Paperwork

5 PPP Loan Papers

Introduction to PPP Loan Papers

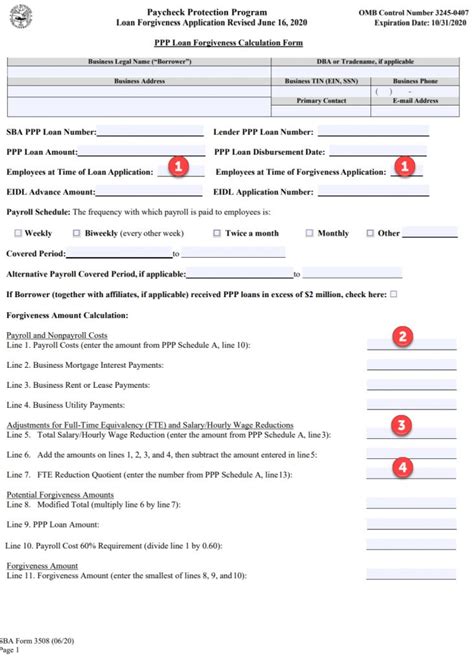

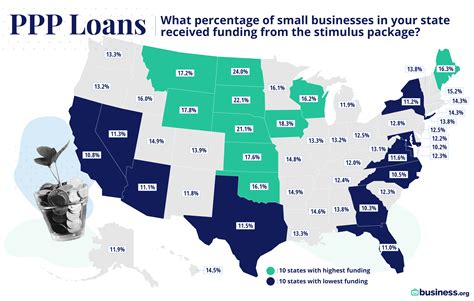

The Paycheck Protection Program (PPP) was established by the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to provide financial assistance to small businesses affected by the COVID-19 pandemic. The program allows businesses to apply for loans that can be forgiven if certain conditions are met. In this blog post, we will discuss the five key PPP loan papers that businesses need to be familiar with.

Understanding the PPP Loan Application Process

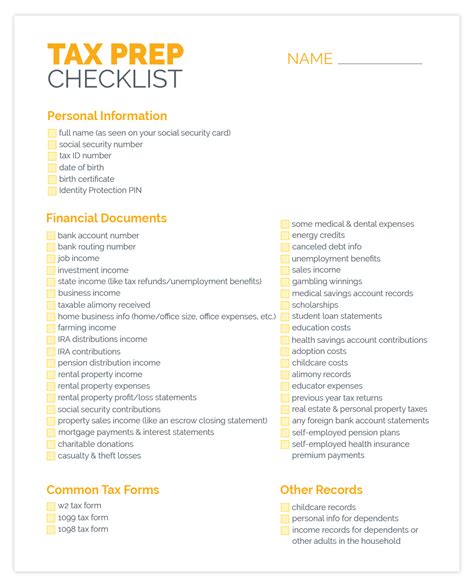

To apply for a PPP loan, businesses need to submit several documents to their lender. The application process typically involves the following steps: * Determine eligibility: Businesses need to determine if they are eligible for a PPP loan based on the program’s criteria. * Gather required documents: Businesses need to gather the required documents, including financial statements, tax returns, and payroll records. * Submit application: Businesses need to submit their application to their lender, along with the required documents. * Wait for approval: The lender will review the application and make a decision.

5 Key PPP Loan Papers

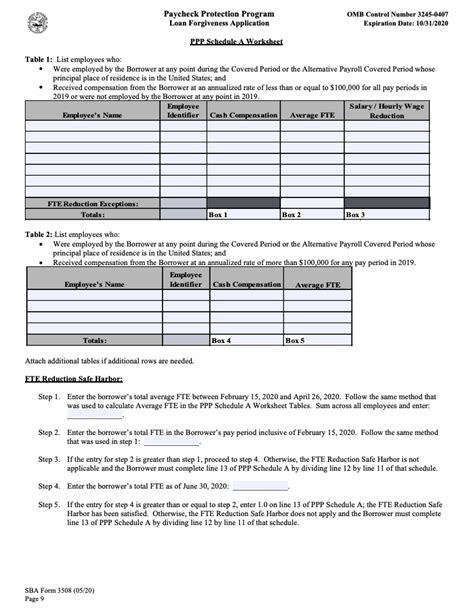

The following are the five key PPP loan papers that businesses need to be familiar with: * PPP Loan Application Form (SBA Form 2483): This form is used to apply for a PPP loan. It requires businesses to provide information about their company, including business name, address, and contact information. * PPP Loan Calculation Worksheet (SBA Form 2483-SD): This worksheet is used to calculate the maximum loan amount that a business is eligible for. * PPP Loan Promissory Note (SBA Form 148): This note outlines the terms and conditions of the PPP loan, including the interest rate, repayment terms, and collateral requirements. * PPP Loan Certification (SBA Form 2483-C): This certification is required for businesses that have received a PPP loan. It certifies that the business has used the loan funds for eligible expenses, such as payroll costs and rent. * PPP Loan Forgiveness Application (SBA Form 3508): This application is used to apply for loan forgiveness. It requires businesses to provide documentation of their eligible expenses and certify that they have met the program’s requirements.

Importance of Accurate Documentation

Accurate documentation is crucial when applying for a PPP loan. Businesses need to ensure that they have all the required documents and that they are accurate and complete.

📝 Note: Inaccurate or incomplete documentation can lead to delays or even denial of the loan application.

Conclusion and Next Steps

In summary, the five key PPP loan papers are essential for businesses that are applying for a PPP loan. Businesses need to ensure that they have all the required documents and that they are accurate and complete. By understanding the PPP loan application process and the required documents, businesses can increase their chances of securing a PPP loan and achieving loan forgiveness.

What is the purpose of the PPP loan program?

+

The purpose of the PPP loan program is to provide financial assistance to small businesses affected by the COVID-19 pandemic.

What are the requirements for loan forgiveness?

+

To be eligible for loan forgiveness, businesses must use at least 60% of the loan funds for payroll costs and not more than 40% for non-payroll costs, such as rent and utilities.

How long do businesses have to apply for a PPP loan?

+

The application period for PPP loans is typically open for a limited time, and businesses should check with their lender for the most up-to-date information.