File Back Taxes Paperwork

Understanding the Importance of Filing Back Taxes

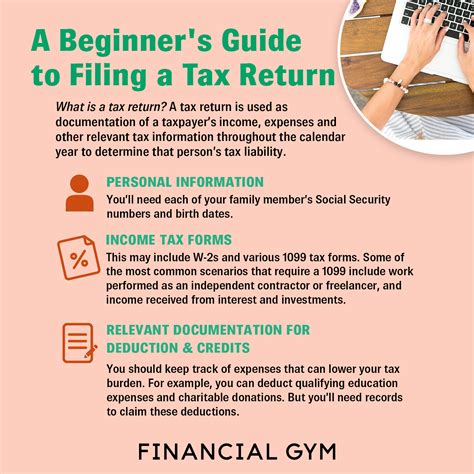

Filing back taxes is a crucial step for individuals who have missed the deadline for submitting their tax returns. Failure to file taxes can result in penalties, fines, and even loss of refunds. The process of filing back taxes involves gathering necessary documents, completing the tax return forms, and submitting them to the relevant tax authority. It is essential to address back taxes as soon as possible to avoid further complications and financial burdens.

Benefits of Filing Back Taxes

There are several benefits to filing back taxes, including: * Avoiding penalties and fines * Claiming refunds and tax credits * Reducing debt and financial stress * Improving credit score and financial stability * Gaining peace of mind and avoiding legal issues By filing back taxes, individuals can take control of their financial situation and make progress towards a more stable and secure future.

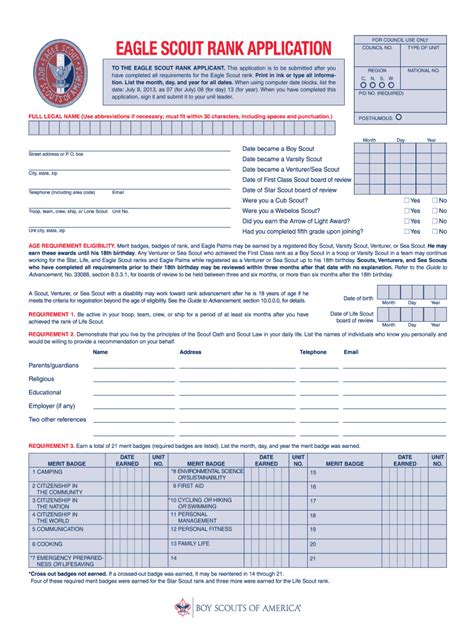

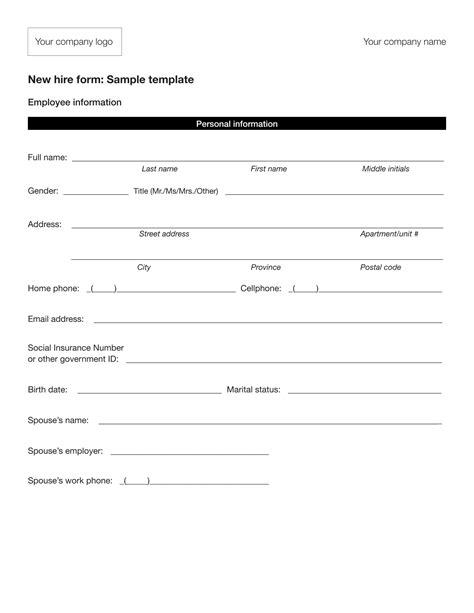

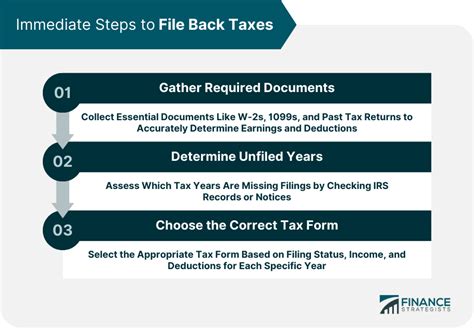

Gathering Necessary Documents

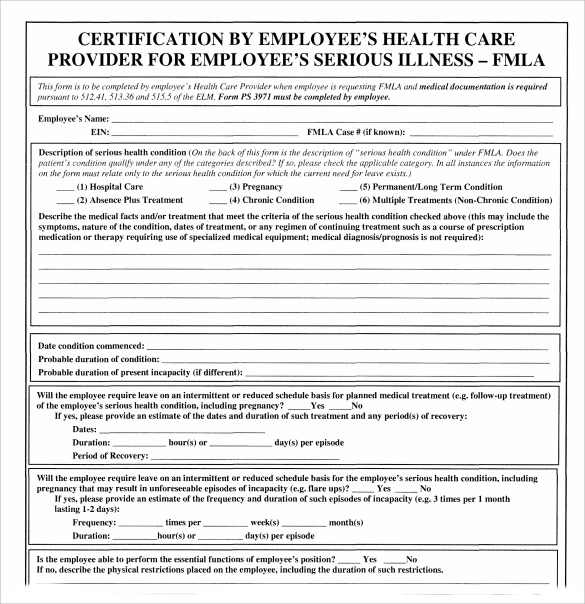

To file back taxes, individuals will need to gather various documents, including: * W-2 forms from employers * 1099 forms for freelance or contract work * Interest statements from banks and investments * Charitable donation receipts * Medical expense records * Business expense records (if self-employed) It is essential to collect all relevant documents to ensure accurate and complete tax returns.

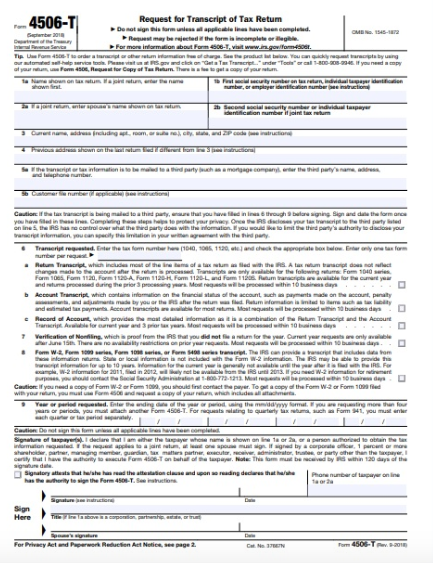

Completing Tax Return Forms

Once the necessary documents are gathered, individuals can begin completing their tax return forms. This can be done manually or with the help of tax software. Tax software can simplify the process and reduce errors, but it is still important to review and understand the forms before submission. The most common tax return forms include: * Form 1040: Personal income tax return * Form 1040A: Simplified personal income tax return * Form 1040EZ: Easy personal income tax return * Schedule C: Business income and expenses (if self-employed)

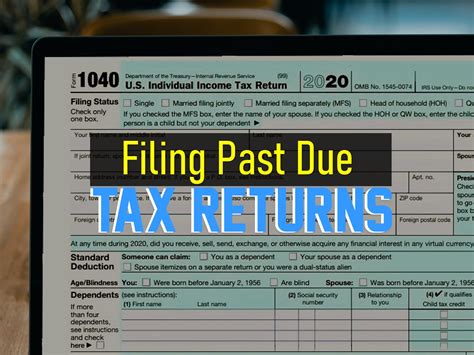

Submitting Back Taxes

After completing the tax return forms, individuals can submit their back taxes to the relevant tax authority. This can be done by mail or electronically, depending on the tax authority’s requirements. Electronic filing is generally faster and more secure, but it may require additional setup and fees. It is essential to follow the tax authority’s guidelines and deadlines to ensure timely and accurate processing.

📝 Note: It is crucial to keep a record of all submitted documents and correspondence with the tax authority, as this can help resolve any future issues or disputes.

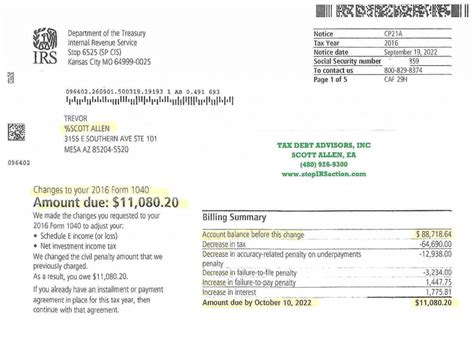

Addressing Penalties and Fines

Individuals who have failed to file taxes may be subject to penalties and fines. These can include: * Late filing penalties * Late payment penalties * Interest on unpaid taxes * Failure-to-file penalties * Failure-to-pay penalties To address these penalties, individuals can: * File Form 2210 to request a waiver of penalties * Set up a payment plan to pay off outstanding taxes * Apply for an Offer in Compromise (OIC) to settle tax debt It is essential to address penalties and fines as soon as possible to minimize financial burdens and avoid further complications.

Seeking Professional Help

Filing back taxes can be a complex and overwhelming process, especially for individuals with limited tax knowledge or experience. Tax professionals can provide guidance and support, helping individuals to: * Gather necessary documents * Complete tax return forms * Submit back taxes * Address penalties and fines * Negotiate with the tax authority By seeking professional help, individuals can ensure accurate and timely filing of their back taxes and reduce the risk of errors or complications.

| Year | Tax Return Form | Deadline |

|---|---|---|

| 2022 | Form 1040 | April 15, 2023 |

| 2021 | Form 1040 | April 15, 2022 |

| 2020 | Form 1040 | April 15, 2021 |

In summary, filing back taxes is a critical step towards resolving tax debt and avoiding further complications. By gathering necessary documents, completing tax return forms, and submitting back taxes, individuals can take control of their financial situation and make progress towards a more stable and secure future. It is essential to address penalties and fines, seek professional help when needed, and follow the tax authority’s guidelines and deadlines to ensure timely and accurate processing.

What happens if I don’t file my back taxes?

+

If you don’t file your back taxes, you may be subject to penalties, fines, and interest on unpaid taxes. You may also lose your refund and face legal issues.

How do I file my back taxes?

+

To file your back taxes, gather necessary documents, complete the tax return forms, and submit them to the relevant tax authority. You can do this manually or with the help of tax software.

Can I file my back taxes electronically?

+

Yes, you can file your back taxes electronically, depending on the tax authority’s requirements. Electronic filing is generally faster and more secure, but it may require additional setup and fees.