Paperwork

Mail Tax Paperwork Easily

Introduction to Mailing Tax Paperwork

Mailing tax paperwork can be a daunting task, especially with the numerous forms and deadlines involved. However, with the right guidance, it can be made easier and less stressful. In this article, we will explore the steps and tips to help individuals and businesses mail their tax paperwork easily and efficiently. We will cover the necessary forms, deadlines, and best practices to ensure that tax paperwork is mailed correctly and on time.

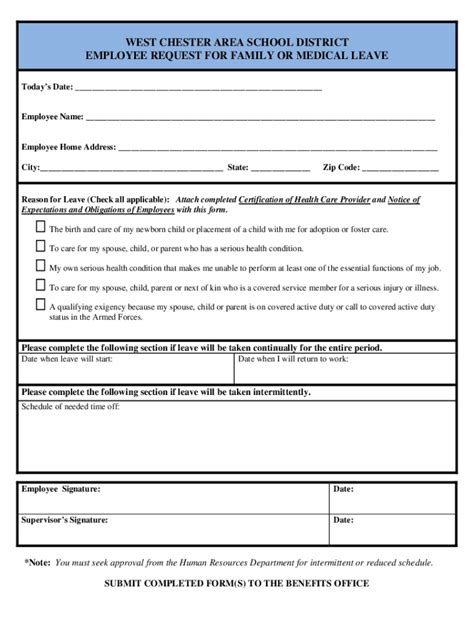

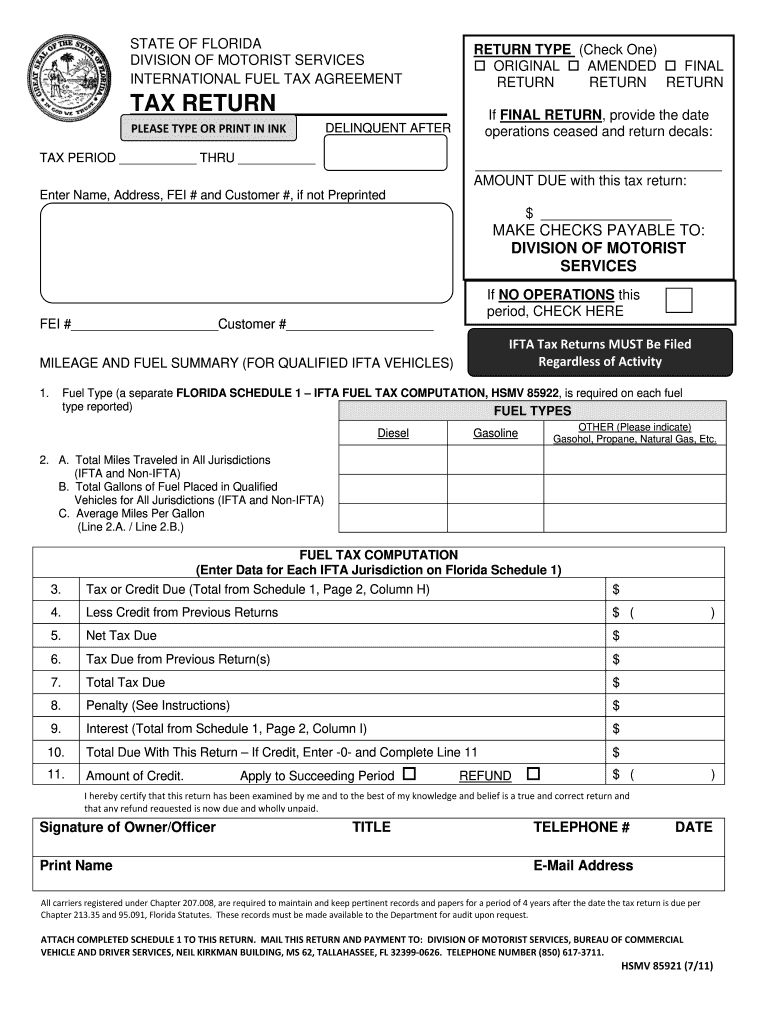

Understanding Tax Forms and Deadlines

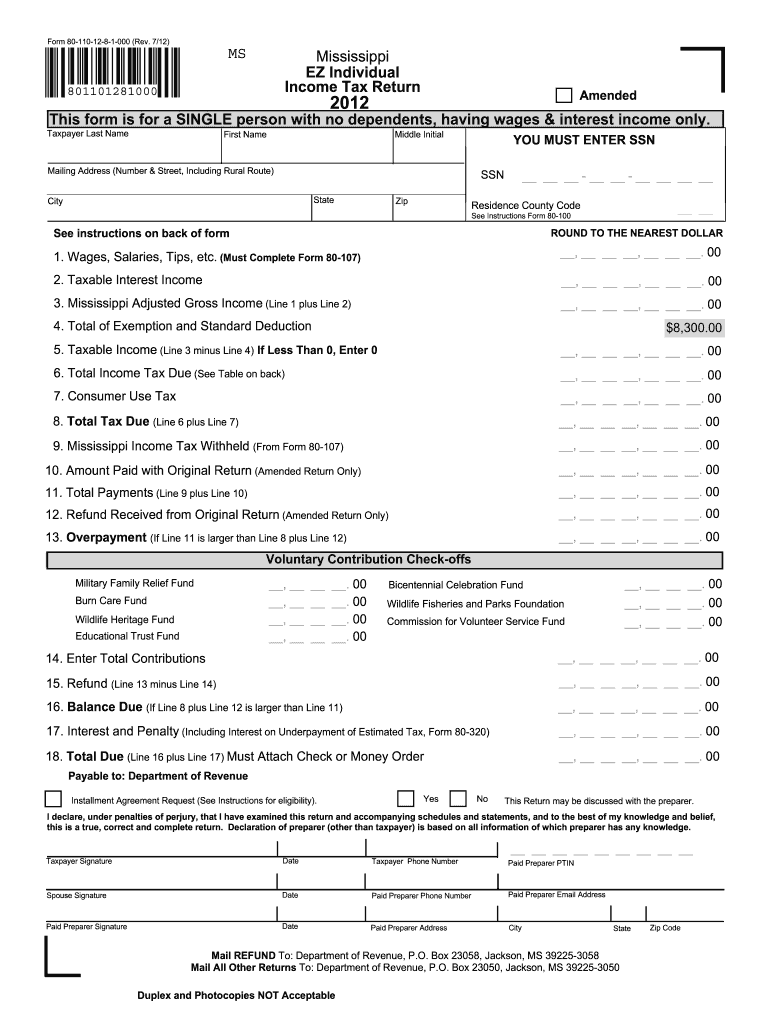

Before mailing tax paperwork, it is essential to understand the different types of tax forms and their corresponding deadlines. The most common tax forms include the 1040 for personal income tax, 1120 for corporate income tax, and 941 for employment tax. Each form has a specific deadline, and failure to meet these deadlines can result in penalties and fines. For example, the deadline for filing personal income tax is typically April 15th, while the deadline for filing corporate income tax is March 15th.

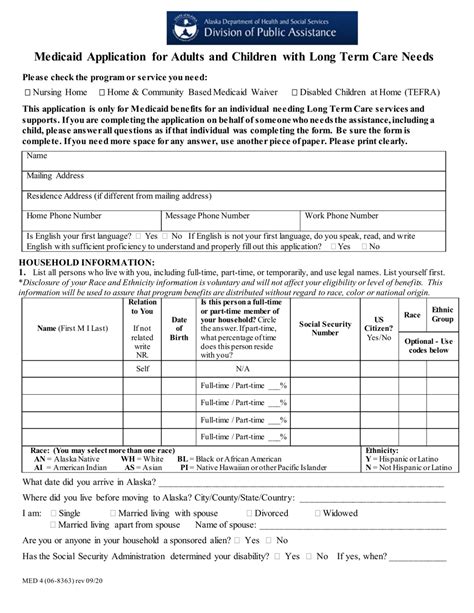

Preparing Tax Paperwork

To mail tax paperwork easily, it is crucial to prepare all the necessary documents and forms in advance. This includes: * Gathering all relevant tax documents, such as W-2s and 1099s * Filling out tax forms accurately and completely * Attaching all required supporting documents, such as receipts and invoices * Signing and dating the tax forms * Making a copy of the tax forms and supporting documents for personal records

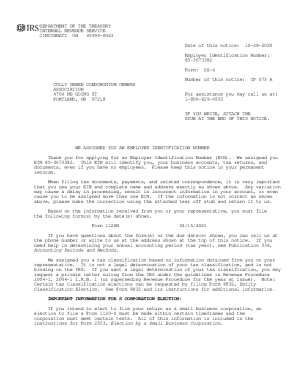

Mailing Tax Paperwork

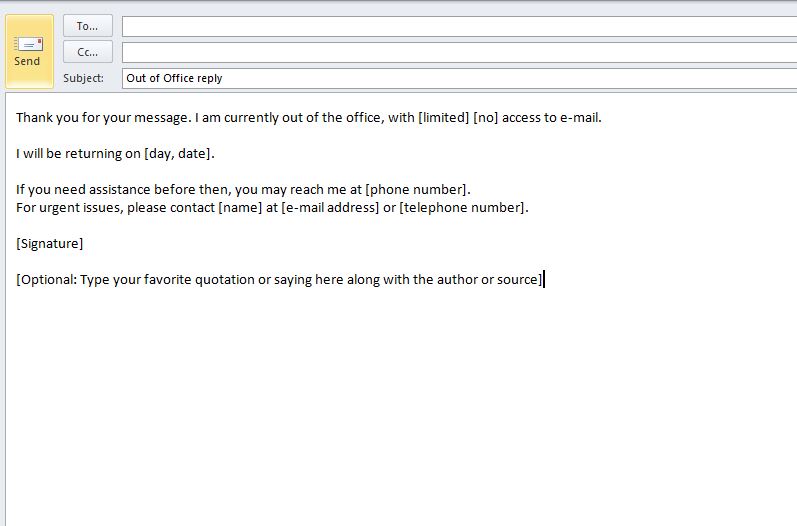

Once the tax paperwork is prepared, it is time to mail it to the relevant tax authority. The mailing address and method will depend on the type of tax form and the taxpayer’s location. For example, personal income tax returns can be mailed to the Internal Revenue Service (IRS) at the address listed on the tax form. It is recommended to use a tracked mailing method, such as certified mail or UPS, to ensure that the tax paperwork is delivered safely and on time.

Best Practices for Mailing Tax Paperwork

To ensure that tax paperwork is mailed easily and efficiently, follow these best practices: * Use a secure mailing method to protect sensitive information * Keep a record of the mailing, including the date and method of mailing * Use a tracked mailing method to ensure delivery * Double-check the mailing address and tax form for accuracy * Consider e-filing tax returns for faster and more secure processing

| Tax Form | Deadline | Mailing Address |

|---|---|---|

| 1040 | April 15th | Internal Revenue Service, 1111 Constitution Ave NW, Washington, DC 20224 |

| 1120 | March 15th | Internal Revenue Service, 1111 Constitution Ave NW, Washington, DC 20224 |

| 941 | April 30th | Internal Revenue Service, 1111 Constitution Ave NW, Washington, DC 20224 |

📝 Note: Always check the official IRS website for the most up-to-date information on tax forms, deadlines, and mailing addresses.

Tips for Businesses

For businesses, mailing tax paperwork can be more complex due to the various forms and deadlines involved. Here are some tips to help businesses mail their tax paperwork easily: * Designate a tax professional to handle tax paperwork and filings * Use tax software to streamline tax preparation and filing * Keep accurate records of tax payments and filings * Plan ahead to ensure timely filing and payment of taxes

Conclusion

Mailing tax paperwork can be a straightforward process if done correctly. By understanding the different tax forms and deadlines, preparing tax paperwork in advance, and following best practices for mailing, individuals and businesses can ensure that their tax paperwork is mailed easily and efficiently. Remember to always check the official IRS website for the most up-to-date information on tax forms, deadlines, and mailing addresses.

What is the deadline for filing personal income tax?

+

The deadline for filing personal income tax is typically April 15th.

Can I e-file my tax return?

+

Yes, you can e-file your tax return for faster and more secure processing.

What is the mailing address for the Internal Revenue Service?

+

The mailing address for the Internal Revenue Service is 1111 Constitution Ave NW, Washington, DC 20224.