Paperwork

USDA Loan Paperwork Requirements

Understanding USDA Loan Paperwork Requirements

The United States Department of Agriculture (USDA) offers a unique loan program designed for borrowers who are purchasing homes in rural areas. These loans are attractive due to their favorable terms, including no down payment requirements and competitive interest rates. However, to qualify for a USDA loan, borrowers must navigate through a specific set of paperwork requirements. Understanding these requirements is crucial for a successful application process.

Eligibility Criteria

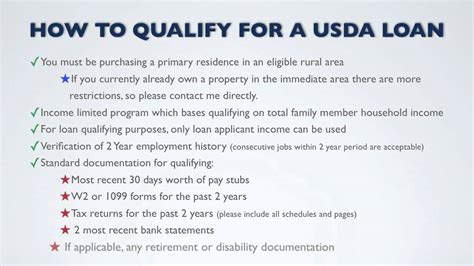

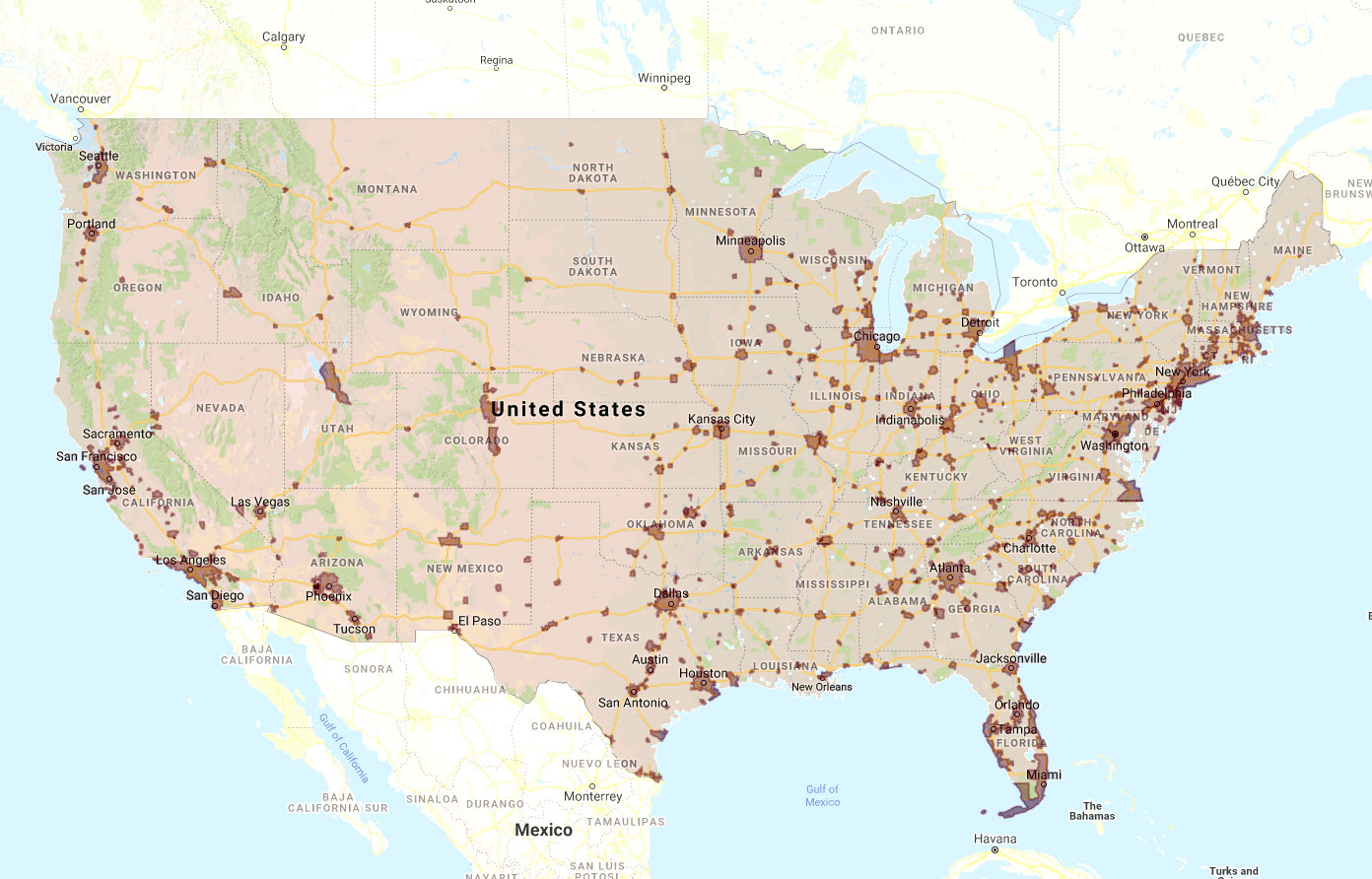

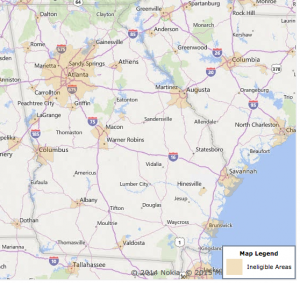

Before diving into the paperwork, it’s essential to understand the eligibility criteria for USDA loans. These include: - The property must be located in a rural area as defined by the USDA. - The borrower must meet income limits, which vary by area. - The borrower must agree to occupy the property as their primary residence. - The borrower must be a U.S. citizen, non-citizen national, or qualified alien. - The borrower must have a reasonable credit history.

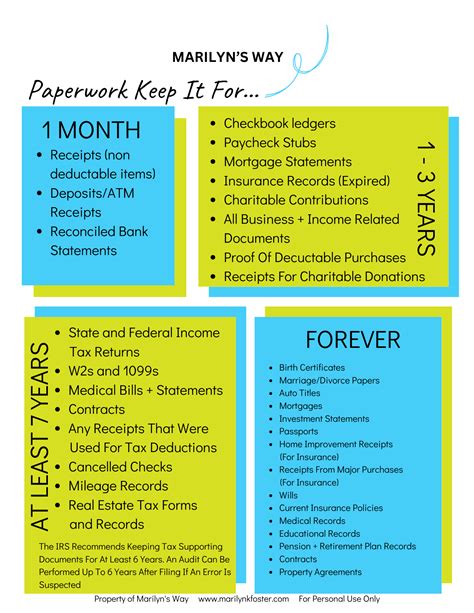

Required Documents

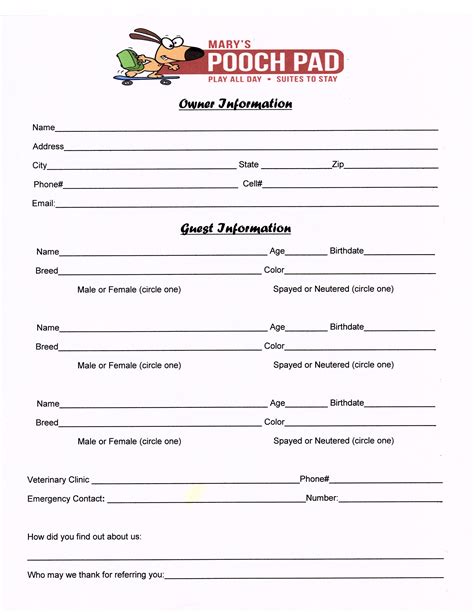

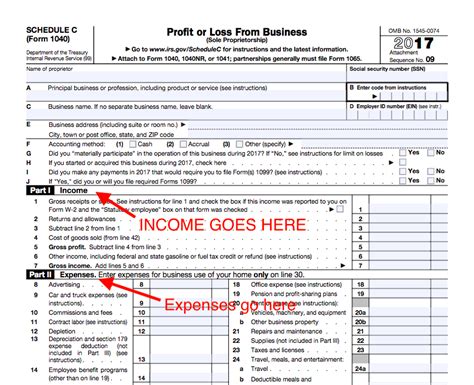

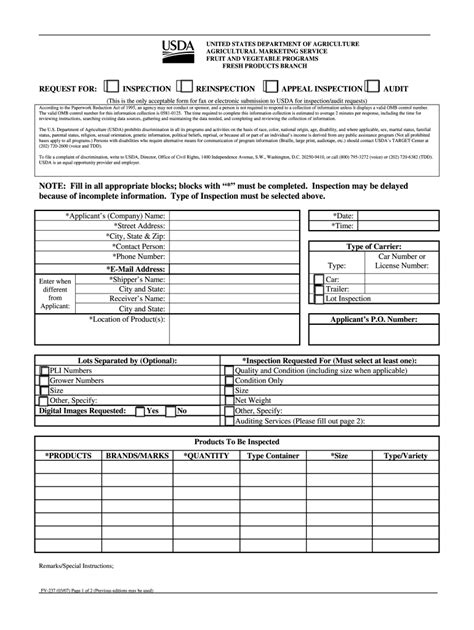

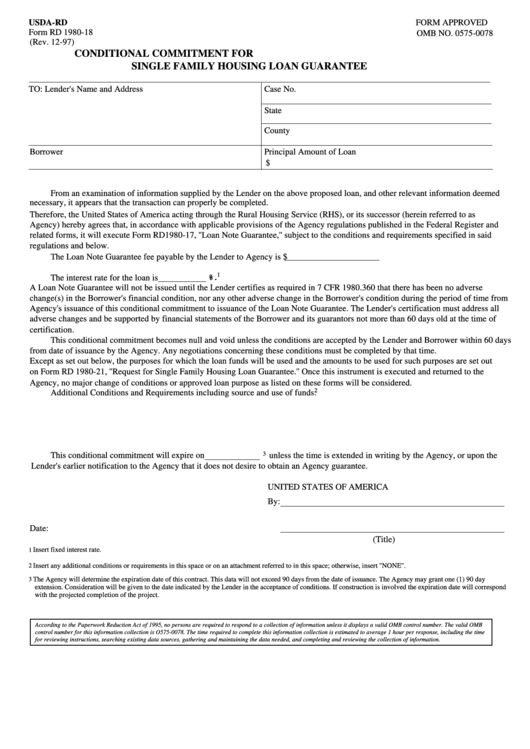

The paperwork requirements for a USDA loan include but are not limited to: - Identification Documents: Borrowers must provide valid government-issued ID. - Income Documents: Pay stubs, W-2 forms, and tax returns are required to verify income. - Credit Reports: While the USDA does not set a minimum credit score, lenders often require a score of at least 640. - Asset Documents: Bank statements and investment accounts to verify savings and assets. - Employment Verification: Letters from employers or other documentation to confirm employment status. - Property Appraisal: An appraisal to ensure the property’s value and that it meets USDA standards.

Application Process

The application process for a USDA loan involves several steps: - Pre-approval: Borrowers should first get pre-approved for a loan to understand their budget. - Find a Property: Once pre-approved, borrowers can find a property that meets the USDA’s location requirements. - Submit Application: The borrower submits their loan application along with all required documents. - Processing and Underwriting: The lender processes the application, orders an appraisal, and underwrites the loan. - Closing: If approved, the borrower attends a closing meeting to sign the final loan documents.

Types of USDA Loans

The USDA offers several types of loans, each with its own set of requirements: - Direct Loans: Issued directly by the USDA, these loans have more stringent eligibility requirements but offer subsidized interest rates. - Guaranteed Loans: Issued by private lenders and guaranteed by the USDA, these loans have more lenient requirements and are more commonly used.

📝 Note: Borrowers should carefully review the requirements for each loan type to determine which best suits their needs.

Benefits of USDA Loans

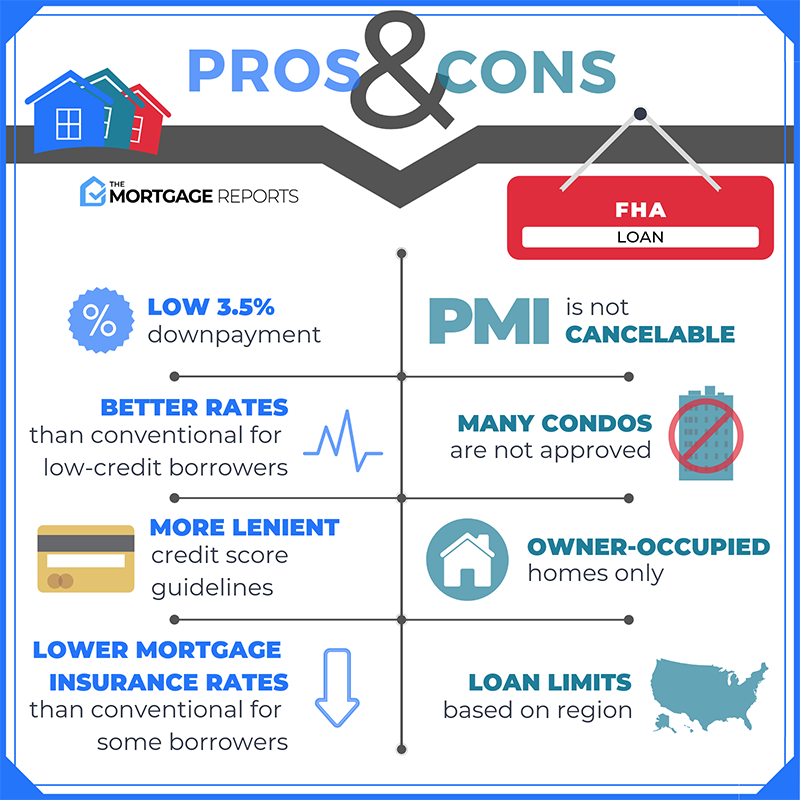

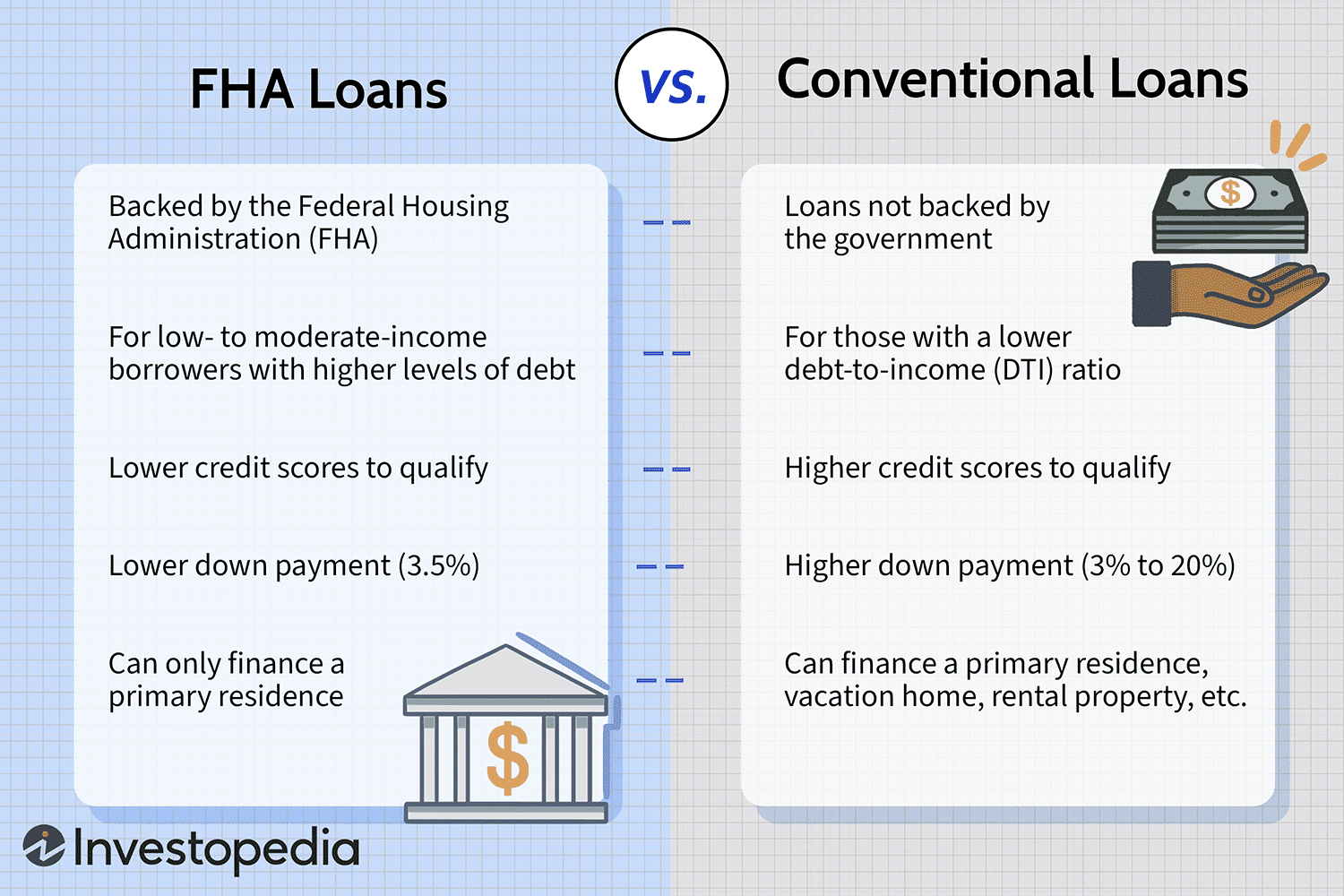

USDA loans offer several benefits to borrowers, including: - No Down Payment: USDA loans do not require a down payment, making them accessible to borrowers who may not have significant savings. - Competitive Interest Rates: Interest rates for USDA loans are often lower than those for conventional loans. - Lower Mortgage Insurance: The mortgage insurance premiums for USDA loans are typically lower than those for FHA loans.

Challenges and Considerations

While USDA loans offer many benefits, there are also challenges and considerations: - Geographic Restrictions: Properties must be located in areas defined as rural by the USDA, which can limit options for some borrowers. - Income Limits: Borrowers must meet specific income limits, which can vary significantly by area. - Funding Fees: USDA loans require an upfront guarantee fee and annual fees, which can add to the cost of the loan.

Conclusion

In summary, USDA loans provide a valuable opportunity for borrowers to purchase homes in rural areas with favorable terms. However, navigating the paperwork requirements and understanding the eligibility criteria and application process are crucial for a successful loan application. By carefully considering the benefits and challenges of USDA loans and preparing all necessary documents, borrowers can make their dream of homeownership a reality.

What are the income limits for USDA loans?

+

Income limits for USDA loans vary by area and are based on the size of the household. Borrowers can check the USDA’s website for the specific income limits in their area.

Do USDA loans require a down payment?

+

No, USDA loans do not require a down payment. This makes them an attractive option for borrowers who may not have significant savings.

What is the difference between a direct and guaranteed USDA loan?

+

Direct loans are issued by the USDA and have more stringent eligibility requirements but offer subsidized interest rates. Guaranteed loans are issued by private lenders and guaranteed by the USDA, with more lenient requirements.