply for Quicken Loans Rocket Mortgage, borrowers can follow these steps: 1. Visit the Rocket Mortgage website: Go to the Rocket Mortgage website and click on the “Apply Now” button. 2. Provide basic information: Enter basic information, such as name, address, and income. 3. Verify income and employment: Provide documentation to verify income and employment. 4. Check credit: Quicken Loans will pull the borrower’s credit reports. 5. Review and customize loan options: Borrowers can review and customize their loan options, including interest rate and term. 6. E-sign loan documents: Once the borrower has selected their loan options, they can e-sign the loan documents.

Table of Quicken Loans Rocket Mortgage Requirements

The following table outlines the requirements for Quicken Loans Rocket Mortgage:

| Requirement | Description |

|---|---|

| Credit score | 620 or higher |

| Income | Steady income and employment |

| Debt-to-income ratio | 49% or lower |

| Down payment | As little as 3% for conventional loans |

Conclusion and Final Thoughts

In summary, Quicken Loans Rocket Mortgage is a convenient and efficient way to apply for a mortgage. With its advanced technology and personalized service, borrowers can quickly and easily navigate the mortgage application process. While there is still some paperwork involved, the Rocket Mortgage platform makes it easy to provide the necessary documentation and get a decision in a matter of minutes.

What is the minimum credit score required for Quicken Loans Rocket Mortgage?

+

The minimum credit score required for Quicken Loans Rocket Mortgage is 620.

How long does the Quicken Loans Rocket Mortgage application process take?

+

The Quicken Loans Rocket Mortgage application process can be completed in as little as 10 minutes.

What types of documentation do I need to provide for Quicken Loans Rocket Mortgage?

+

You will need to provide identification, income verification, employment verification, and credit reports.