5 Car Loan Papers

Understanding the 5 Essential Car Loan Papers

When purchasing a vehicle, whether new or used, most buyers opt for a car loan to finance their purchase. The process of obtaining a car loan involves several steps, including applying for the loan, getting approved, and finally, signing the necessary documents. Among these documents, there are five critical car loan papers that every borrower should be familiar with. Understanding these papers is crucial for a smooth and transparent loan process.

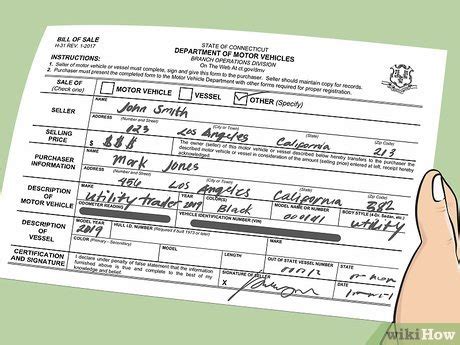

1. Loan Application

The loan application is the first document in the car loan process. It is where you provide personal, financial, and employment information to the lender. This document is crucial because it determines your eligibility for the loan. Lenders use the information provided to assess your creditworthiness and decide whether to approve your loan application. It’s essential to fill out this form accurately and honestly to avoid any complications during the loan process.

2. Loan Approval Letter

After submitting your loan application, if you meet the lender’s criteria, you will receive a loan approval letter. This document outlines the terms of the loan, including the loan amount, interest rate, repayment term, and monthly installment. It’s a critical document that confirms your loan has been approved and provides details about the loan. Before signing any further documents, review this letter carefully to ensure you understand and agree with the loan terms.

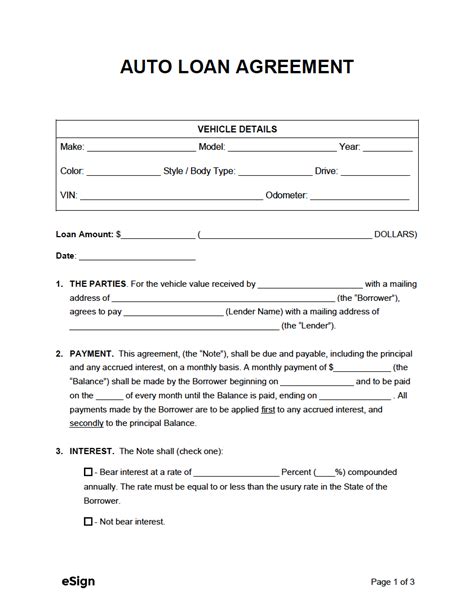

3. Promissory Note

A promissory note is a legal document that serves as a promise to repay the loan. It includes the borrower’s (your) promise to pay back the loan amount plus interest, as agreed upon. This note is a legally binding contract and is essential for securing the loan. The promissory note will specify the loan amount, interest rate, repayment schedule, and any late payment fees. It’s crucial to read and understand the terms of the promissory note before signing, as it commits you to the repayment terms outlined.

4. Security Agreement

For secured car loans, a security agreement is necessary. This document specifies that the vehicle being purchased serves as collateral for the loan. It means that if you fail to make payments as agreed, the lender has the right to repossess the vehicle. The security agreement outlines the terms under which the lender can take possession of the vehicle and sell it to recover the loan amount. Understanding the security agreement is vital to avoid the risk of losing your vehicle due to default.

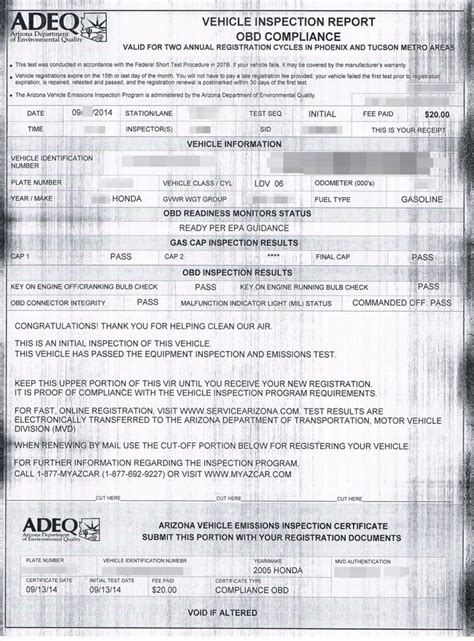

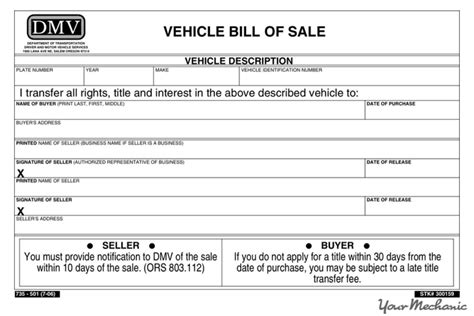

5. Vehicle Title

The vehicle title, also known as the pink slip, is a document that proves ownership of the vehicle. When you purchase a vehicle with a loan, the lender’s name is typically listed on the title as a lienholder until the loan is fully repaid. This means the lender has a legal claim to the vehicle until you have paid off the loan in full. Once the loan is paid off, you will receive a clear title, indicating you are the sole owner of the vehicle.

📝 Note: It's essential to keep all these documents in a safe place, as they are crucial for your records and may be required for future reference, such as when selling the vehicle or applying for another loan.

To summarize, the five essential car loan papers are critical components of the car buying process. Each document plays a significant role in the loan process, from application to repayment. Understanding these documents can help you navigate the process more smoothly and avoid potential pitfalls. Whether you’re a first-time car buyer or have purchased vehicles before, familiarity with these documents is key to a successful and stress-free car loan experience.

What is the importance of the loan application in the car loan process?

+

The loan application is crucial because it provides the lender with the necessary information to assess your creditworthiness and decide on your loan eligibility.

How does a security agreement impact the car loan?

+

A security agreement specifies the vehicle as collateral for the loan, allowing the lender to repossess and sell the vehicle if payments are not made as agreed.

Why is it necessary to carefully review the loan approval letter?

+

Reviewing the loan approval letter carefully is necessary to ensure you understand and agree with the loan terms, including the loan amount, interest rate, and repayment terms, before proceeding with the loan.