New Hire Paperwork Requirements

Introduction to New Hire Paperwork Requirements

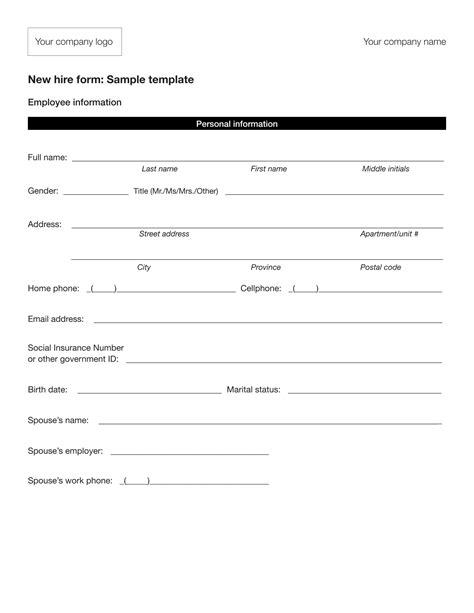

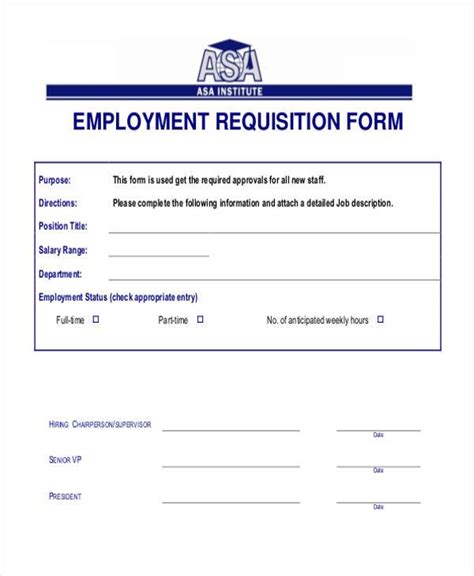

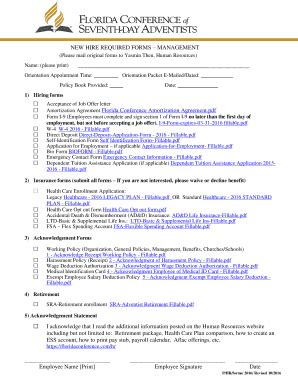

When a new employee is hired, there are several paperwork requirements that must be completed to ensure compliance with federal, state, and local laws. These requirements can vary depending on the location and type of business, but there are some common forms and documents that are typically required. In this article, we will explore the different types of paperwork that are typically required for new hires, including tax forms, benefit enrollment forms, and other HR-related documents.

Required Tax Forms

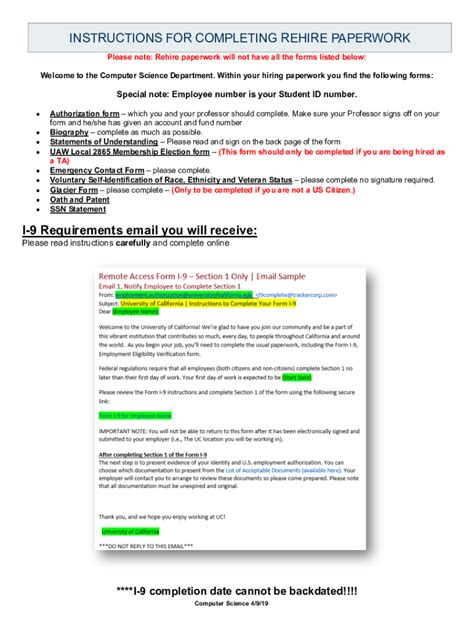

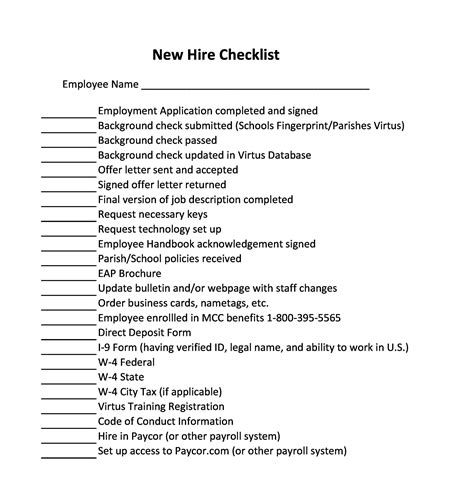

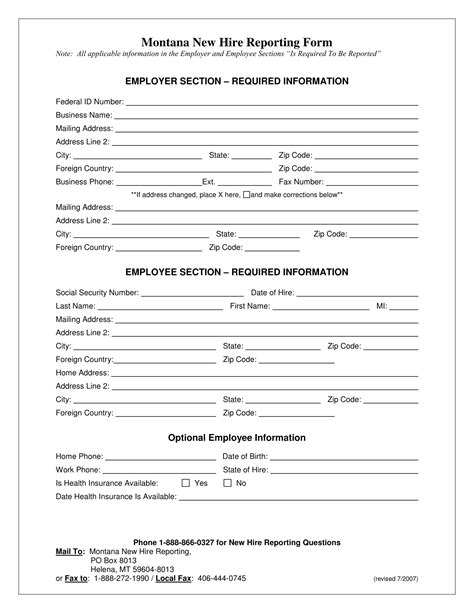

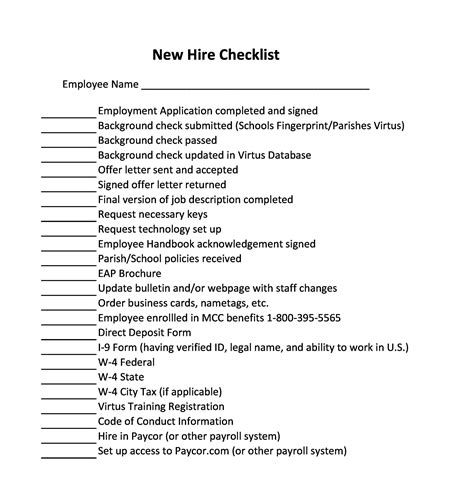

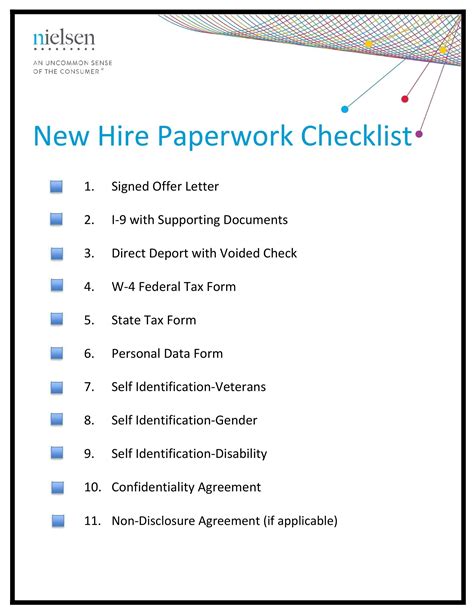

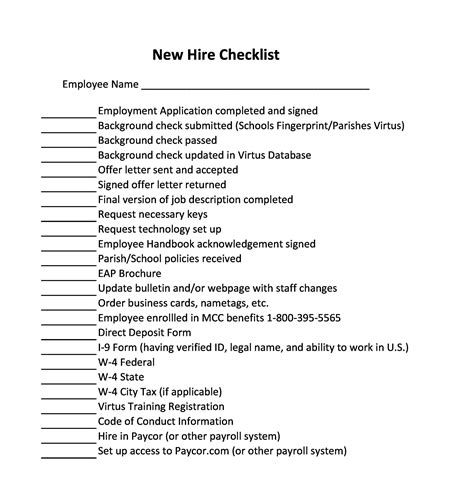

One of the most important paperwork requirements for new hires is the completion of tax forms. These forms are used to determine the amount of taxes that will be withheld from the employee’s paycheck and to ensure compliance with federal and state tax laws. The following are some of the most common tax forms that are required for new hires: * Form W-4: This form is used to determine the amount of federal income tax that will be withheld from the employee’s paycheck. * Form I-9: This form is used to verify the employee’s identity and work authorization. * State tax forms: These forms are used to determine the amount of state income tax that will be withheld from the employee’s paycheck.

Benefit Enrollment Forms

In addition to tax forms, new hires may also be required to complete benefit enrollment forms. These forms are used to enroll the employee in company-sponsored benefits, such as health insurance, life insurance, and retirement plans. The following are some of the most common benefit enrollment forms: * Health insurance enrollment form: This form is used to enroll the employee in the company’s health insurance plan. * Life insurance enrollment form: This form is used to enroll the employee in the company’s life insurance plan. * Retirement plan enrollment form: This form is used to enroll the employee in the company’s retirement plan.

Other HR-Related Documents

In addition to tax forms and benefit enrollment forms, new hires may also be required to complete other HR-related documents. These documents may include: * Employee handbook acknowledgement form: This form is used to acknowledge that the employee has received and reviewed the company’s employee handbook. * Confidentiality agreement: This form is used to protect the company’s confidential information and trade secrets. * Non-compete agreement: This form is used to prevent the employee from working for a competitor or starting a competing business.

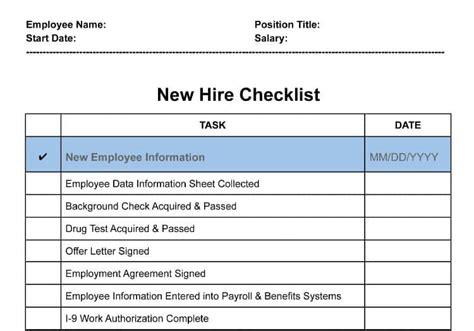

Best Practices for Managing New Hire Paperwork

To ensure that new hire paperwork is completed efficiently and accurately, it’s essential to have a well-organized system in place. The following are some best practices for managing new hire paperwork: * Use a checklist: Create a checklist of all the required paperwork and forms to ensure that nothing is missed. * Provide clear instructions: Provide clear instructions on how to complete each form and where to return them. * Use electronic forms: Consider using electronic forms to make it easier for new hires to complete and return paperwork. * Follow up: Follow up with new hires to ensure that all paperwork has been completed and returned.

📝 Note: It's essential to ensure that all new hire paperwork is completed accurately and efficiently to avoid any delays or compliance issues.

Common Mistakes to Avoid

When it comes to new hire paperwork, there are several common mistakes that can be avoided. The following are some of the most common mistakes: * Not completing all required forms: Failing to complete all required forms can result in delays or compliance issues. * Not providing clear instructions: Not providing clear instructions on how to complete each form can result in errors or delays. * Not following up: Not following up with new hires to ensure that all paperwork has been completed and returned can result in delays or compliance issues.

Conclusion and Final Thoughts

In conclusion, new hire paperwork requirements are an essential part of the hiring process. By understanding the different types of paperwork that are required and having a well-organized system in place, employers can ensure that all necessary forms and documents are completed accurately and efficiently. By following best practices and avoiding common mistakes, employers can reduce the risk of delays or compliance issues and ensure a smooth onboarding process for new hires.

What are the most common tax forms required for new hires?

+

The most common tax forms required for new hires are Form W-4 and Form I-9. Form W-4 is used to determine the amount of federal income tax that will be withheld from the employee’s paycheck, while Form I-9 is used to verify the employee’s identity and work authorization.

What are the benefits of using electronic forms for new hire paperwork?

+

The benefits of using electronic forms for new hire paperwork include increased efficiency, reduced errors, and improved compliance. Electronic forms can also make it easier for new hires to complete and return paperwork, reducing the risk of delays or compliance issues.

What are some best practices for managing new hire paperwork?

+

Some best practices for managing new hire paperwork include using a checklist, providing clear instructions, using electronic forms, and following up with new hires to ensure that all paperwork has been completed and returned.