7 Bankruptcy Paper Tips

Understanding Bankruptcy Papers: A Comprehensive Guide

When dealing with bankruptcy, one of the most critical aspects is understanding and navigating the complex paperwork involved. Bankruptcy papers are legal documents that play a crucial role in the bankruptcy process, providing detailed financial information about the individual or business filing for bankruptcy. In this article, we will delve into the world of bankruptcy papers, exploring their importance, the types of papers involved, and providing valuable tips for managing them effectively.

The Importance of Bankruptcy Papers

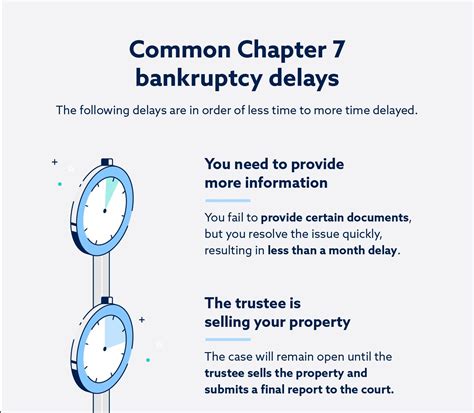

Bankruptcy papers serve as the foundation of a bankruptcy case. They contain vital information about the debtor’s financial situation, including assets, liabilities, income, and expenses. This information is used by the court to determine the debtor’s eligibility for bankruptcy and to guide the bankruptcy process. Accurate and complete bankruptcy papers are essential for a successful bankruptcy filing, as errors or omissions can lead to delays or even dismissal of the case.

Types of Bankruptcy Papers

There are several types of bankruptcy papers that may be required, depending on the specific circumstances of the case. These include:

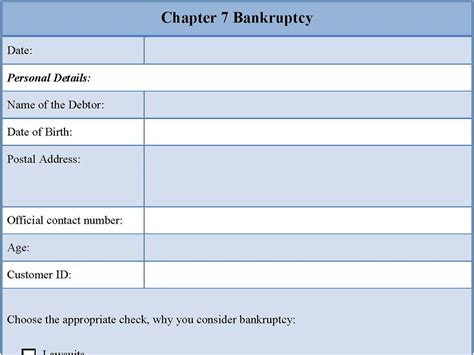

- Petition: The initial document filed with the court to commence the bankruptcy process.

- Schedules: Detailed lists of the debtor’s assets, liabilities, income, and expenses.

- Statement of Financial Affairs: A document providing information about the debtor’s financial transactions and activities.

- Plan: A proposal outlining how the debtor intends to repay creditors, typically required in Chapter 13 bankruptcy cases.

7 Bankruptcy Paper Tips

Managing bankruptcy papers can be a daunting task, but with the right approach, it can be made more manageable. Here are 7 valuable tips for handling bankruptcy papers:

- Seek Professional Help: Consult with a bankruptcy attorney to ensure that all papers are completed accurately and submitted on time.

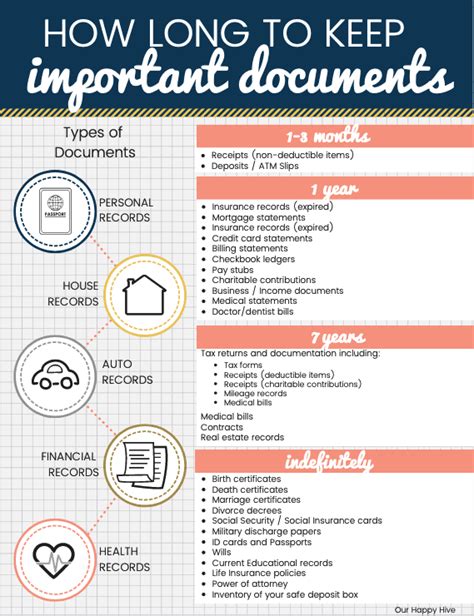

- Keep Detailed Records: Maintain comprehensive financial records, including receipts, invoices, and bank statements, to support the information provided in the bankruptcy papers.

- Be Thorough and Accurate: Ensure that all information provided in the bankruptcy papers is complete and accurate, as errors can lead to complications in the bankruptcy process.

- Submit Papers on Time: Meet all deadlines for submitting bankruptcy papers to avoid delays or penalties.

- Keep Copies of All Papers: Make and retain copies of all bankruptcy papers, including receipts and notices, for future reference.

- Stay Organized: Use a filing system to keep track of all bankruptcy papers and related documents, making it easier to access information when needed.

- Review and Update Papers as Necessary: Regularly review the bankruptcy papers to ensure that they remain accurate and up-to-date, making any necessary adjustments as the bankruptcy process progresses.

Bankruptcy Paper Checklist

To help ensure that all necessary bankruptcy papers are completed and submitted, consider using the following checklist:

| Document | Description |

|---|---|

| Petition | Initial document filed with the court to commence the bankruptcy process. |

| Schedules | Detailed lists of the debtor’s assets, liabilities, income, and expenses. |

| Statement of Financial Affairs | Document providing information about the debtor’s financial transactions and activities. |

| Plan | Proposal outlining how the debtor intends to repay creditors (Chapter 13 cases). |

📝 Note: This checklist is not exhaustive and may vary depending on the specific circumstances of the bankruptcy case. It is essential to consult with a bankruptcy attorney to ensure that all necessary papers are completed and submitted.

Conclusion and Next Steps

In conclusion, bankruptcy papers are a critical component of the bankruptcy process, providing the court with essential information about the debtor’s financial situation. By understanding the types of bankruptcy papers involved, seeking professional help, and following the 7 bankruptcy paper tips outlined above, individuals can navigate the complex world of bankruptcy papers with confidence. Remember to stay organized, keep detailed records, and review and update papers as necessary to ensure a smooth bankruptcy process.

What is the purpose of bankruptcy papers?

+

Bankruptcy papers provide the court with detailed financial information about the debtor, including assets, liabilities, income, and expenses, and are used to determine eligibility for bankruptcy and guide the bankruptcy process.

What types of bankruptcy papers are required?

+

The types of bankruptcy papers required may include a petition, schedules, statement of financial affairs, and plan, depending on the specific circumstances of the case.

Why is it essential to seek professional help with bankruptcy papers?

+

Seeking professional help with bankruptcy papers ensures that all papers are completed accurately and submitted on time, reducing the risk of errors or omissions that can lead to delays or penalties.