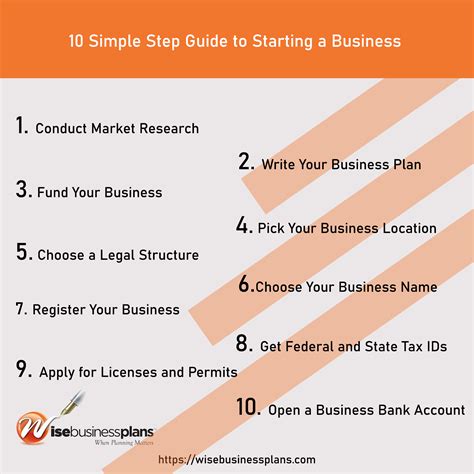

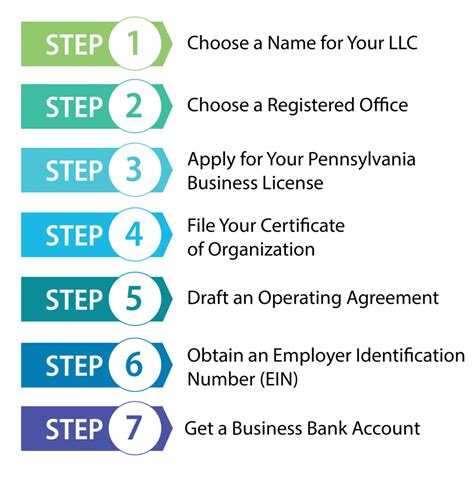

File Your Own LLC Paperwork

Introduction to Filing Your Own LLC Paperwork

Filing your own LLC (Limited Liability Company) paperwork can seem like a daunting task, but with the right guidance, it can be a straightforward process. An LLC is a popular business structure that offers personal liability protection and tax benefits. By filing your own LLC paperwork, you can save money on legal fees and have more control over the process. In this article, we will walk you through the steps to file your own LLC paperwork and provide you with the necessary information to get started.

Step 1: Choose a Business Name

The first step in filing your own LLC paperwork is to choose a business name. Your business name should be unique and reflect the type of business you are operating. It’s essential to choose a name that is not already in use by another business in your state. You can check the availability of your desired business name by searching your state’s business database. Make sure to choose a name that is easy to remember and spells out the type of business you are operating. You will also need to ensure that your business name complies with your state’s naming requirements.

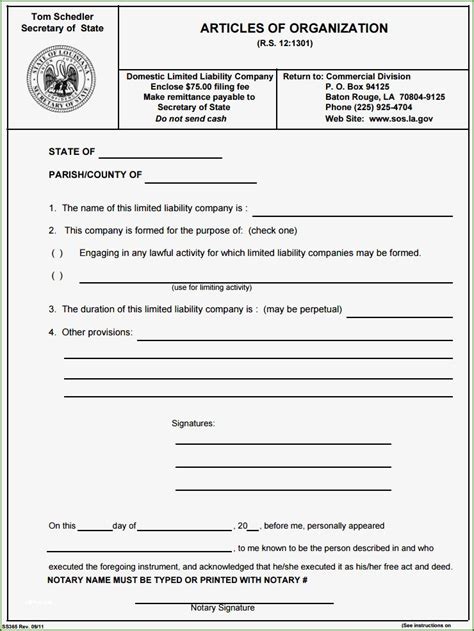

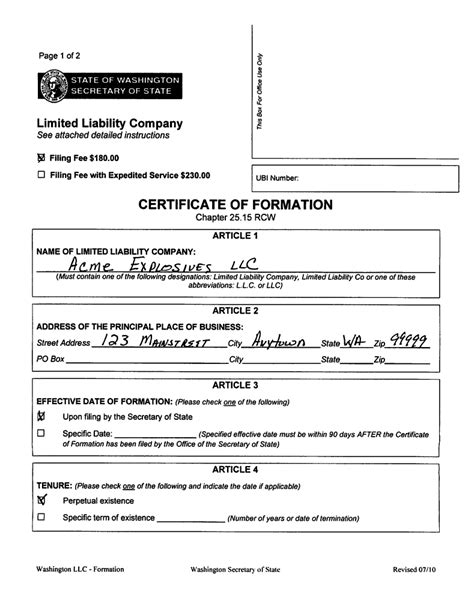

Step 2: Prepare Your Articles of Organization

The next step is to prepare your Articles of Organization, which is the document that officially establishes your LLC. The Articles of Organization typically include the following information:

- Business name and address

- Business purpose

- Management structure (member-managed or manager-managed)

- Registered agent information

Step 3: Appoint a Registered Agent

A registered agent is an individual or business that agrees to receive legal documents and notices on behalf of your LLC. You can appoint yourself or another individual as the registered agent, or you can hire a registered agent service. The registered agent must have a physical address in the state where your LLC is registered. The registered agent’s role is to receive and forward important documents, such as tax notices and lawsuit filings, to your LLC.

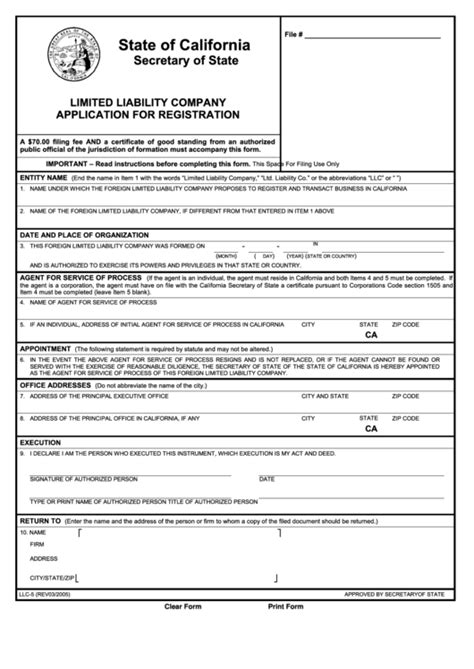

Step 4: File Your Articles of Organization

Once you have prepared your Articles of Organization, you can file them with your state’s business registration office. The filing process typically involves submitting the completed forms and paying the required filing fee. The filing fee varies by state, but it’s usually around 100-500. Make sure to keep a copy of your filed Articles of Organization, as you will need them to obtain an EIN and open a business bank account.

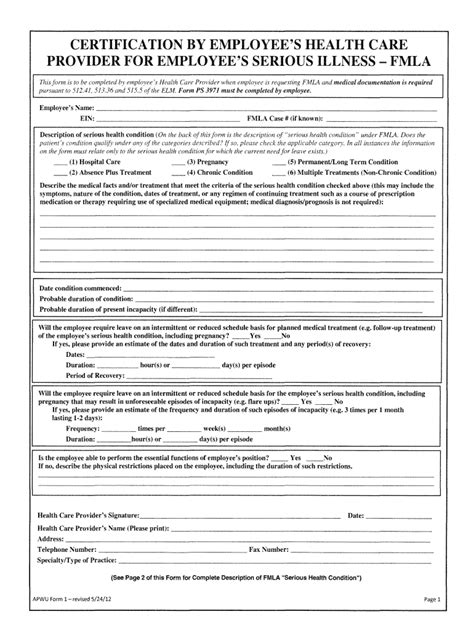

Step 5: Obtain an EIN

An EIN (Employer Identification Number) is a unique number assigned to your LLC by the IRS. You will need an EIN to open a business bank account, file taxes, and hire employees. You can apply for an EIN online through the IRS website or by mail. The application process is straightforward, and you will typically receive your EIN immediately after applying.

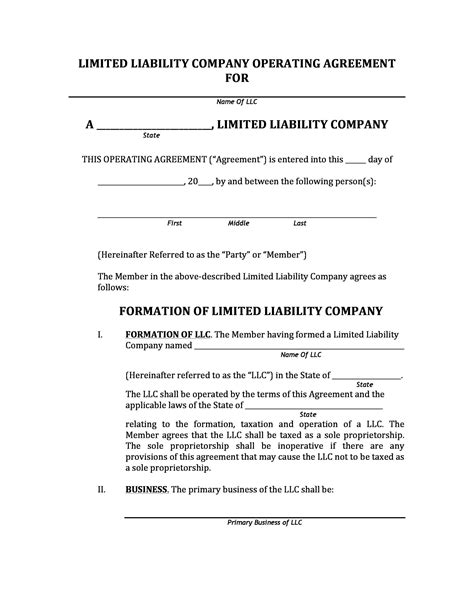

Step 6: Create an Operating Agreement

An operating agreement is a document that outlines the ownership and management structure of your LLC. It’s essential to create an operating agreement, even if you are the sole owner of your LLC. The operating agreement should include the following information:

- Ownership percentages

- Management structure

- Voting rights

- Profit and loss distribution

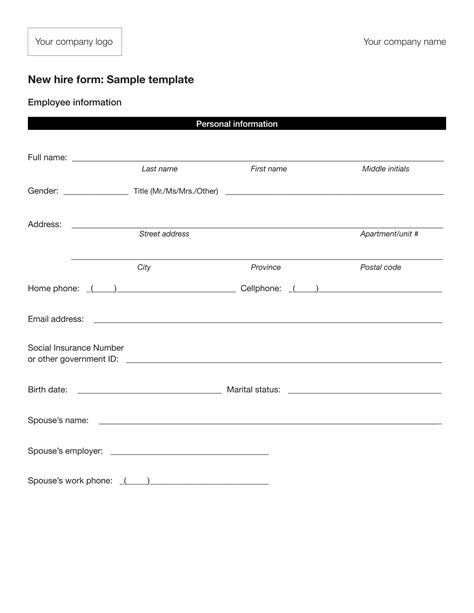

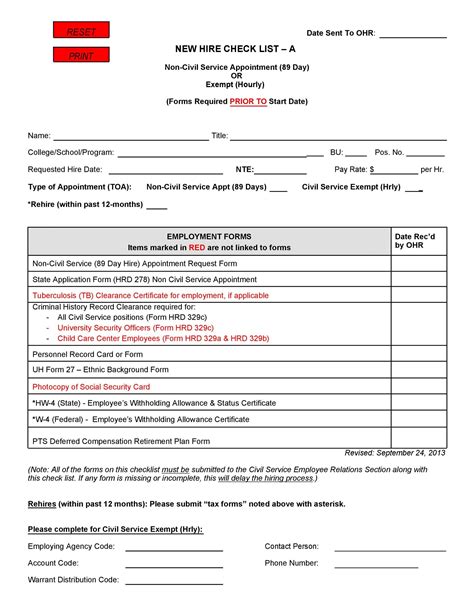

Step 7: Obtain Licenses and Permits

Depending on the type of business you are operating, you may need to obtain licenses and permits to operate legally. Check with your state and local government to determine what licenses and permits are required for your business. You may need to obtain a business license, sales tax permit, or other specialized licenses.

| State | Filing Fee | Processing Time |

|---|---|---|

| California | $70 | 2-3 weeks |

| New York | $200 | 2-3 weeks |

| Florida | $125 | 1-2 weeks |

📝 Note: The filing fees and processing times listed in the table are subject to change, and you should check with your state's business registration office for the most up-to-date information.

As you can see, filing your own LLC paperwork requires careful attention to detail and a basic understanding of the filing process. By following these steps and seeking guidance when necessary, you can successfully file your own LLC paperwork and establish a strong foundation for your business.

In summary, filing your own LLC paperwork involves choosing a business name, preparing and filing your Articles of Organization, appointing a registered agent, obtaining an EIN, creating an operating agreement, and obtaining licenses and permits. By taking the time to understand the filing process and seeking guidance when necessary, you can establish a successful and legally compliant LLC.

What is the difference between a member-managed and manager-managed LLC?

+

A member-managed LLC is managed by its owners, while a manager-managed LLC is managed by a designated manager. The management structure you choose will depend on your business needs and preferences.

Do I need to obtain a business license to operate an LLC?

+

Yes, you may need to obtain a business license to operate an LLC, depending on the type of business you are operating and the state and local regulations that apply to your business.

How long does it take to process an LLC filing?

+

The processing time for an LLC filing varies by state, but it’s typically 2-3 weeks. You can check with your state’s business registration office for the most up-to-date information on processing times.