5 NY Admin Rights

Understanding Administrator Rights in New York

As a resident of New York, it’s essential to understand the concept of administrator rights, particularly in the context of estate administration. When an individual passes away, their estate must be managed and distributed according to their will or the laws of intestacy. In New York, the administrator of an estate plays a crucial role in this process. In this article, we will delve into the world of administrator rights in New York, exploring the basics, responsibilities, and limitations of these rights.

What are Administrator Rights?

Administrator rights refer to the authority granted to an individual or entity to manage and distribute the estate of a deceased person. This authority is typically granted by the Surrogate’s Court, which is responsible for overseeing the administration of estates in New York. The administrator is tasked with collecting the assets of the estate, paying off debts and taxes, and distributing the remaining assets to the beneficiaries.

Types of Administrator Rights

There are several types of administrator rights in New York, including: * Letters Testamentary: These are granted to the executor named in the deceased person’s will. * Letters of Administration: These are granted to an administrator when the deceased person did not leave a will. * Letters of Administration with Will Annexed: These are granted when the deceased person left a will, but the executor is unable or unwilling to serve.

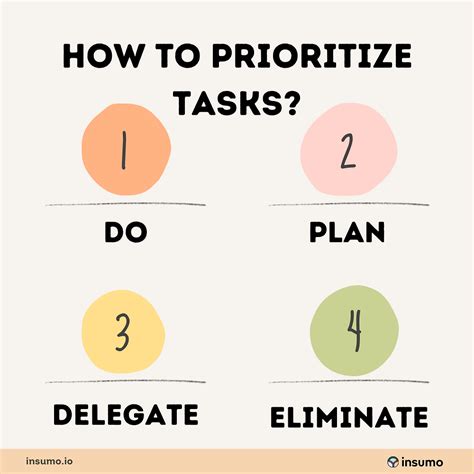

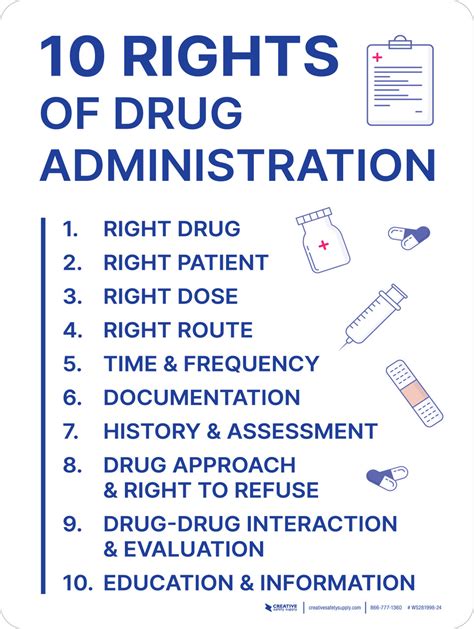

Responsibilities of an Administrator

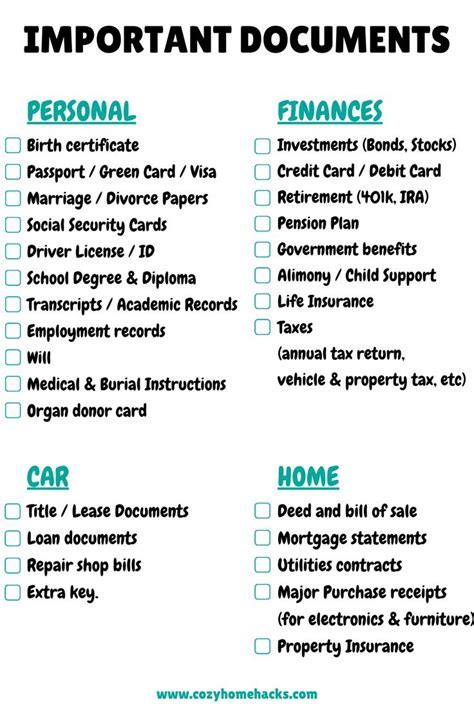

The administrator of an estate in New York has several key responsibilities, including: * Collecting and managing the assets of the estate * Paying off debts and taxes * Distributing the remaining assets to the beneficiaries * Maintaining accurate records of the estate’s transactions * Filing tax returns and other necessary documents

Limitations of Administrator Rights

While an administrator has significant authority over the estate, there are also limitations to their rights. For example: * The administrator must act in the best interests of the estate and its beneficiaries * The administrator must follow the instructions outlined in the will, if applicable * The administrator is subject to the oversight of the Surrogate’s Court * The administrator may be required to post a bond to ensure the proper administration of the estate

Challenges Facing Administrators in New York

Administrators in New York may face several challenges, including: * Complexity of estate laws: New York’s estate laws can be complex and nuanced, making it difficult for administrators to navigate. * Disputes among beneficiaries: Beneficiaries may disagree over the distribution of assets or the actions of the administrator. * Financial constraints: The administrator may need to manage significant debts or taxes, which can impact the distribution of assets.

💡 Note: Administrators in New York should seek the guidance of an experienced attorney to ensure they are meeting their responsibilities and avoiding potential pitfalls.

Best Practices for Administrators in New York

To ensure the smooth administration of an estate in New York, administrators should follow these best practices: * Seek the guidance of an experienced attorney * Maintain accurate and detailed records of the estate’s transactions * Communicate regularly with beneficiaries and other stakeholders * Act in the best interests of the estate and its beneficiaries

| Task | Responsibility |

|---|---|

| Collecting assets | Administrator |

| Paying off debts and taxes | Administrator |

| Distributing assets | Administrator |

In the end, understanding administrator rights in New York is crucial for ensuring the proper administration of an estate. By grasping the basics, responsibilities, and limitations of these rights, administrators can navigate the complex process of estate administration with confidence. Whether you are an experienced administrator or just starting out, it’s essential to stay informed and seek guidance when needed to ensure the best possible outcome for the estate and its beneficiaries.

What is the role of the Surrogate’s Court in New York estate administration?

+

The Surrogate’s Court is responsible for overseeing the administration of estates in New York, including granting administrator rights and monitoring the actions of administrators.

How do I become an administrator of an estate in New York?

+

To become an administrator of an estate in New York, you must petition the Surrogate’s Court and demonstrate your ability to manage the estate in accordance with the law.

What are the consequences of mismanaging an estate in New York?

+

Mismanaging an estate in New York can result in legal action, including removal as administrator, fines, and penalties. It’s essential to seek guidance from an experienced attorney to avoid these consequences.