5 Turbo Tax Tips

Introduction to TurboTax

TurboTax is a popular tax preparation software that guides users through the process of filing their taxes. With its user-friendly interface and comprehensive features, TurboTax has become a go-to solution for many individuals and businesses. However, navigating the software and taking advantage of its features can be overwhelming, especially for those who are new to tax preparation. In this article, we will provide 5 TurboTax tips to help you get the most out of the software and ensure a smooth tax filing experience.

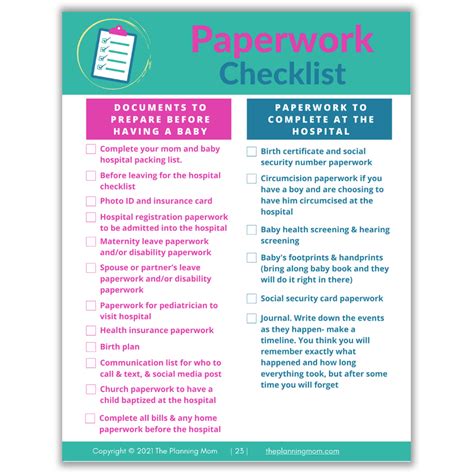

Tip 1: Gather All Necessary Documents

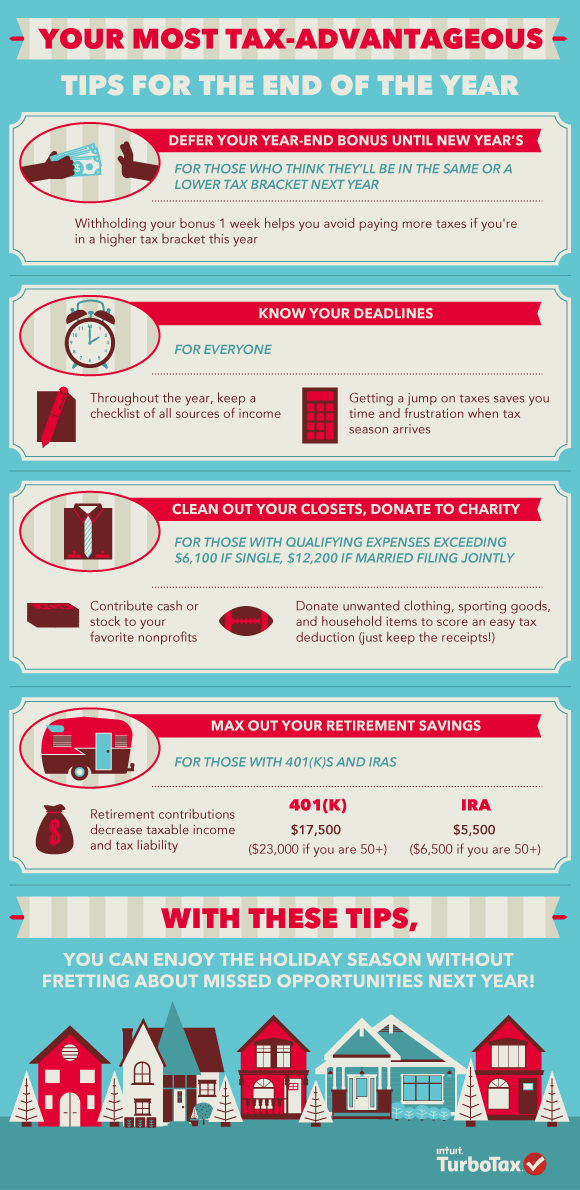

Before starting the tax filing process, it’s essential to gather all necessary documents. This includes W-2 forms, 1099 forms, receipts for deductions, and last year’s tax return. Having all the required documents in one place will help you avoid delays and ensure that you don’t miss any important deductions. Here are some key documents to gather: * W-2 forms from your employer * 1099 forms for freelance work or self-employment income * Receipts for charitable donations, medical expenses, and other deductions * Last year’s tax return to reference and compare

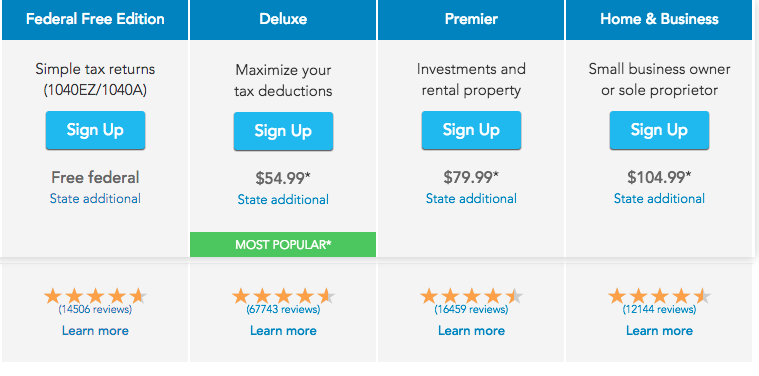

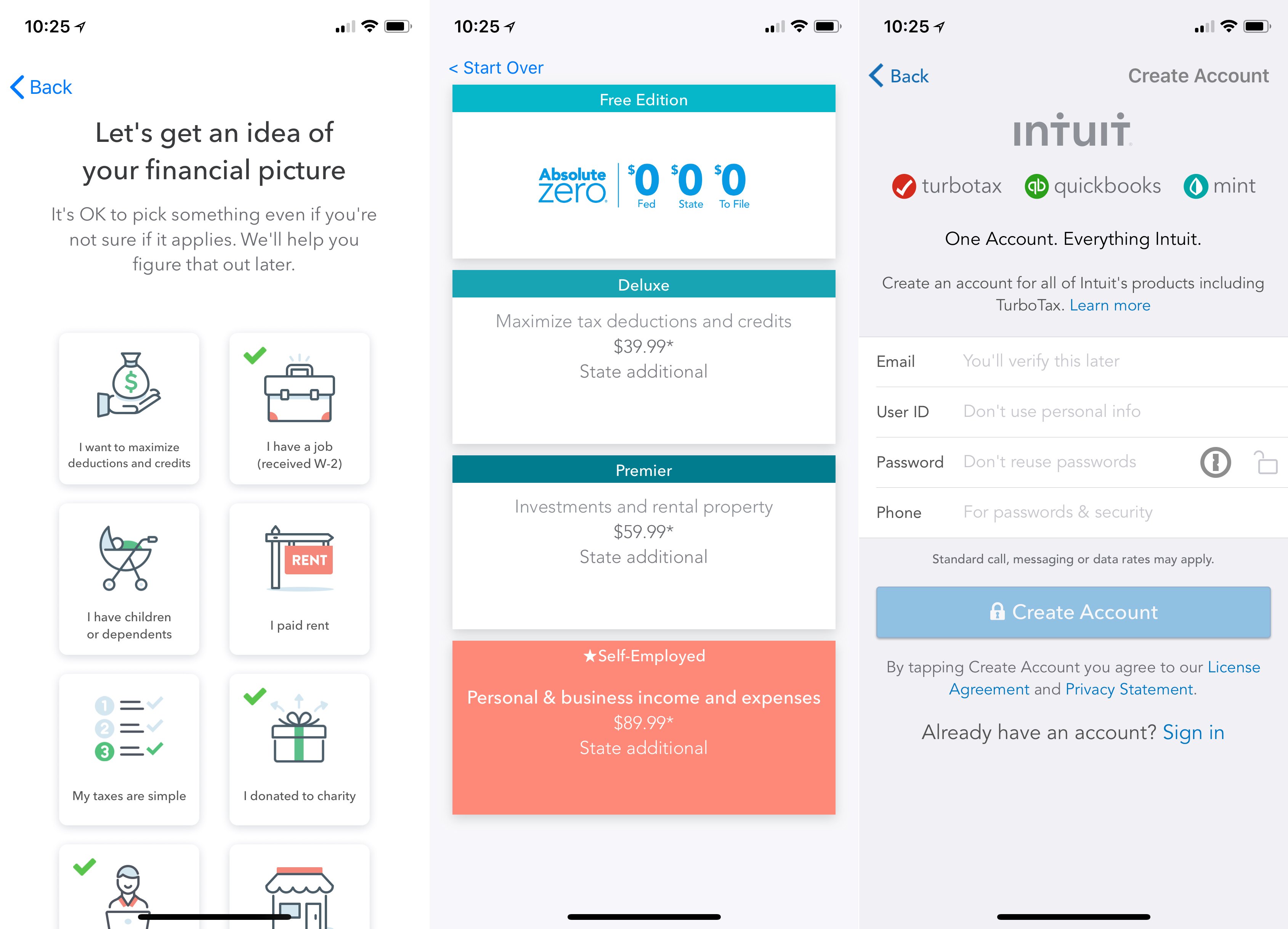

Tip 2: Choose the Right TurboTax Version

TurboTax offers several versions, each designed for specific tax filing needs. Choosing the right version can help you save time and money. Here are the different versions and their features:

| Version | Features |

|---|---|

| TurboTax Deluxe | Itemized deductions, mortgage interest, and charitable donations |

| TurboTax Premier | Investment income, rental income, and self-employment income |

| TurboTax Self-Employed | Business income and expenses, home office deductions, and business use of your car |

📝 Note: Choose the version that best fits your tax filing needs to avoid paying for unnecessary features.

Tip 3: Take Advantage of TurboTax’s Audit Support

TurboTax offers audit support to help you navigate the audit process in case you’re audited by the IRS. This feature provides guidance on how to respond to audit notices and helps you prepare for an audit. With TurboTax’s audit support, you can: * Get help with audit notices and letters * Prepare for an audit with guidance on what to expect * Access to audit support specialists for personalized help

Tip 4: Use TurboTax’s Import Feature

TurboTax’s import feature allows you to import your W-2 forms and 1099 forms directly from your employer or financial institution. This feature saves you time and reduces the risk of errors. Here’s how to use the import feature: * Log in to your TurboTax account * Click on the “Import” button * Select the type of form you want to import (W-2 or 1099) * Follow the prompts to complete the import process

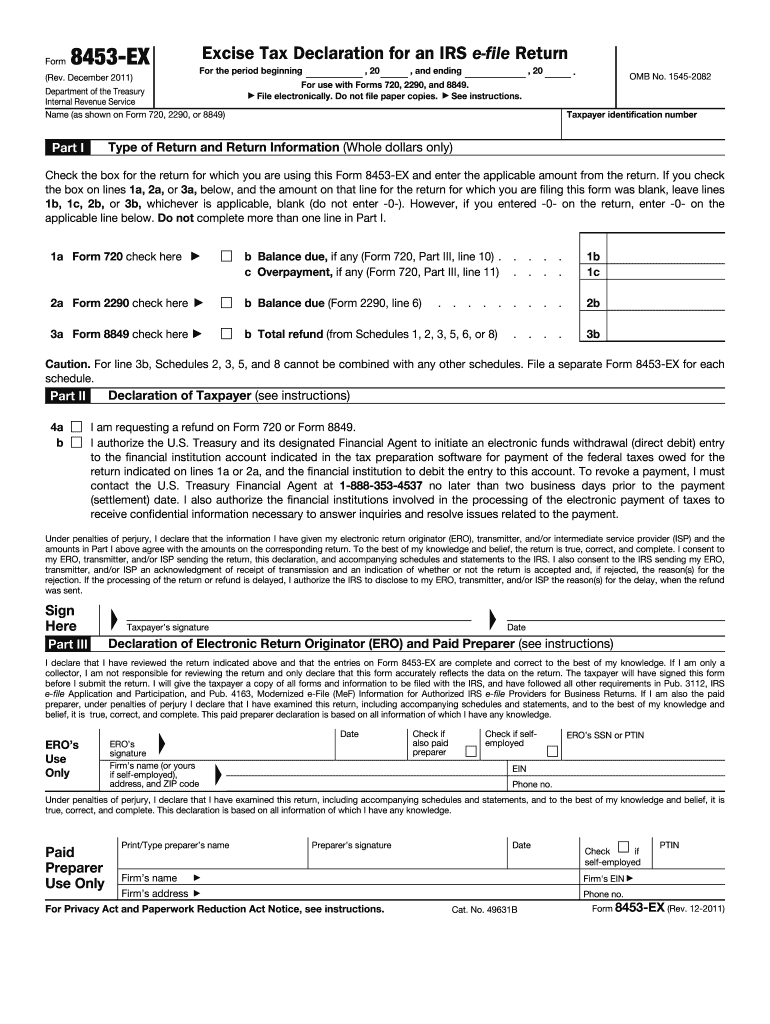

Tip 5: E-File Your Tax Return

E-filing your tax return is the fastest and most secure way to submit your taxes. With TurboTax, you can e-file your return directly to the IRS. Here are the benefits of e-filing: * Faster refund processing * Reduced risk of errors and lost returns * Confirmation of receipt from the IRS * Ability to track the status of your refund

In summary, by following these 5 TurboTax tips, you can ensure a smooth and efficient tax filing experience. Remember to gather all necessary documents, choose the right TurboTax version, take advantage of audit support, use the import feature, and e-file your tax return.

What is the difference between TurboTax Deluxe and TurboTax Premier?

+

TurboTax Deluxe is designed for itemized deductions, mortgage interest, and charitable donations, while TurboTax Premier is designed for investment income, rental income, and self-employment income.

How do I import my W-2 forms into TurboTax?

+

To import your W-2 forms, log in to your TurboTax account, click on the “Import” button, select the type of form you want to import (W-2), and follow the prompts to complete the import process.

What is the benefit of e-filing my tax return with TurboTax?

+

The benefit of e-filing your tax return with TurboTax is faster refund processing, reduced risk of errors and lost returns, confirmation of receipt from the IRS, and the ability to track the status of your refund.