5 Tips on FMLA Fees

Introduction to FMLA Fees

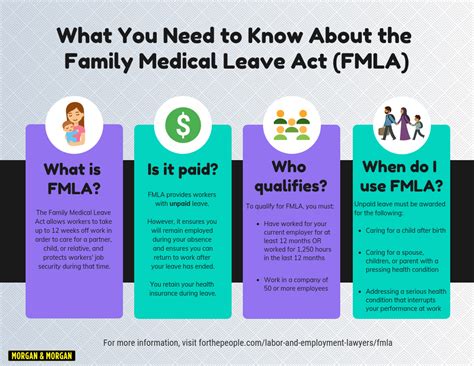

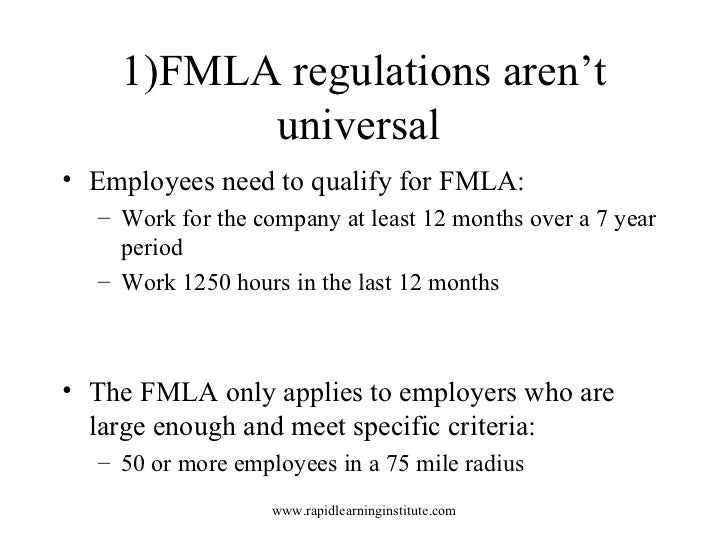

The Family and Medical Leave Act (FMLA) is a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons. While the law is designed to provide employees with job protection and continuation of health insurance coverage during their leave, there are some fees and costs associated with administering the FMLA. In this article, we will discuss 5 tips on FMLA fees that employers should be aware of.

Understanding FMLA Fees

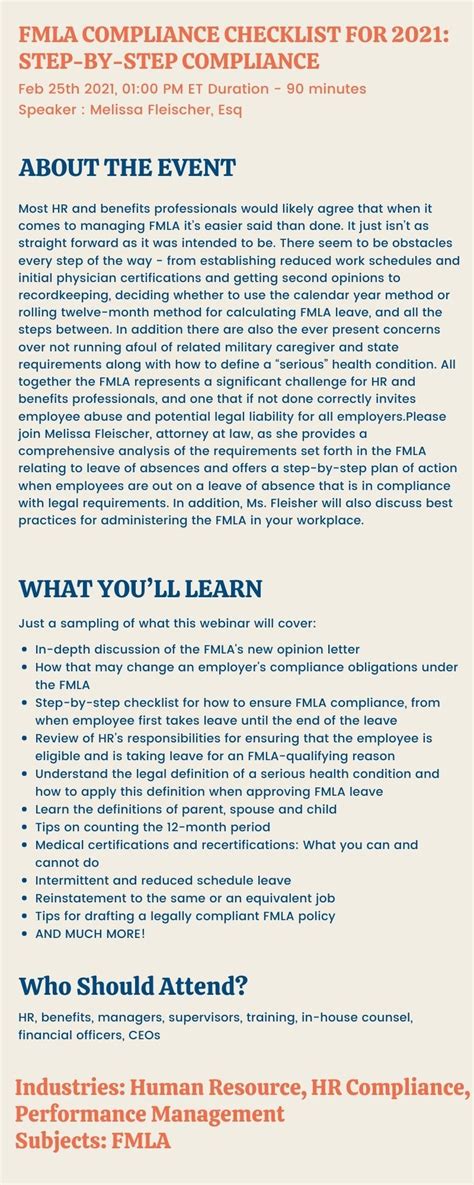

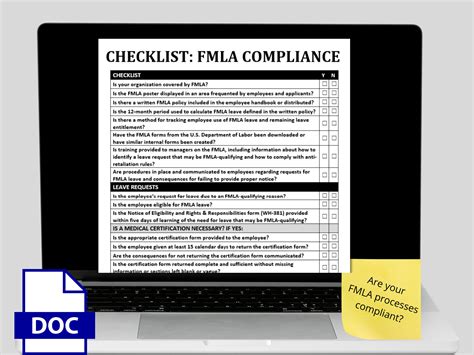

FMLA fees can include costs such as administrative fees, medical certification fees, and posting requirements fees. Employers must understand these fees and how they can impact their business. The first tip is to review and understand the FMLA regulations and the associated fees. This will help employers to budget and plan accordingly.

Tip 1: Review and Understand FMLA Regulations

The first tip is to review and understand the FMLA regulations and the associated fees. Employers should familiarize themselves with the Department of Labor’s (DOL) regulations and guidelines on FMLA. This will help employers to comply with the law and avoid any penalties or fines. Some of the key regulations include: * Posting requirements: Employers must post a notice explaining the FMLA rights and responsibilities in a conspicuous place. * Medical certification: Employers may require employees to provide medical certification to support their leave request. * Administrative fees: Employers may charge employees for administrative fees associated with processing their leave request.

Tip 2: Calculate Administrative Fees

The second tip is to calculate administrative fees associated with processing FMLA leave requests. Employers should identify and track the costs associated with administering the FMLA, such as: * HR personnel time: The time spent by HR personnel to process leave requests and respond to employee inquiries. * Benefits administration: The costs associated with administering benefits during the employee’s leave. * Records management: The costs associated with maintaining records and documentation related to FMLA leave.

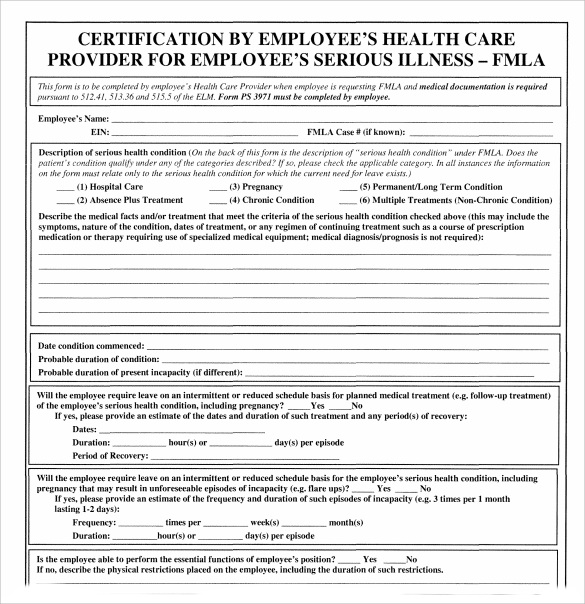

Tip 3: Determine Medical Certification Fees

The third tip is to determine medical certification fees associated with obtaining medical certification from employees. Employers may require employees to provide medical certification to support their leave request. The costs associated with obtaining medical certification may include: * Doctor’s fees: The fees charged by healthcare providers to complete medical certification forms. * Travel costs: The costs associated with traveling to healthcare providers to obtain medical certification.

Tip 4: Consider Posting Requirements Fees

The fourth tip is to consider posting requirements fees associated with posting FMLA notices. Employers must post a notice explaining the FMLA rights and responsibilities in a conspicuous place. The costs associated with posting requirements may include: * Printing costs: The costs associated with printing FMLA notices. * Posting costs: The costs associated with posting FMLA notices in a conspicuous place.

Tip 5: Budget and Plan for FMLA Fees

The fifth tip is to budget and plan for FMLA fees. Employers should anticipate and budget for the costs associated with administering the FMLA. This may include: * HR personnel costs: The costs associated with hiring and training HR personnel to administer the FMLA. * Benefits administration costs: The costs associated with administering benefits during the employee’s leave. * Records management costs: The costs associated with maintaining records and documentation related to FMLA leave.

📝 Note: Employers should review and understand the FMLA regulations and associated fees to ensure compliance and avoid any penalties or fines.

The key to managing FMLA fees is to understand and anticipate the costs associated with administering the law. By following these 5 tips, employers can budget and plan for FMLA fees and ensure compliance with the law.

In summary, understanding and managing FMLA fees is crucial for employers to ensure compliance with the law and avoid any penalties or fines. By reviewing and understanding the FMLA regulations, calculating administrative fees, determining medical certification fees, considering posting requirements fees, and budgeting and planning for FMLA fees, employers can effectively manage the costs associated with administering the FMLA.

What is the purpose of the FMLA?

+

The purpose of the FMLA is to provide eligible employees with up to 12 weeks of unpaid leave in a 12-month period for certain family and medical reasons.

What are the types of FMLA fees?

+

The types of FMLA fees include administrative fees, medical certification fees, and posting requirements fees.

How can employers manage FMLA fees?

+

Employers can manage FMLA fees by reviewing and understanding the FMLA regulations, calculating administrative fees, determining medical certification fees, considering posting requirements fees, and budgeting and planning for FMLA fees.