5 Docs to Buy Business

Introduction to Buying a Business

When considering the purchase of a business, it’s essential to approach the process with a clear understanding of the necessary steps and documentation involved. Buying a business can be a complex and challenging endeavor, requiring careful planning, research, and due diligence. In this article, we will explore the key documents and factors to consider when buying a business, providing a comprehensive guide to help navigate this process.

Understanding the Purchase Process

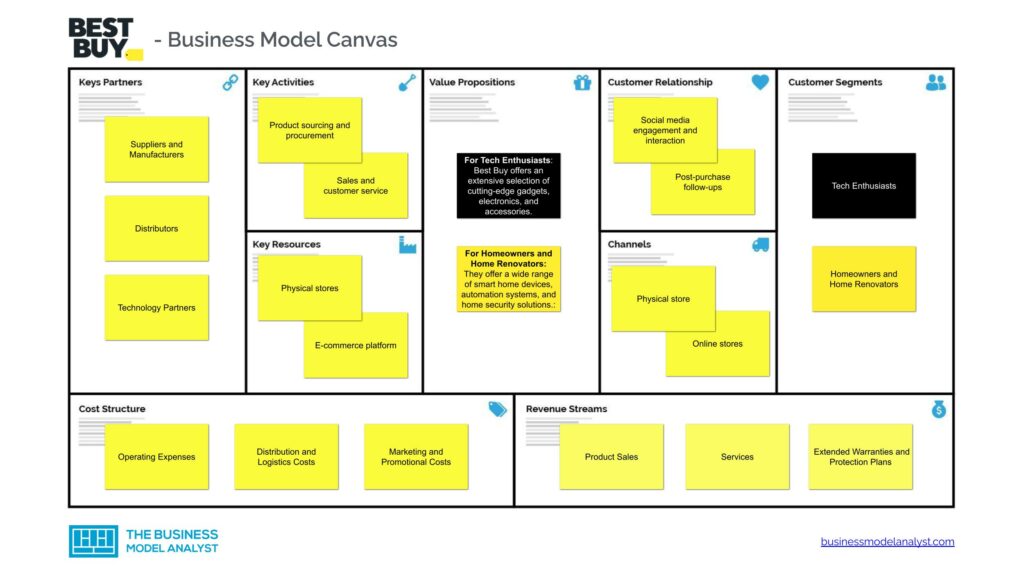

The process of buying a business typically involves several stages, including initial research, due diligence, and the final purchase agreement. Each stage requires careful consideration and the review of specific documents to ensure a successful transaction. Due diligence is a critical phase where the buyer examines the business’s financials, operations, and legal standing to identify potential risks and opportunities.

Key Documents for Buying a Business

Several documents are crucial in the business purchase process. These include: - Non-Disclosure Agreement (NDA): Protects the confidentiality of the business’s information shared during the purchase process. - Letter of Intent (LOI): Outlines the terms of the proposed purchase, including price, and serves as a basis for further negotiations. - Asset Purchase Agreement: Specifies the assets to be purchased and the terms of the sale. - Stock Purchase Agreement: Applies when buying the company’s stock, outlining the terms of the stock sale. - Financing Documents: If the purchase is financed through a loan, these documents will outline the terms of the financing agreement.

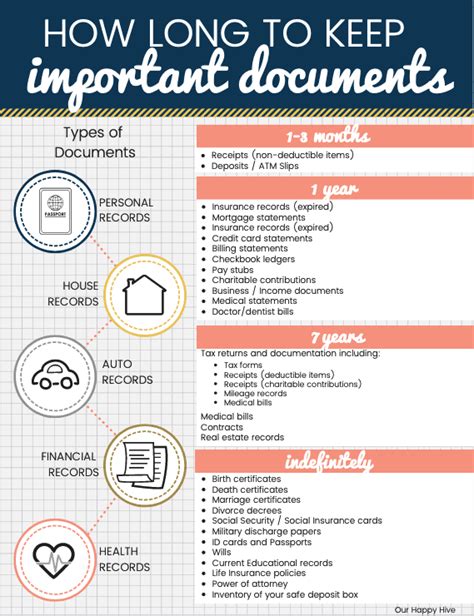

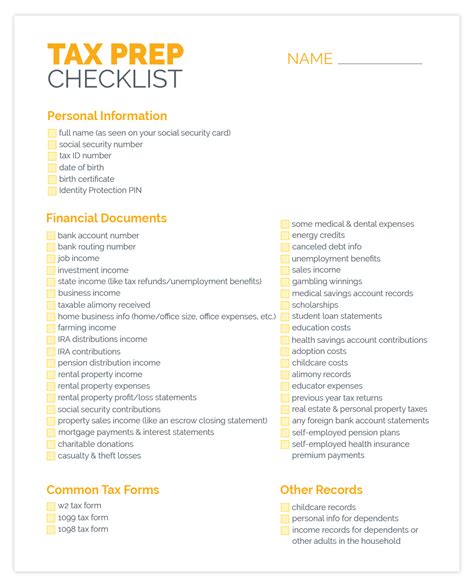

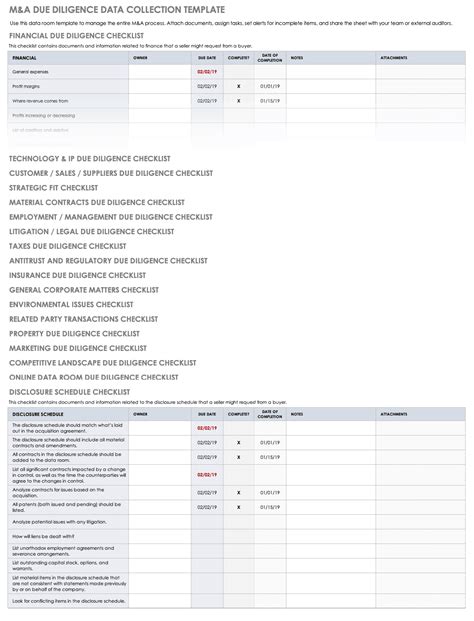

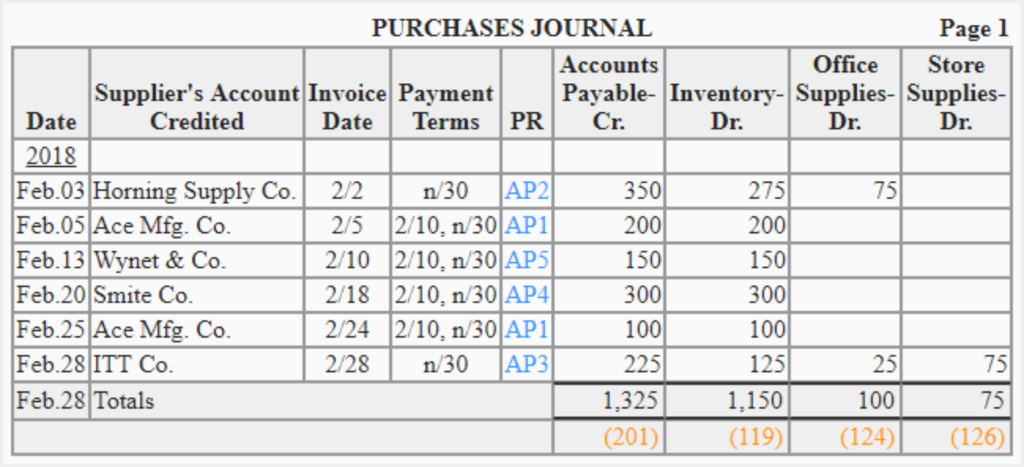

Due Diligence Checklist

A thorough due diligence process involves reviewing a wide range of documents and information. Key areas to focus on include: - Financial Records: Review income statements, balance sheets, and cash flow statements to understand the business’s financial health. - Legal Documents: Examine contracts, leases, and legal disputes to assess potential legal risks. - Operational Documents: Look at employee contracts, operational manuals, and supplier agreements to understand the business’s operations. - Tax Documents: Review tax returns and any tax-related issues.

📝 Note: It's crucial to work with legal and financial advisors during the due diligence process to ensure all aspects are thoroughly examined.

Negotiating the Purchase

Negotiation is a vital part of buying a business. Buyers should be prepared to negotiate the price, terms of the sale, and any contingencies. Understanding the business’s valuation, identifying areas for potential savings, and being flexible can help in achieving a favorable agreement.

Finalizing the Purchase

After negotiations are complete and all documents have been reviewed and agreed upon, the final step is to close the deal. This involves signing the purchase agreement and transferring the ownership of the business. It’s essential to ensure that all legal and financial aspects are properly handled during this phase.

Post-Purchase Considerations

After the purchase, the focus shifts to integrating the new business into existing operations or managing it as a standalone entity. This includes: - Transition Planning: Ensuring a smooth transition of ownership and operations. - Employee Integration: Managing employee relations and potential restructuring. - Financial Integration: Combining financial systems and ensuring compliance with all financial regulations.

| Document | Description |

|---|---|

| Non-Disclosure Agreement | Protects the confidentiality of the business's information. |

| Letter of Intent | Outlines the proposed purchase terms. |

| Asset/Stock Purchase Agreement | Specifies the terms of the asset or stock sale. |

| Financing Documents | Outlines the terms of the financing agreement. |

In summary, buying a business is a complex process that requires careful consideration of numerous factors and the review of several key documents. By understanding the purchase process, conducting thorough due diligence, and negotiating effectively, buyers can navigate this challenging process successfully. The ability to manage the transition post-purchase is also crucial for the long-term success of the acquired business.

What is the first step in buying a business?

+

The first step in buying a business is typically to sign a Non-Disclosure Agreement (NDA) to protect the confidentiality of the information shared about the business.

Why is due diligence important?

+

Due diligence is crucial because it allows the buyer to examine the business’s financial, legal, and operational aspects, identifying potential risks and opportunities before finalizing the purchase.

What documents are involved in the purchase process?

+

Key documents include the Non-Disclosure Agreement, Letter of Intent, Asset or Stock Purchase Agreement, and Financing Documents, among others.