5 Ways Find EIN Paperwork

Introduction to EIN Paperwork

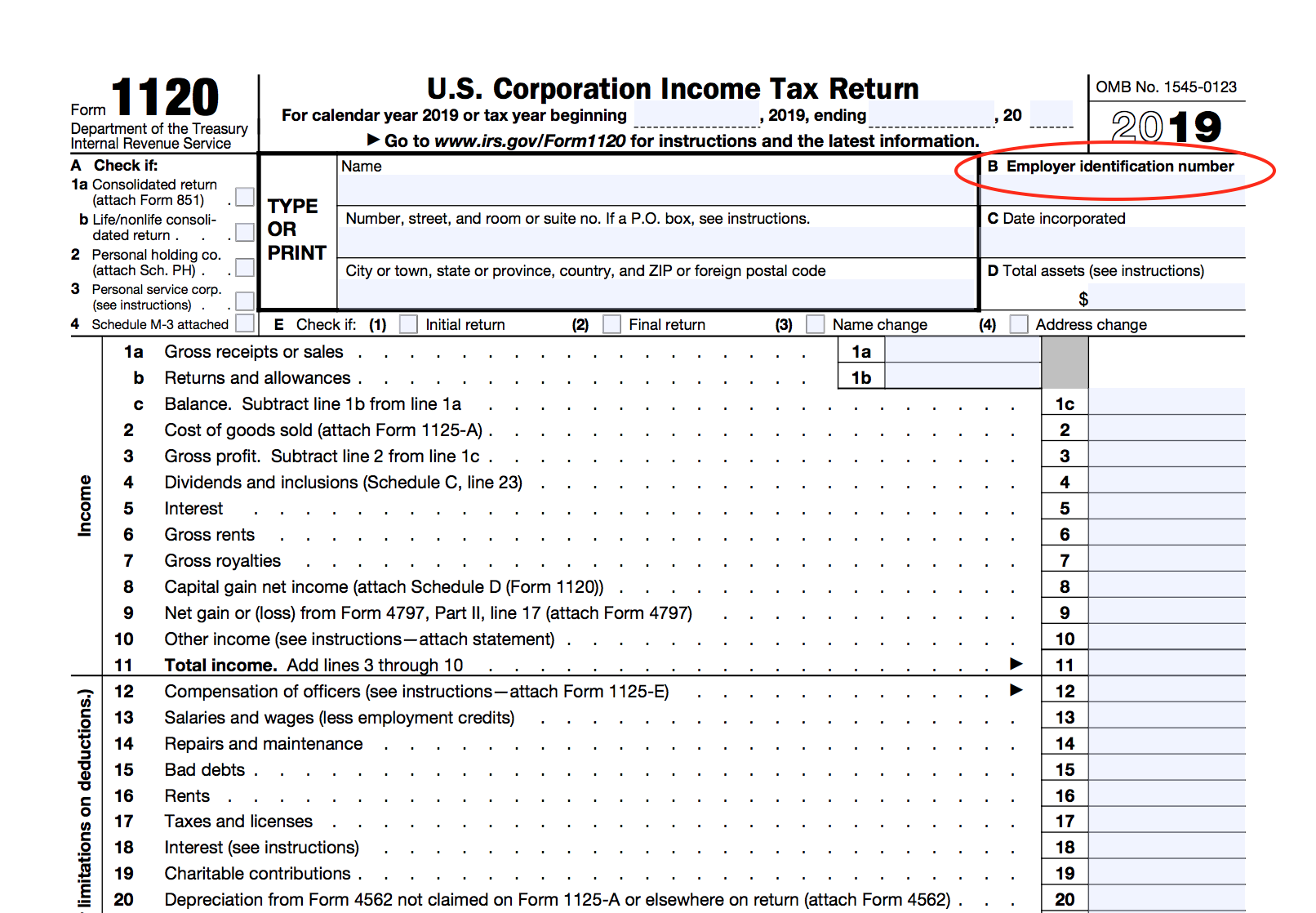

Finding the necessary paperwork for an Employer Identification Number (EIN) can be a daunting task, especially for those who are new to the process. An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity, and it is required for various tax and financial purposes. In this article, we will explore the different ways to find the required EIN paperwork, making it easier for businesses to comply with the IRS regulations.

Understanding the Importance of EIN Paperwork

Before we dive into the ways to find the EIN paperwork, it is essential to understand the significance of an EIN. An EIN is used to identify a business entity and is required for:

- Opening a business bank account

- Filing tax returns

- Hiring employees

- Applying for credit or loans

- Complying with state and local regulations

5 Ways to Find EIN Paperwork

Now that we have established the importance of EIN paperwork, let’s explore the different ways to find the necessary documents:

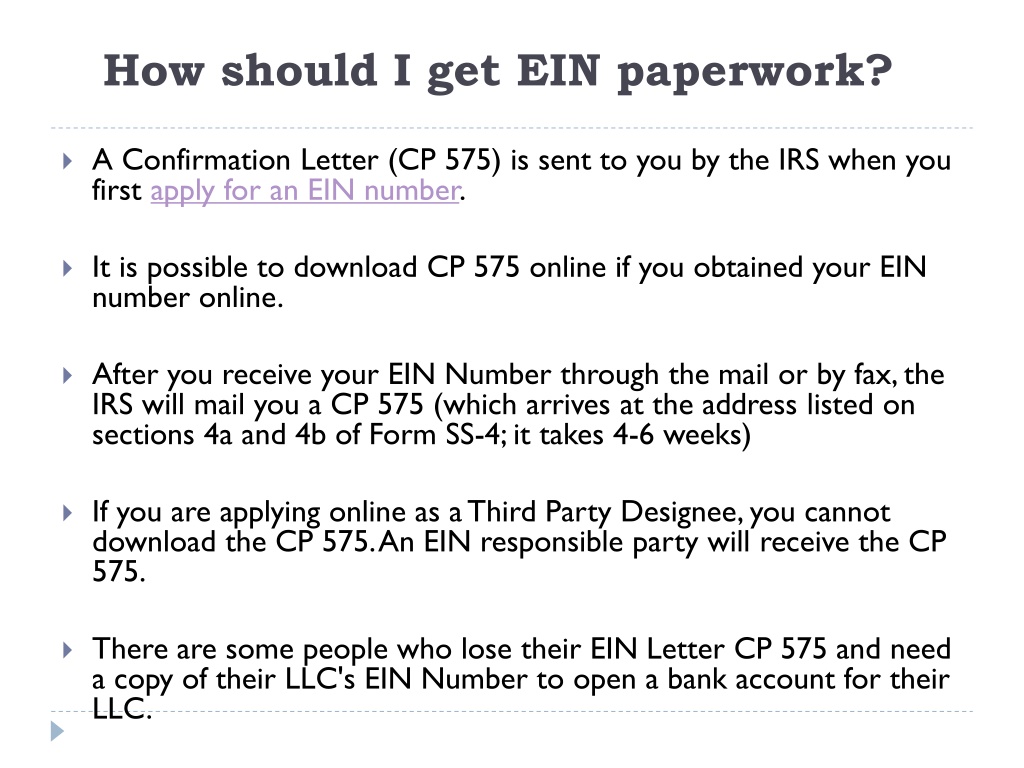

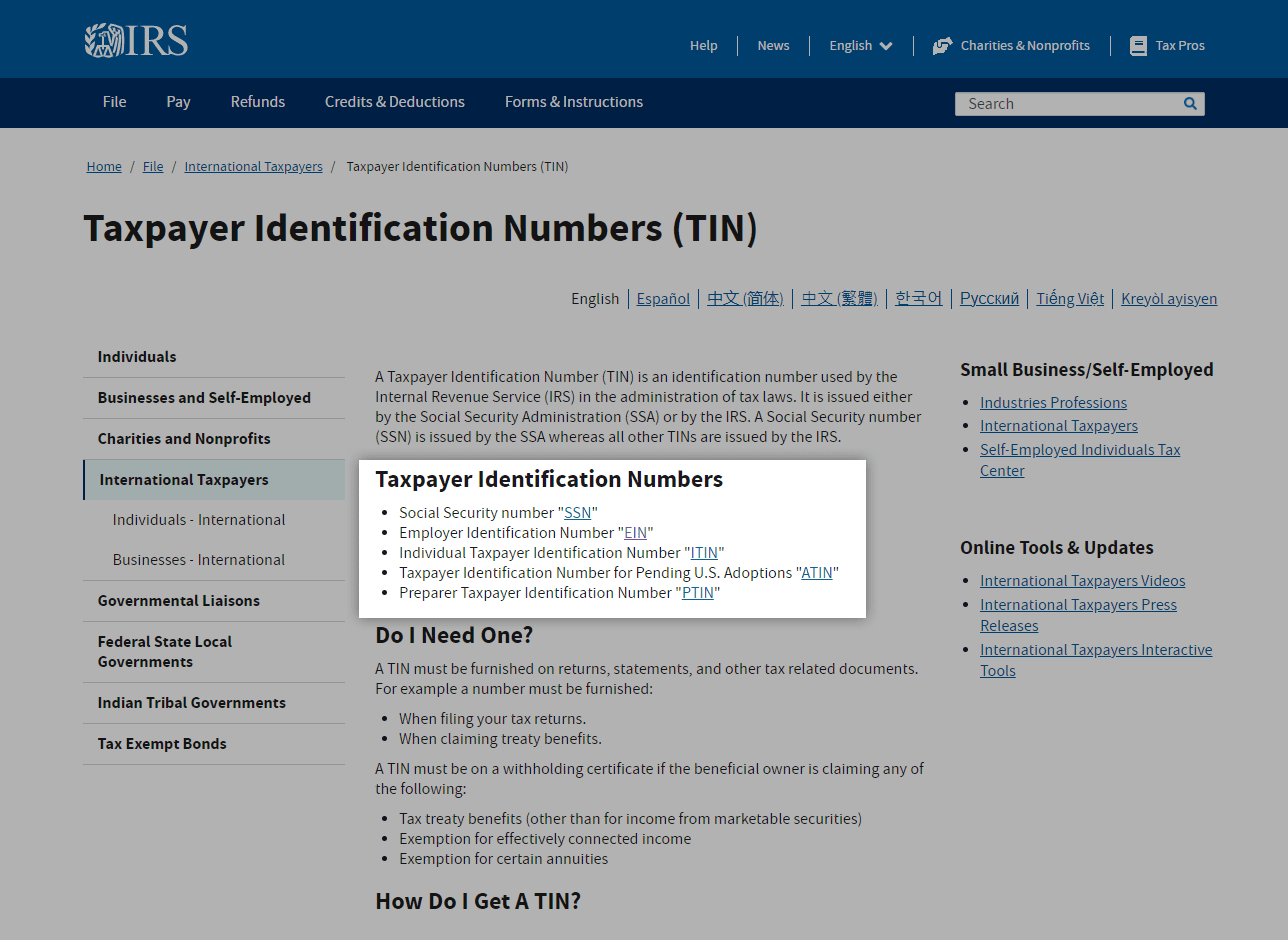

- IRS Website: The official IRS website (irs.gov) is an excellent resource for finding EIN paperwork. The website provides a comprehensive guide on how to apply for an EIN, including the required documents and forms.

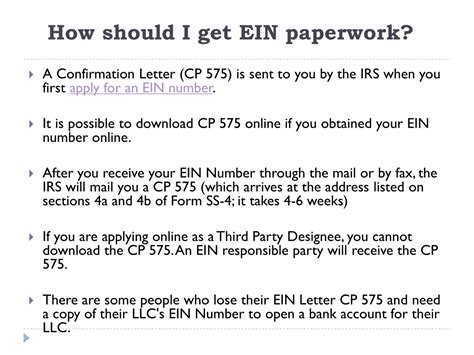

- IRS Forms and Publications: The IRS website also offers a range of forms and publications that can help businesses find the necessary EIN paperwork. These forms and publications include instructions on how to complete the application process and what documents are required.

- Business Formation Documents: When a business is formed, it is essential to keep a record of the formation documents, such as articles of incorporation or a partnership agreement. These documents often include the EIN and can serve as proof of the business’s identity.

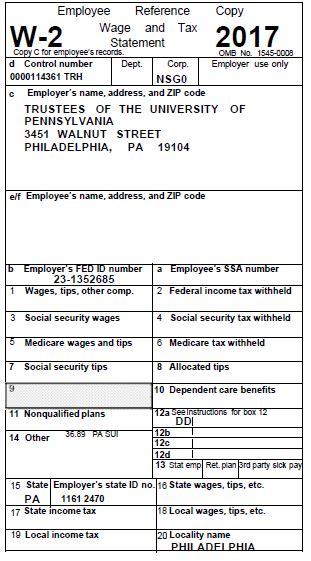

- Bank Statements and Records: Business bank statements and records can also provide evidence of an EIN. When a business opens a bank account, the bank typically requires the EIN to be provided, and this information is often included on the bank statements.

- Accountant or Tax Professional: If a business is unsure about how to find its EIN paperwork, it may be helpful to consult with an accountant or tax professional. These professionals often have experience with EIN applications and can provide guidance on how to obtain the necessary documents.

Additional Tips for Finding EIN Paperwork

In addition to the methods mentioned above, there are a few more tips that can help businesses find their EIN paperwork:

- Keep accurate records: It is essential to keep accurate and up-to-date records of all business documents, including EIN paperwork.

- Check with state and local authorities: Depending on the state and local regulations, businesses may need to provide their EIN to comply with specific requirements.

- Use online resources: There are many online resources available that can help businesses find their EIN paperwork, including the IRS website and other tax-related websites.

📝 Note: It is essential to keep a record of all EIN paperwork, as it may be required for future reference or audits.

Table of EIN Paperwork Requirements

The following table summarizes the typical paperwork requirements for an EIN application:

| Document | Description |

|---|---|

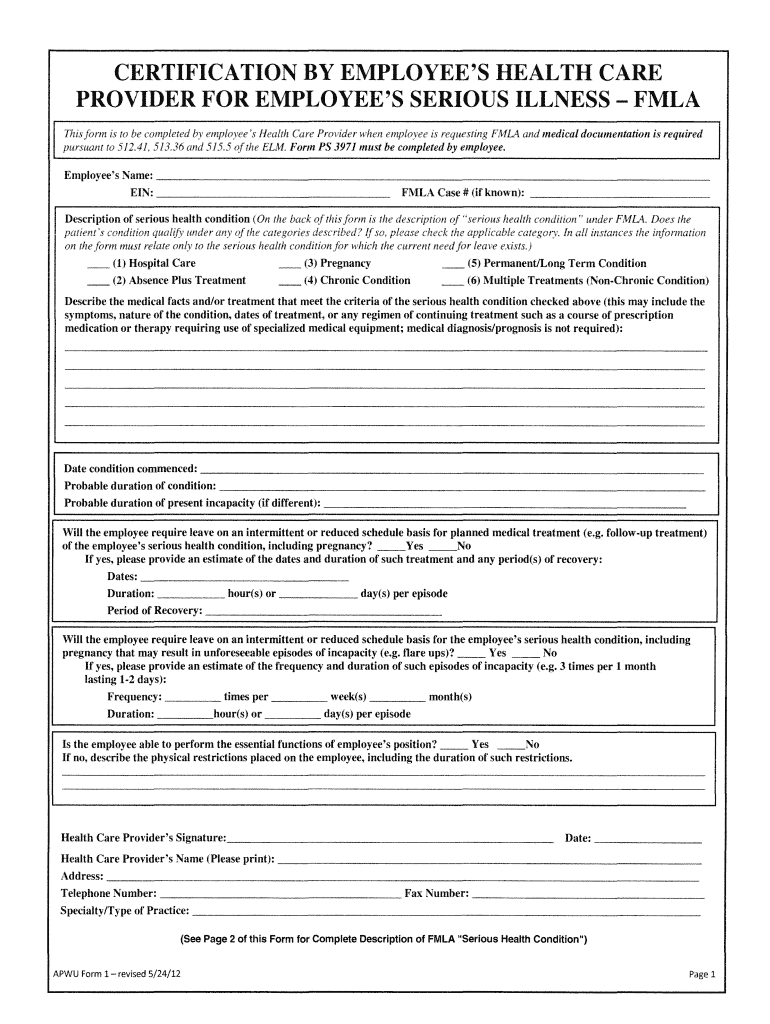

| SS-4 Form | Application for Employer Identification Number |

| Business Formation Documents | Articles of incorporation, partnership agreement, or other documents that establish the business entity |

| Identification Documents | Driver’s license, passport, or other government-issued ID |

| Bank Statements and Records | Documents that verify the business’s bank account and EIN |

As we have explored the different ways to find EIN paperwork, it is clear that having the correct documents is crucial for businesses to operate efficiently and comply with IRS regulations. By following the tips and methods outlined in this article, businesses can ensure that they have the necessary paperwork to succeed.

To summarize, finding EIN paperwork requires attention to detail and a thorough understanding of the IRS regulations. By utilizing the IRS website, business formation documents, bank statements, and consulting with professionals, businesses can ensure that they have the necessary paperwork to comply with the IRS and operate successfully. The key takeaways from this article include the importance of keeping accurate records, checking with state and local authorities, and using online resources to find EIN paperwork. By following these tips and understanding the EIN paperwork requirements, businesses can avoid potential issues and ensure a smooth operation.

What is an EIN, and why is it necessary for businesses?

+

An EIN is a unique nine-digit number assigned by the IRS to identify a business entity. It is necessary for businesses to comply with tax and financial regulations, open a business bank account, file tax returns, and hire employees.

How do I apply for an EIN, and what documents are required?

+

To apply for an EIN, businesses can use the IRS website or consult with a tax professional. The required documents typically include the SS-4 form, business formation documents, identification documents, and bank statements.

What are the consequences of not having the correct EIN paperwork?

+

Not having the correct EIN paperwork can result in delays or rejection of tax returns, penalties, and fines. It can also affect a business’s ability to open a bank account, hire employees, or comply with state and local regulations.