Investment Advisor Compliance Paperwork

Introduction to Investment Advisor Compliance

As an investment advisor, navigating the complex world of financial regulations can be daunting. Compliance is a critical aspect of any investment advisory firm, ensuring that operations are conducted in accordance with the law, protecting both the firm and its clients from potential legal and financial repercussions. The core of compliance for investment advisors lies in the paperwork and documentation that support their day-to-day operations. This includes a myriad of documents, from client agreements and disclosure forms to more detailed reports and filings required by regulatory bodies.

Understanding Key Compliance Documents

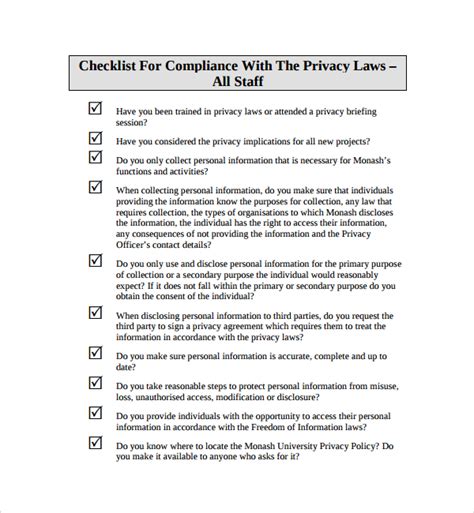

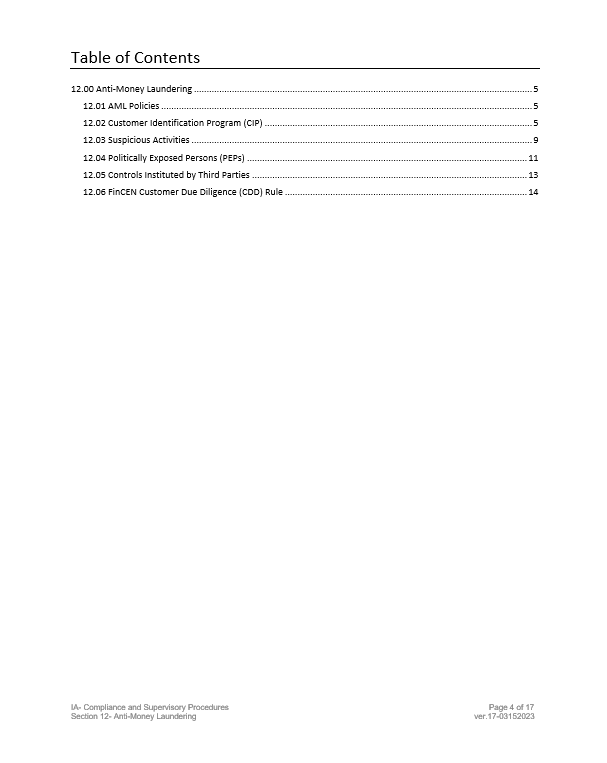

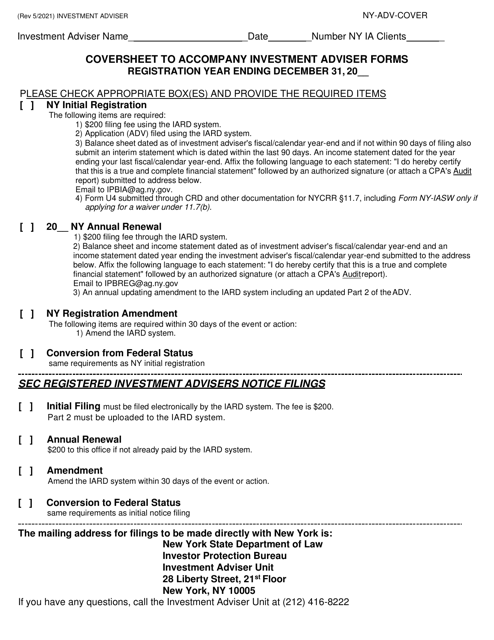

Compliance for investment advisors involves a deep understanding of several key documents and their roles in the advisory process. These documents not only facilitate transparency and accountability but also play a crucial role in maintaining regulatory compliance. Some of the most important documents include: - Form ADV: This is a uniform application used by investment advisors to register with the Securities and Exchange Commission (SEC) and state securities authorities. It consists of two parts: Part 1 provides general information about the advisor’s business, while Part 2A (the brochure) and Part 2B (the brochure supplement) provide detailed information about the advisor’s services, fees, and business practices. - Client Agreements: These contracts outline the terms and conditions of the advisory relationship, including the scope of services, compensation, and responsibilities of both the advisor and the client. They are essential for setting clear expectations and protecting both parties. - Privacy Policies: Given the sensitive nature of client information, investment advisors must have robust privacy policies in place. These policies must detail how client information is collected, stored, and protected, as well as under what circumstances it may be disclosed. - Compliance Manuals: A comprehensive compliance manual is a vital resource for any investment advisory firm. It outlines the firm’s policies and procedures for maintaining compliance with relevant laws and regulations, serving as a guide for employees and a demonstration of the firm’s commitment to compliance for regulatory purposes.

Best Practices for Managing Compliance Paperwork

Effective management of compliance paperwork is crucial for the success and integrity of an investment advisory firm. Implementing best practices can help streamline compliance processes, reduce the risk of non-compliance, and enhance overall operational efficiency. Some key best practices include: - Centralized Document Management: Utilizing a centralized document management system can help ensure that all compliance documents are accessible, up-to-date, and properly archived. This can be particularly beneficial for firms with multiple locations or a large volume of documents. - Regular Review and Update: Compliance documents should be reviewed and updated regularly to reflect changes in regulations, business practices, or client needs. This proactive approach can help prevent compliance issues and demonstrate a commitment to ongoing compliance. - Employee Training: Providing comprehensive training to employees on compliance policies and procedures is essential. This not only ensures that all staff members understand their roles in maintaining compliance but also fosters a culture of compliance within the firm. - Audit Preparation: Being prepared for audits, whether they are routine or surprise inspections by regulatory bodies, is critical. Maintaining organized and accessible compliance paperwork, along with demonstrating a clear understanding of compliance procedures, can significantly reduce the stress and potential repercussions of an audit.

Technological Solutions for Compliance Management

The advent of technology has provided investment advisory firms with powerful tools to manage compliance paperwork more efficiently. Solutions such as compliance software can automate many tasks, from document management and reporting to training and auditing. These technological advancements offer several benefits, including: - Enhanced Accuracy: Automated systems can reduce the likelihood of human error, ensuring that compliance documents are accurate and complete. - Increased Efficiency: By automating routine compliance tasks, firms can free up resources for more critical functions, improving overall operational efficiency. - Improved Accessibility: Cloud-based compliance management systems provide secure, anytime access to compliance documents and information, facilitating collaboration and review. - Real-time Monitoring: Advanced compliance software often includes real-time monitoring capabilities, enabling firms to quickly identify and address potential compliance issues before they become major problems.

| Compliance Document | Purpose | Frequency of Update |

|---|---|---|

| Form ADV | Registration with SEC and state securities authorities | Annually, and upon material changes |

| Client Agreements | Outlines terms and conditions of advisory relationship | Upon inception, and as necessary |

| Privacy Policies | Details how client information is handled | Regularly, to reflect changes in practices or regulations |

| Compliance Manuals | Guides policies and procedures for compliance | Regularly, to reflect changes in regulations or business practices |

📝 Note: Regular review and update of compliance documents are crucial for maintaining compliance and reducing the risk of regulatory issues.

In conclusion, the management of compliance paperwork is a cornerstone of any successful investment advisory firm. By understanding the key documents involved, implementing best practices for their management, and leveraging technological solutions, firms can ensure they are operating within the bounds of regulatory requirements while providing the highest level of service to their clients. Effective compliance management not only protects the firm and its clients but also contributes to a reputation of integrity and professionalism, which is essential in the competitive and highly regulated world of investment advisory services.

What is the primary purpose of Form ADV for investment advisors?

+

The primary purpose of Form ADV is to provide potential clients with information about the investment advisor’s business practices, services, and fees, facilitating informed decision-making.

Why is regular review and update of compliance documents important?

+

Regular review and update of compliance documents are important to reflect changes in regulations, business practices, or client needs, ensuring ongoing compliance and reducing the risk of regulatory issues.

How can technology aid in compliance management for investment advisors?

+

Technology can aid in compliance management by automating tasks such as document management and reporting, providing real-time monitoring, and enhancing accessibility and accuracy, thus improving overall efficiency and compliance.