5 MI Paperwork Tips

Streamlining Your Workflow: 5 MI Paperwork Tips

When dealing with MI (Motor Insurance) paperwork, it’s essential to stay organized and efficient to ensure a smooth claims process. Proper documentation and accurate data entry are crucial in preventing delays and reducing the risk of errors. In this article, we’ll explore five valuable tips to help you navigate MI paperwork with ease.

Understanding MI Paperwork Requirements

Before diving into the tips, it’s vital to understand the types of paperwork involved in MI claims. These may include: * Accident reports * Police reports * Medical records * Repair estimates * Insurance policy documents Familiarizing yourself with these documents will help you better manage the claims process and ensure that all necessary information is collected.

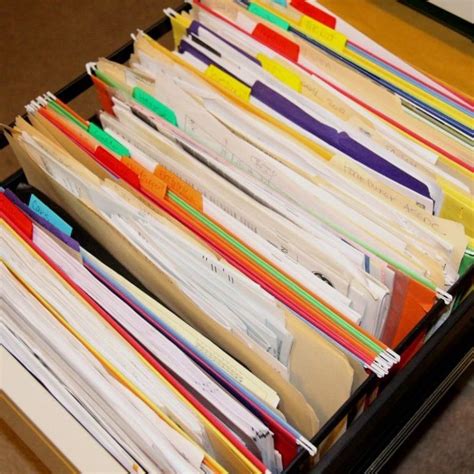

Tip 1: Implement a Centralized Filing System

A centralized filing system is essential for keeping track of MI paperwork. This can be a physical file cabinet or a digital storage system, depending on your preference. The key is to have a single location where all relevant documents are stored, making it easy to access and retrieve information as needed. Consider using cloud-based storage to ensure that your files are secure and accessible from anywhere.

Tip 2: Use a Checklist to Ensure Completeness

Creating a checklist can help you ensure that all necessary documents are collected and completed. This can include: * Claimant information * Vehicle details * Accident description * Witness statements * Medical records Using a checklist will help you stay organized and prevent delays in the claims process.

Tip 3: Invest in Automation Tools

Automation tools can significantly streamline your MI paperwork process. Consider investing in software solutions that can help with: * Data entry * Document management * Claims tracking * Communication with claimants Automation tools can help reduce errors, increase efficiency, and improve the overall claims experience.

Tip 4: Establish Clear Communication Channels

Clear communication is critical in the MI claims process. Establishing open lines of communication with claimants, insurers, and other stakeholders can help prevent misunderstandings and delays. Consider using project management tools to facilitate communication and collaboration.

Tip 5: Regularly Review and Update Your Processes

Finally, it’s essential to regularly review and update your MI paperwork processes. This can help you: * Identify areas for improvement * Implement new technologies * Stay compliant with regulatory requirements Regular review and updates will help you stay ahead of the curve and ensure that your MI paperwork processes are efficient, effective, and compliant.

📝 Note: Regularly reviewing and updating your processes can help you stay compliant with regulatory requirements and reduce the risk of errors.

As you implement these tips, you’ll be well on your way to streamlining your MI paperwork processes and improving the overall claims experience. By staying organized, leveraging technology, and maintaining clear communication channels, you can reduce delays, increase efficiency, and provide better service to your clients.

To further illustrate the importance of efficient MI paperwork processes, consider the following table:

| Process | Benefits |

|---|---|

| Centralized filing system | Improved organization, reduced errors |

| Checklist | Ensures completeness, prevents delays |

| Automation tools | Increases efficiency, reduces errors |

| Clear communication | Prevents misunderstandings, improves claims experience |

| Regular review and updates | Identifies areas for improvement, ensures compliance |

In summary, implementing these five tips can help you streamline your MI paperwork processes, improve efficiency, and provide better service to your clients. By staying organized, leveraging technology, and maintaining clear communication channels, you can reduce delays, increase productivity, and achieve a more successful claims process.

What is the importance of a centralized filing system in MI paperwork?

+

A centralized filing system is essential for keeping track of MI paperwork, making it easy to access and retrieve information as needed.

How can automation tools improve the MI claims process?

+

Automation tools can help reduce errors, increase efficiency, and improve the overall claims experience by streamlining data entry, document management, and communication with claimants.

What are the benefits of regularly reviewing and updating MI paperwork processes?

+

Regularly reviewing and updating MI paperwork processes can help identify areas for improvement, implement new technologies, and stay compliant with regulatory requirements, ultimately reducing the risk of errors and improving the claims experience.