Paperwork

5 Tips File Business Taxes

Understanding the Importance of Business Taxes

When it comes to running a successful business, one of the most critical aspects is managing and filing business taxes. Accurate and timely tax filing is essential to avoid penalties, fines, and even legal issues. In this article, we will discuss five valuable tips to help businesses navigate the complex world of taxation.

Tip 1: Keep Accurate and Detailed Records

Maintaining precise and comprehensive records is the foundation of efficient tax filing. This includes income statements, balance sheets, expense reports, and receipts. Businesses should implement a robust accounting system to track all financial transactions, ensuring that they can provide the necessary documentation when filing taxes. Organized records also facilitate the identification of deductible expenses, which can significantly reduce the tax liability.

Tip 2: Understand Business Tax Obligations

Different businesses have different tax obligations, depending on their structure, size, and industry. It is crucial for businesses to understand their specific tax requirements, including tax deadlines, tax rates, and tax deductions. For instance, sole proprietorships and partnerships are pass-through entities, meaning that the business income is reported on the owner’s personal tax return. In contrast, corporations are taxed on their profits and may also be subject to dividends tax.

Tip 3: Take Advantage of Tax Deductions and Credits

Tax deductions and credits can substantially reduce a business’s tax liability. Business expense deductions include items such as office supplies, travel expenses, and equipment purchases. Additionally, businesses may be eligible for tax credits, such as the research and development tax credit or the work opportunity tax credit. It is essential to consult with a tax professional to ensure that all eligible deductions and credits are claimed.

Tip 4: File Taxes Electronically

Electronic tax filing, also known as e-filing, offers numerous benefits, including faster processing times, reduced errors, and increased security. The Internal Revenue Service (IRS) encourages businesses to e-file their tax returns, as it helps to streamline the tax filing process and reduce the risk of errors. Furthermore, e-filing allows businesses to receive confirmation of receipt and faster refunds.

Tip 5: Seek Professional Tax Advice

Tax laws and regulations are constantly evolving, making it challenging for businesses to stay up-to-date. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide valuable guidance and support to ensure that businesses are in compliance with all tax requirements. They can also help businesses to identify potential tax savings opportunities and navigate the tax filing process.

💡 Note: It is essential to consult with a tax professional to ensure that your business is meeting all tax obligations and taking advantage of available tax deductions and credits.

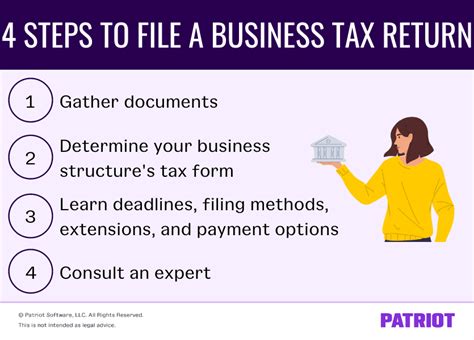

Additional Tips and Considerations

In addition to the above tips, businesses should also consider the following: * Stay organized and maintain accurate records throughout the year * Keep track of deadlines and filing requirements * Be aware of tax law changes and updates * Consider tax planning strategies to minimize tax liability

| Business Structure | Tax Obligations |

|---|---|

| Sole Proprietorship | Pass-through entity, reported on owner's personal tax return |

| Partnership | Pass-through entity, reported on partners' personal tax returns |

| Corporation | Taxed on profits, may also be subject to dividends tax |

In the end, managing and filing business taxes requires careful planning, attention to detail, and a thorough understanding of tax laws and regulations. By following these tips and seeking professional tax advice, businesses can ensure that they are meeting all tax obligations and taking advantage of available tax savings opportunities. The key to successful tax management is to stay informed, stay organized, and stay proactive.