Organizing Bills and Paperwork Made Easy

Introduction to Bill Organization

Managing bills and paperwork can be a daunting task, especially with the constant influx of documents and financial statements. However, with a solid system in place, individuals can stay on top of their financial obligations and reduce stress. This article will provide a comprehensive guide on how to organize bills and paperwork efficiently, utilizing digital tools and physical storage methods. By implementing these strategies, individuals can streamline their financial management and make the most of their time.

Understanding the Importance of Organization

Effective organization of bills and paperwork is crucial for several reasons. Firstly, it helps individuals avoid late fees and penalties associated with missed payments. Secondly, it enables them to track their expenses and make informed decisions about their financial situation. Finally, it reduces the risk of identity theft and financial fraud by keeping sensitive documents secure. By recognizing the importance of organization, individuals can take the first step towards creating a more manageable and secure financial system.

Assessing Current Systems

Before implementing a new system, it’s essential to assess the current state of bill and paperwork organization. Individuals should take stock of their existing documents, including bank statements, credit card bills, and utility bills. They should also evaluate their current storage methods, such as filing cabinets or digital folders. By understanding what works and what doesn’t, individuals can identify areas for improvement and create a tailored system that meets their needs.

Implementing a Digital System

In today’s digital age, utilizing digital tools is an effective way to organize bills and paperwork. Individuals can take advantage of online bill pay services, which allow them to receive and pay bills electronically. They can also use digital storage services, such as cloud storage or digital wallets, to store and manage their documents. Additionally, budgeting apps can help individuals track their expenses and stay on top of their finances. Some popular digital tools include: * Mint: A personal finance app that tracks expenses and provides budgeting advice * You Need a Budget (YNAB): A budgeting app that helps individuals manage their finances and stay on track * Dropbox: A cloud storage service that allows individuals to store and access their documents from anywhere

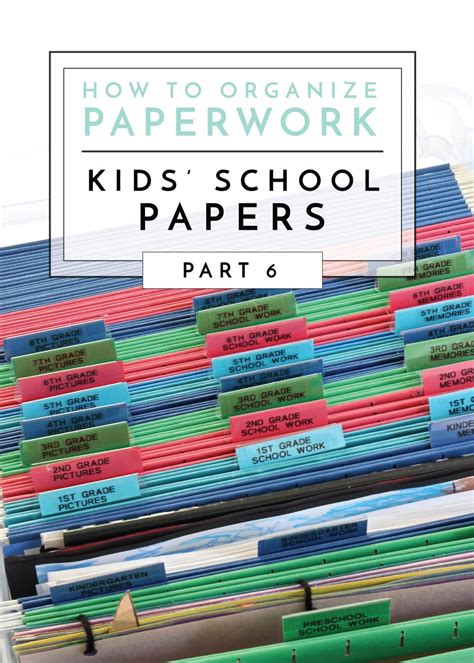

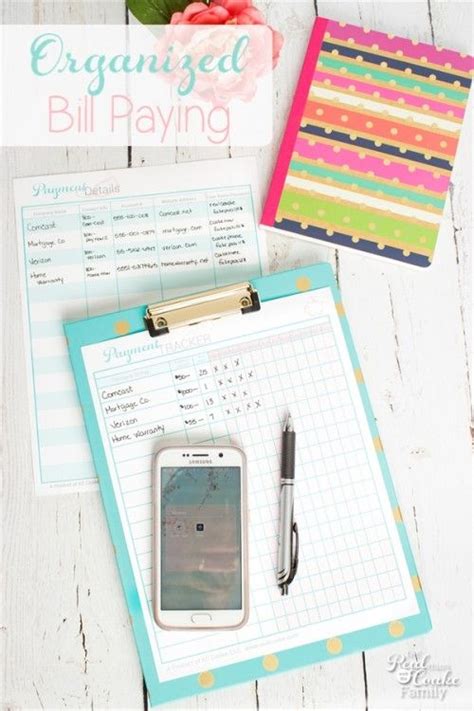

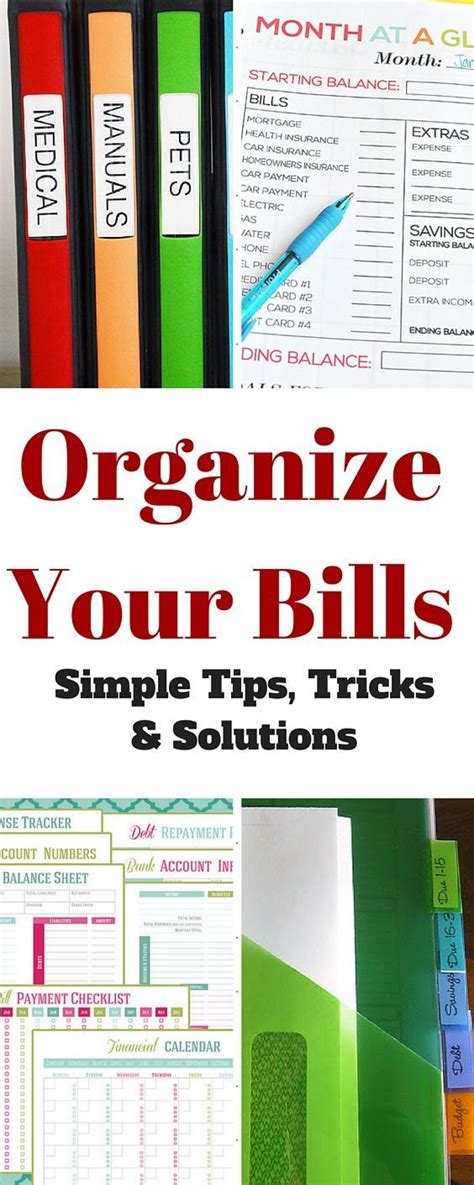

Implementing a Physical System

While digital tools are convenient, physical storage methods are still essential for managing bills and paperwork. Individuals can use filing cabinets or file folders to store important documents, such as tax returns and insurance policies. They can also use labels and color-coding to categorize and prioritize their documents. Additionally, a paper tray or inbox can help individuals manage incoming documents and stay on top of their paperwork. Some popular physical storage methods include: * File cabinets: A secure and organized way to store important documents * File folders: A convenient way to categorize and store documents * Label makers: A tool that helps individuals label and prioritize their documents

Creating a Maintenance Routine

Once a system is in place, it’s essential to create a maintenance routine to ensure it remains effective. Individuals should set aside time each week to review their bills and update their documents. They should also shred unnecessary documents and back up their digital files to prevent loss or damage. By establishing a routine, individuals can stay on top of their financial obligations and prevent disorganization from creeping back in.

📝 Note: It's essential to review and update your system regularly to ensure it remains effective and secure.

Additional Tips and Tricks

In addition to implementing a digital and physical system, individuals can use several tips and tricks to enhance their bill and paperwork organization. They can: * Use a calendar to stay on top of payment due dates and deadlines * Set up automatic payments to ensure timely payments * Keep a list of important phone numbers and contact information * Use a secure shredder to dispose of sensitive documents

| Document Type | Storage Method | Retention Period |

|---|---|---|

| Bank Statements | Digital Storage | 1-2 years |

| Credit Card Bills | Physical Storage | 1-2 years |

| Tax Returns | Physical Storage | 5-7 years |

In summary, organizing bills and paperwork requires a combination of digital and physical systems, as well as a maintenance routine to ensure effectiveness. By implementing these strategies and using additional tips and tricks, individuals can streamline their financial management and reduce stress. The key is to find a system that works for you and stick to it, making adjustments as needed to ensure long-term success.

What are the benefits of organizing bills and paperwork?

+

The benefits of organizing bills and paperwork include avoiding late fees and penalties, tracking expenses, and reducing the risk of identity theft and financial fraud.

What are some popular digital tools for organizing bills and paperwork?

+

Some popular digital tools include Mint, You Need a Budget (YNAB), and Dropbox.

How often should I review and update my bill and paperwork organization system?

+

It’s essential to review and update your system regularly, ideally on a weekly or monthly basis, to ensure it remains effective and secure.