UK Paperwork Retention Periods

Introduction to UK Paperwork Retention Periods

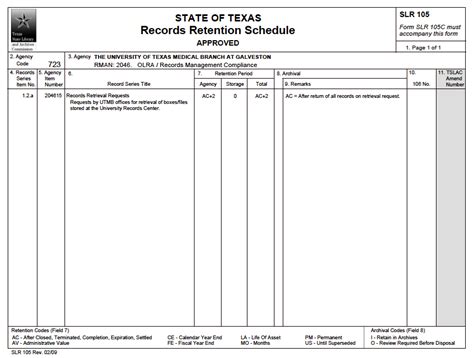

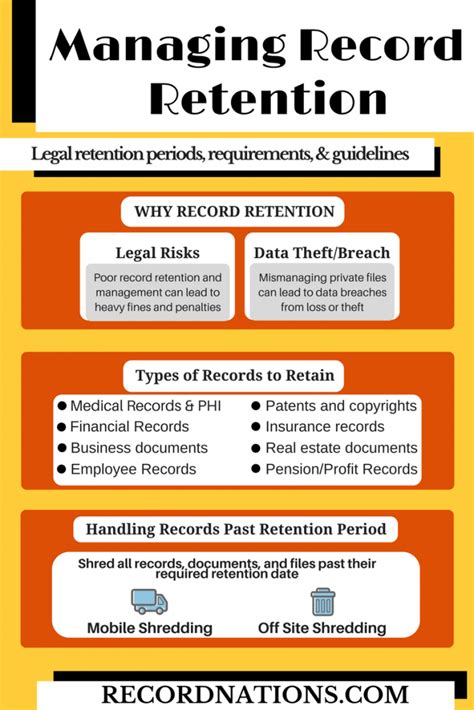

In the United Kingdom, businesses and individuals are required to retain certain documents for specific periods to comply with various laws and regulations. These retention periods can vary depending on the type of document, the industry, and the relevant legislation. It is essential to understand these requirements to ensure that you are meeting your obligations and avoiding potential penalties.

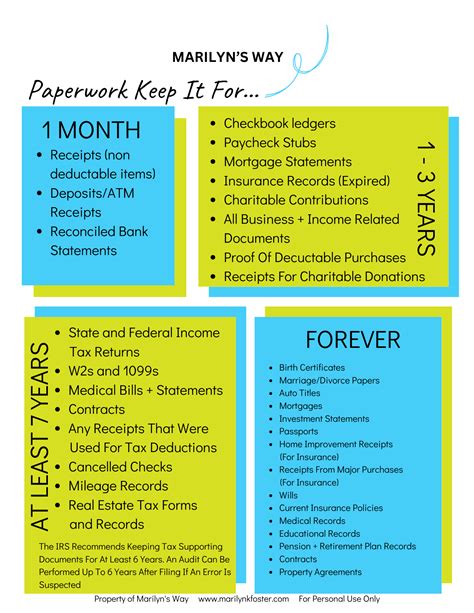

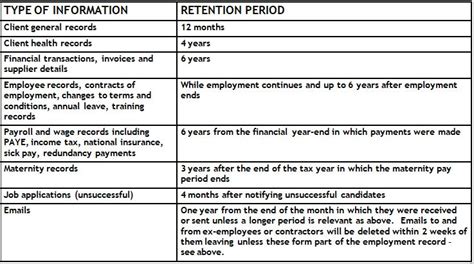

Types of Documents and Their Retention Periods

There are several types of documents that businesses and individuals in the UK need to retain, including: * Financial documents: These include invoices, receipts, bank statements, and tax returns. The retention period for these documents typically ranges from 6 to 22 years, depending on the specific document and the relevant legislation. * Employment documents: These include employee contracts, payroll records, and personnel files. The retention period for these documents typically ranges from 3 to 50 years, depending on the specific document and the relevant legislation. * Health and safety documents: These include accident reports, risk assessments, and safety records. The retention period for these documents typically ranges from 3 to 40 years, depending on the specific document and the relevant legislation. * Tax documents: These include tax returns, VAT records, and PAYE records. The retention period for these documents typically ranges from 6 to 22 years, depending on the specific document and the relevant legislation.

Retention Periods for Specific Documents

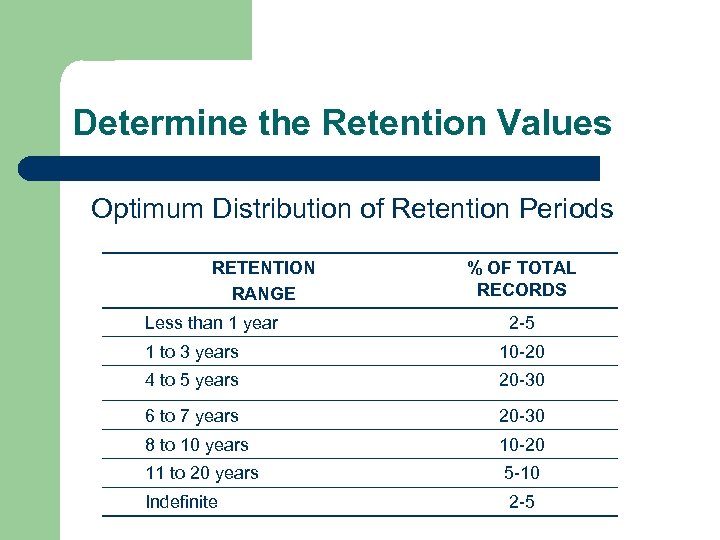

The following table outlines the retention periods for specific documents in the UK:

| Document Type | Retention Period |

|---|---|

| Invoices and receipts | 6 years |

| Bank statements | 6 years |

| Tax returns | 22 years |

| Employee contracts | 6 years after termination |

| Payroll records | 3 years after termination |

| Accident reports | 3 years |

| Risk assessments | 5 years |

Consequences of Not Retaining Documents

Failure to retain documents for the required period can result in penalties, fines, and even prosecution. It is essential to have a robust document retention policy in place to ensure that you are meeting your obligations.

Best Practices for Document Retention

To ensure that you are retaining documents correctly, follow these best practices: * Develop a document retention policy that outlines the types of documents to be retained, the retention periods, and the procedures for storing and disposing of documents. * Store documents in a secure and accessible location, such as a filing cabinet or a digital storage system. * Use a document management system to track and manage documents, including their retention periods and disposal dates. * Train employees on the importance of document retention and the procedures for storing and disposing of documents. * Review and update your document retention policy regularly to ensure that it remains compliant with changing legislation and regulations.

📝 Note: It is essential to consult with a legal professional or a regulatory expert to ensure that you are meeting the specific document retention requirements for your business or industry.

In summary, retaining documents for the required period is crucial for businesses and individuals in the UK to comply with various laws and regulations. By understanding the types of documents to be retained, their retention periods, and the best practices for document retention, you can ensure that you are meeting your obligations and avoiding potential penalties.

What is the retention period for tax returns in the UK?

+

The retention period for tax returns in the UK is 22 years.

What are the consequences of not retaining documents in the UK?

+

Failure to retain documents for the required period can result in penalties, fines, and even prosecution.

How can I ensure that I am retaining documents correctly in the UK?

+

To ensure that you are retaining documents correctly, develop a document retention policy, store documents in a secure and accessible location, use a document management system, train employees, and review and update your policy regularly.