File Taxes Without Last Year's Paperwork

Introduction to Filing Taxes Without Last Year’s Paperwork

Filing taxes can be a daunting task, especially when you’re missing crucial documents like last year’s paperwork. Whether you’ve lost the documents, never received them, or are a first-time filer, there are ways to navigate the tax filing process without last year’s paperwork. This guide will walk you through the steps to take and the resources available to help you successfully file your taxes.

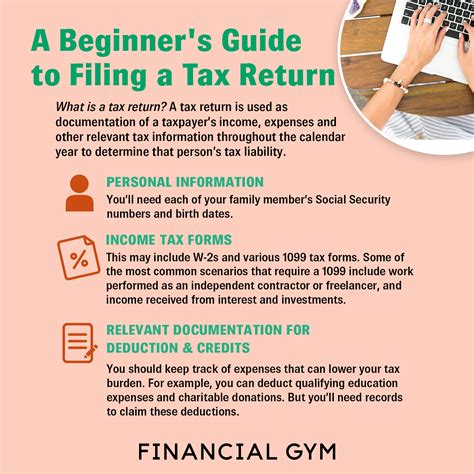

Understanding the Importance of Last Year’s Paperwork

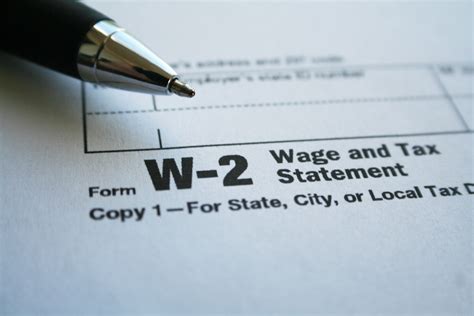

Last year’s paperwork, including your tax return and any supporting documents like W-2s and 1099s, are essential for filing your current year’s taxes. These documents provide vital information like your income, deductions, and tax credits that you may be eligible for. However, if you’re missing these documents, don’t worry – there are alternatives to obtain the necessary information.

Obtaining Missing Documents

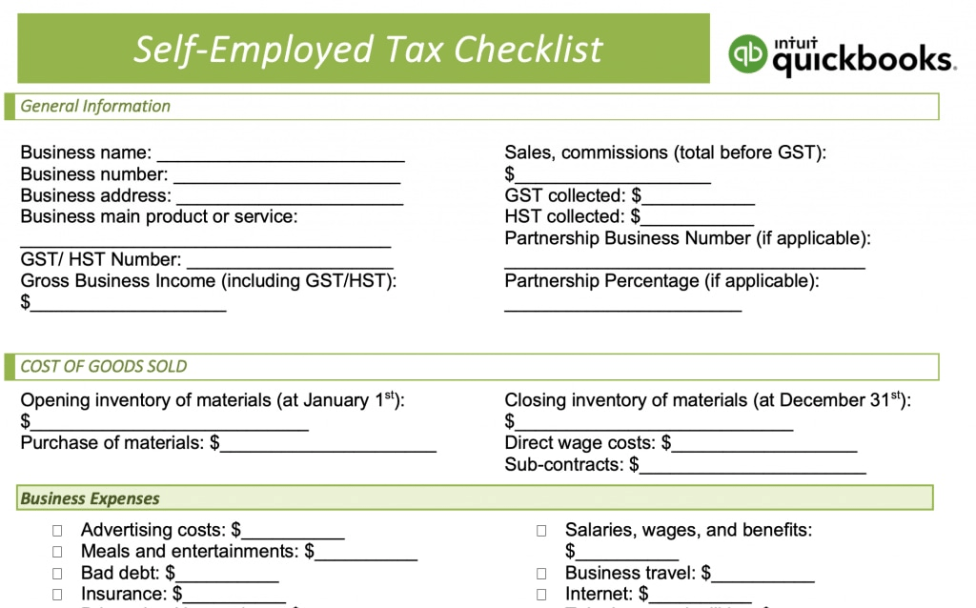

If you’re missing last year’s paperwork, here are some steps you can take to obtain the necessary documents:

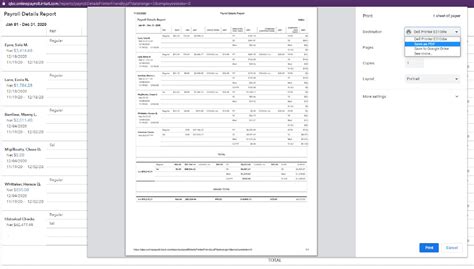

- Contact your employer: Reach out to your employer’s HR or payroll department to request a copy of your W-2 or any other missing documents.

- Check with the IRS: You can contact the IRS directly to request a transcript of your last year’s tax return. This transcript will provide you with the necessary information to file your current year’s taxes.

- Use online resources: Websites like the IRS’s Get Transcript Online tool or the Social Security Administration’s website can provide you with access to your tax transcripts and other important documents.

Filing Taxes Without Last Year’s Paperwork

Once you’ve obtained the necessary documents or information, you can proceed with filing your taxes. Here are some tips to keep in mind:

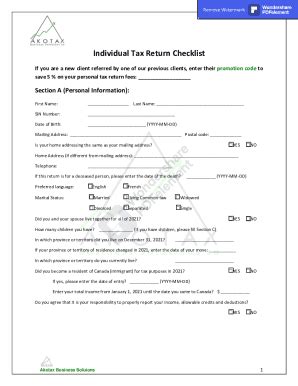

- Be prepared to provide additional information: If you’re missing last year’s paperwork, you may need to provide additional documentation to support your tax return. This could include proof of income, deductions, or tax credits.

- Use tax filing software: Tax filing software like TurboTax or H&R Block can guide you through the filing process and help you identify any missing information.

- Consider hiring a tax professional: If you’re feeling overwhelmed or unsure about the filing process, consider hiring a tax professional to help you navigate the process.

Additional Resources

If you’re still having trouble filing your taxes without last year’s paperwork, there are additional resources available to help:

| Resource | Description |

|---|---|

| IRS Website | The official IRS website provides a wealth of information on tax filing, including forms, instructions, and FAQs. |

| Tax Filing Software | Tax filing software like TurboTax or H&R Block can guide you through the filing process and help you identify any missing information. |

| Tax Professionals | Consider hiring a tax professional to help you navigate the filing process and ensure you’re taking advantage of all the deductions and credits you’re eligible for. |

📝 Note: If you're experiencing difficulties filing your taxes, don't hesitate to reach out to the IRS or a tax professional for assistance.

Final Thoughts

Filing taxes without last year’s paperwork can be challenging, but it’s not impossible. By following the steps outlined in this guide and utilizing the resources available, you can successfully file your taxes and ensure you’re taking advantage of all the deductions and credits you’re eligible for. Remember to stay organized, be prepared to provide additional information, and don’t hesitate to seek help if you need it.

In the end, filing taxes without last year’s paperwork requires patience, persistence, and the right resources. By staying informed and seeking help when needed, you can navigate the tax filing process with confidence and ensure you’re meeting your tax obligations.

What if I’m missing my W-2 or 1099?

+

If you’re missing your W-2 or 1099, you can contact your employer or the IRS to request a copy. You can also use online resources like the IRS’s Get Transcript Online tool to access your tax transcripts.

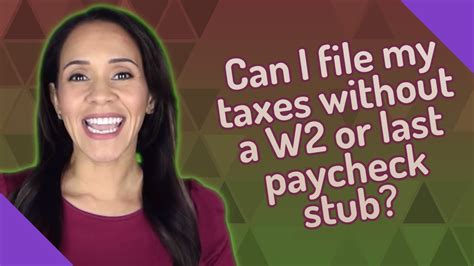

Can I file my taxes without last year’s paperwork?

+

Yes, you can file your taxes without last year’s paperwork. However, you may need to provide additional documentation to support your tax return. It’s recommended that you use tax filing software or consult with a tax professional to ensure you’re taking advantage of all the deductions and credits you’re eligible for.

What resources are available to help me file my taxes?

+

There are several resources available to help you file your taxes, including the IRS website, tax filing software, and tax professionals. You can also contact the IRS directly for assistance or visit a local tax preparation office.