5 Ways Pay Tags

Introduction to Pay Tags

Pay tags, also known as payment tags or pay-by-tag, are an innovative payment solution that allows users to make payments using a unique identifier, such as a QR code or NFC tag. This technology has gained popularity in recent years due to its convenience, security, and ease of use. In this article, we will explore the 5 ways pay tags are revolutionizing the payment industry.

What are Pay Tags?

Pay tags are small, RFID-enabled devices that can be attached to various objects, such as keychains, wristbands, or stickers. These devices contain a unique identifier that can be linked to a user’s payment account, allowing them to make payments with a simple tap or scan. Pay tags can be used for a variety of transactions, including online purchases, in-store payments, and even person-to-person transactions.

5 Ways Pay Tags are Revolutionizing the Payment Industry

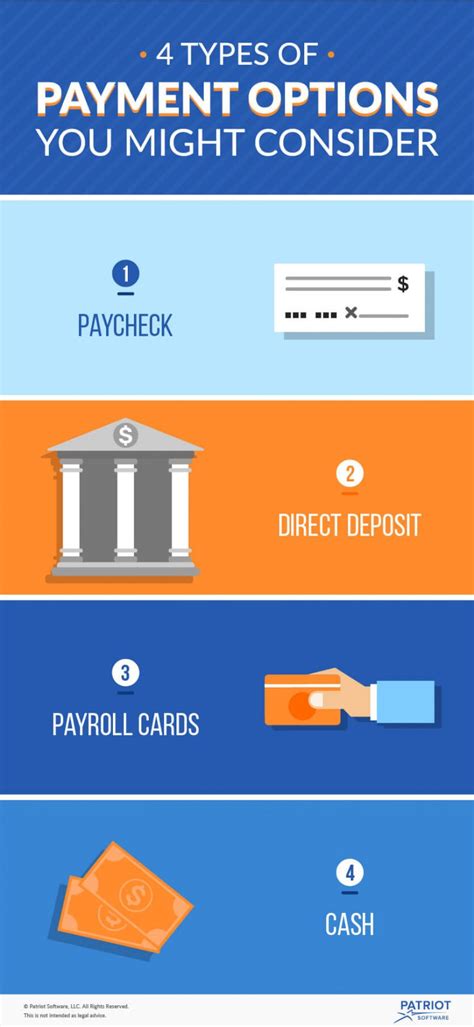

Here are 5 ways pay tags are changing the way we make payments: * Convenience: Pay tags offer a convenient way to make payments, eliminating the need to carry cash or credit cards. * Security: Pay tags use advanced encryption and tokenization to protect user data and prevent unauthorized transactions. * Ease of use: Pay tags are easy to use, requiring only a simple tap or scan to complete a transaction. * Flexibility: Pay tags can be used for a variety of transactions, including online purchases, in-store payments, and even person-to-person transactions. * Cost-effectiveness: Pay tags can help reduce transaction fees and processing costs for merchants.

Benefits of Pay Tags

The benefits of pay tags are numerous, including: * Increased convenience: Pay tags offer a convenient way to make payments, eliminating the need to carry cash or credit cards. * Improved security: Pay tags use advanced encryption and tokenization to protect user data and prevent unauthorized transactions. * Enhanced user experience: Pay tags provide a seamless and intuitive payment experience, making it easier for users to make payments. * Reduced costs: Pay tags can help reduce transaction fees and processing costs for merchants. * Increased adoption: Pay tags have the potential to increase adoption of digital payments, particularly in developing markets where cash is still the dominant form of payment.

Examples of Pay Tags in Use

Here are a few examples of pay tags in use:

| Company | Pay Tag Solution |

|---|---|

| Apple | Apple Pay |

| Google Pay | |

| Samsung | Samsung Pay |

These companies have developed pay tag solutions that allow users to make payments using their smartphones or wearables.

💡 Note: Pay tags are still a relatively new technology, and their adoption is expected to increase in the coming years as more companies develop pay tag solutions.

In summary, pay tags are revolutionizing the payment industry by offering a convenient, secure, and easy-to-use payment solution. With their potential to increase adoption of digital payments, reduce costs, and improve the user experience, pay tags are an exciting development in the world of payments. As the technology continues to evolve, we can expect to see even more innovative applications of pay tags in the future. The future of payments is looking bright, and pay tags are leading the way. The payment industry is expected to continue growing, and pay tags will play a major role in shaping its future. With the rise of pay tags, we can expect to see a significant shift in the way we make payments, and it will be exciting to see how this technology continues to evolve and improve over time.