Paperwork

Claim Solar Tax Credit Paperwork

Introduction to Solar Tax Credits

The adoption of solar energy has been on the rise, driven by its numerous benefits, including reduced carbon footprint, energy independence, and significant cost savings. One of the key incentives that have encouraged individuals and businesses to invest in solar panels is the solar tax credit. This credit allows homeowners and companies to deduct a portion of their solar panel installation costs from their taxable income, thereby reducing their tax liability. However, to claim this credit, it’s essential to understand the process and ensure all necessary paperwork is in order.

Understanding the Solar Tax Credit

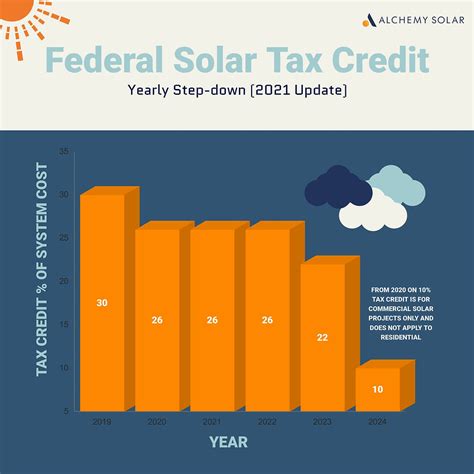

The solar tax credit, also known as the Investment Tax Credit (ITC), is a federal tax incentive that allows individuals and businesses to claim a credit of up to 26% of the total cost of a solar panel system installed on their property. This credit can be claimed against the taxpayer’s income tax liability for the year the system is installed. The percentage of the credit has varied over the years, with the rate stepping down over time. It’s crucial to check the current rate and any deadlines for claiming the credit.

Eligibility for the Solar Tax Credit

To be eligible for the solar tax credit, several conditions must be met: - The solar panel system must be installed on a property that is used as a residence or for business. - The system must be installed in a location that is connected to the electrical grid or is designed to provide electricity for the property. - The system must be new or being used for the first time; used systems do not qualify. - The taxpayer must have a tax liability to claim against; the credit cannot be refunded if it exceeds the taxpayer’s tax liability for the year.

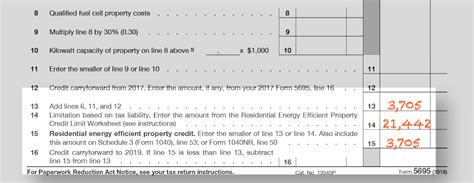

Required Paperwork for Claiming the Solar Tax Credit

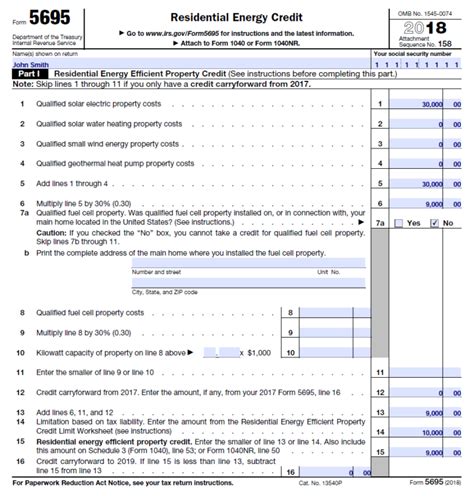

To claim the solar tax credit, taxpayers need to ensure they have the following paperwork in order: - Receipts and Invoices: Detailed receipts and invoices from the solar panel installation company that include the total cost of the system, the date of installation, and a description of the system. - Manufacturer Certifications: Certifications from the manufacturers of the solar panels and other system components stating that the products meet the requirements for the tax credit. - Utility Interconnection Documents: Documentation showing that the solar panel system has been interconnected with the electrical grid, if applicable. - Form 5695: This is the Residential Energy Credits form that taxpayers will need to complete and submit with their tax return (Form 1040) to claim the solar tax credit.

Step-by-Step Guide to Claiming the Solar Tax Credit

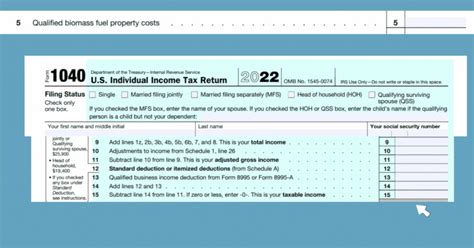

Claiming the solar tax credit involves the following steps: 1. Gather All Required Documents: Ensure you have all the receipts, invoices, certifications, and other documents necessary for your tax credit claim. 2. Complete Form 5695: Fill out Form 5695, making sure to calculate the credit correctly based on the eligible costs of your solar panel system. 3. File Form 1040: Submit your completed Form 5695 with your tax return (Form 1040) to the IRS. 4. Keep Records: Maintain all documentation related to your solar tax credit claim, as you may need these if your return is audited.

Benefits of the Solar Tax Credit

The solar tax credit offers several benefits, including: - Financial Savings: The credit can significantly reduce the upfront cost of installing a solar panel system. - Environmental Benefits: By incentivizing the use of solar energy, the credit promotes cleaner, renewable energy sources. - Energy Independence: Solar energy allows homeowners and businesses to generate their own electricity, reducing reliance on the grid.

Important Considerations

When considering the solar tax credit, keep in mind: - Time Limits: There are deadlines for claiming the credit, and the percentage of the credit available decreases over time. - System Costs: Only certain costs associated with the solar panel system are eligible for the credit. - Tax Liability: The credit can only be claimed against tax liability for the year it is installed.

📝 Note: It's essential to consult with a tax professional to ensure you meet all the eligibility criteria and follow the correct procedure for claiming the solar tax credit.

Conclusion and Future Outlook

In conclusion, the solar tax credit is a valuable incentive for those looking to invest in solar energy. By understanding the eligibility criteria, required paperwork, and the process for claiming the credit, individuals and businesses can make the most of this opportunity. As the world continues to shift towards renewable energy sources, incentives like the solar tax credit play a crucial role in encouraging the adoption of cleaner, more sustainable practices.

What is the current rate of the solar tax credit?

+

The current rate of the solar tax credit is up to 26% of the total cost of a solar panel system installed on a property. However, this rate is subject to change over time, so it’s essential to check the current rate and any deadlines for claiming the credit.

Can I claim the solar tax credit for a system installed on a rental property?

+

Yes, the solar tax credit can be claimed for a system installed on a rental property, but the property must be used for business purposes. The credit is claimed against the business’s tax liability.

How long do I have to keep the records related to my solar tax credit claim?

+