Window Tax Paperwork Requirements

Introduction to Window Tax Paperwork Requirements

The window tax, a property tax based on the number of windows in a building, has been a part of history in several countries, including the United Kingdom. Although the tax itself is no longer in effect, understanding its historical context and the paperwork requirements it entailed can provide insight into how taxes have evolved over time. In this blog post, we will delve into the historical window tax, its implications, and what the paperwork requirements would have looked like during its enforcement.

Historical Context of the Window Tax

The window tax was first introduced in England in 1696 under King William III as a way to impose a tax on the wealthy, who typically had larger houses with more windows. The tax was based on the number of windows in a house, with the rationale being that larger, more luxurious homes would have more windows, thus the owners could afford to pay more tax. This tax was in effect for over a century, with various amendments, until it was finally repealed in 1851.

Paperwork Requirements for the Window Tax

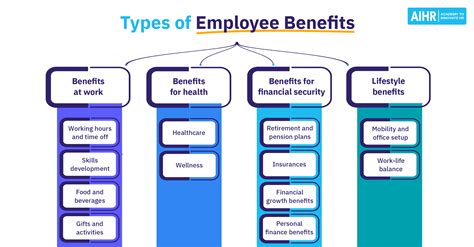

During its enforcement, the window tax required meticulous record-keeping and paperwork. Homeowners or property managers had to maintain accurate counts of the windows in their buildings. This information was crucial for tax assessment purposes. Here are some key aspects of the paperwork requirements: - Window Count: An accurate count of all windows in the property. This included not just the standard windows but any opening that allowed light into the house. - Property Details: Detailed descriptions of the property, including its location, size, and the number of rooms. This information helped in assessing the property’s value and determining the appropriate tax bracket. - Tax Returns: Annual tax returns were required, where property owners had to declare the number of windows in their properties and calculate the tax owed based on the current tax rate per window. - Payment Receipts: Upon payment of the tax, property owners would receive receipts as proof of payment. These receipts were essential for avoiding penalties or disputes over unpaid taxes.

Impact of the Window Tax on Architecture and Society

The window tax had a significant impact on the architecture of buildings during its time. To minimize tax liabilities, many homeowners opted to brick up windows, reducing the number of windows in their homes. This practice, while saving on taxes, also led to darker, less healthy living conditions. The tax also influenced the design of new buildings, with architects incorporating fewer windows into their designs to save owners money on taxes.

Repeal of the Window Tax

By the mid-19th century, the window tax was widely recognized as an inefficient and unfair system. It was criticized for its impact on public health, as the reduction in windows led to poorly ventilated homes. The tax was finally repealed in 1851, marking a significant shift towards more equitable and less intrusive taxation methods.

📝 Note: The repeal of the window tax led to significant improvements in housing conditions, as homes could once again be designed with ample natural light and ventilation, improving the health and quality of life of the inhabitants.

Lessons from the Window Tax

The window tax serves as a historical example of how taxation policies can have unintended consequences on society and architecture. It highlights the importance of designing tax systems that are fair, efficient, and consider the broader social and environmental impacts. As we look back, it’s clear that the window tax, while intended to generate revenue, ultimately led to adverse effects on public health and architectural innovation.

Modern Taxation and Property

Today, property taxation is based on more sophisticated and equitable methods, such as the value of the property itself or the income it generates. These systems aim to be more fair and less invasive than the window tax, recognizing the importance of natural light and ventilation in homes. Modern taxation also considers environmental and health factors, promoting sustainable development and healthy living conditions.

What was the primary purpose of the window tax?

+

The primary purpose of the window tax was to impose a tax on the wealthy, who typically had larger houses with more windows, as a means of generating revenue.

How did the window tax influence architecture?

+

The window tax led to the practice of bricking up windows to minimize tax liabilities and influenced the design of new buildings to incorporate fewer windows, affecting the living conditions and health of the inhabitants.

Why was the window tax repealed?

+

The window tax was repealed due to its recognized inefficiencies and unfairness, particularly its negative impact on public health by leading to poorly ventilated homes.

In summary, the window tax, though historically significant, had profound unintended consequences on architecture, public health, and societal equality. Its repeal marked an important step towards more equitable and health-conscious taxation policies. Understanding the history and implications of the window tax can provide valuable insights into the evolution of taxation and its impact on society and architecture. The legacy of the window tax serves as a reminder of the importance of carefully considering the potential effects of taxation policies on the environment, health, and societal well-being.