USDA Loans Paperwork Not Found

Understanding USDA Loans and the Importance of Paperwork

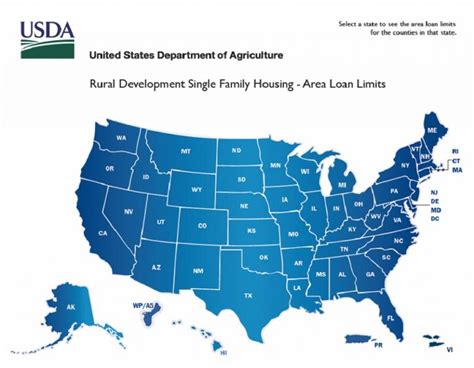

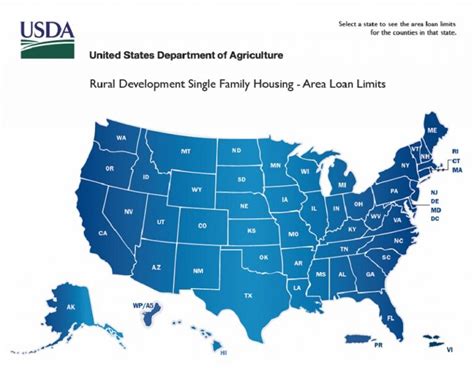

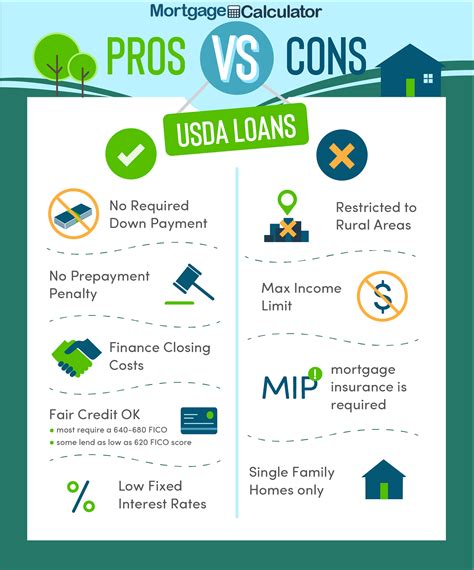

When it comes to purchasing a home, especially in rural areas, USDA loans are a popular choice due to their favorable terms, including no down payment requirements and lower interest rates. However, like any other loan process, USDA loan applications involve a significant amount of paperwork. The absence of required documents can lead to delays or even the rejection of the loan application. In this context, it’s crucial to understand what constitutes the necessary paperwork for a USDA loan and the steps to take if any documents are missing.

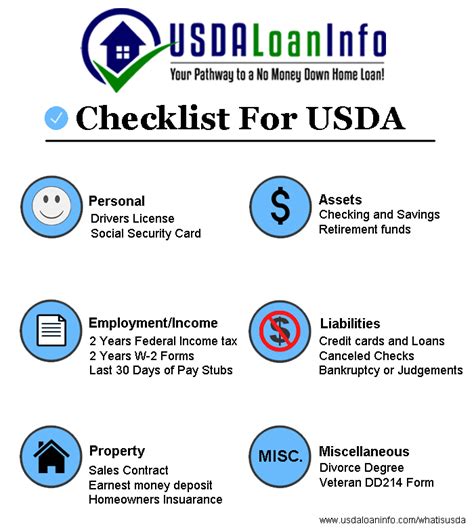

Required Paperwork for USDA Loans

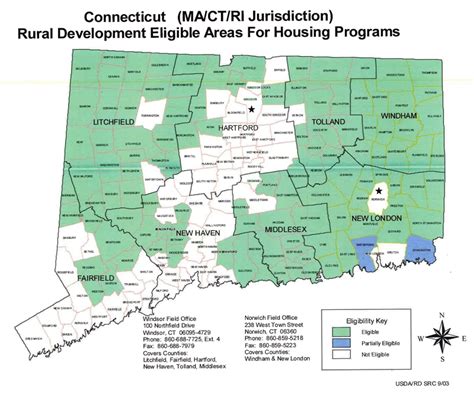

The USDA loan process requires several key documents to verify the borrower’s eligibility and the property’s qualification for the loan. Some of the essential paperwork includes: - Identification Documents: Valid government-issued IDs, such as a driver’s license or passport. - Income Verification: Pay stubs, W-2 forms, and tax returns to prove income stability. - Credit Reports: To assess the borrower’s creditworthiness. - Property Documents: The property must be located in an eligible rural area, and documents such as the property deed and appraisal report are necessary. - Loan Application: The USDA loan application form, which includes detailed personal and financial information.

Consequences of Missing Paperwork

If any of the required paperwork for a USDA loan is missing, it can significantly hinder the loan application process. Delays are common, as lenders cannot proceed without verifying all necessary information. In some cases, if critical documents are missing and cannot be produced, the loan application might be denied. It’s essential for borrowers to ensure they have all required documents ready when applying for a USDA loan to avoid any complications.

Steps to Take if Paperwork is Missing

If upon reviewing the loan application, it’s discovered that some paperwork is missing, there are several steps that can be taken: - Communicate with the Lender: Immediately inform the lender about the missing documents to understand what is required and the urgency of the situation. - Gather Missing Documents: Act quickly to gather the missing paperwork. This might involve requesting additional documents from employers, tax authorities, or other relevant parties. - Resubmit the Application: Once all the necessary documents are gathered, resubmit the loan application. Be prepared for potential delays in the processing time.

📝 Note: It's crucial to keep detailed records of all communications and submissions related to the loan application, including dates, times, and the specific documents sent or received.

Preventing Paperwork Issues

To avoid issues with missing paperwork, it’s advisable to: - Start Early: Begin gathering necessary documents well in advance of the loan application submission. - Use Checklists: Utilize checklists provided by the lender or create one based on the USDA’s requirements to ensure all documents are accounted for. - Stay Organized: Keep all documents and correspondence related to the loan application organized and easily accessible.

Technology and Streamlining the Process

In recent years, there has been a push towards digitalization in the loan application process, including USDA loans. This shift aims to make the application and approval process more efficient and less prone to errors due to missing paperwork. Borrowers can now often submit their applications and supporting documents online, reducing the reliance on physical paperwork and the potential for loss or misplacement of critical documents.

| Document Type | Purpose |

|---|---|

| Identification Documents | To verify the borrower's identity |

| Income Verification | To confirm the borrower's income stability |

| Credit Reports | To evaluate the borrower's creditworthiness |

| Property Documents | To ensure the property is in an eligible area and meets USDA standards |

In summary, while the process of applying for a USDA loan involves considerable paperwork, being prepared and organized can significantly reduce the risk of complications due to missing documents. Understanding the requirements and taking proactive steps to gather all necessary paperwork in advance can help borrowers navigate the process more smoothly.

As we reflect on the importance of having all the necessary paperwork in order for a USDA loan application, it becomes clear that preparation and attention to detail are key to a successful and stress-free experience. By following the guidelines and tips outlined, individuals can better position themselves for approval and move closer to achieving their goal of homeownership.

What is the primary advantage of a USDA loan?

+

The primary advantage of a USDA loan is that it offers borrowers the opportunity to purchase a home with no down payment, making it an attractive option for those who may not have the funds for a down payment.

How do I check if a property is eligible for a USDA loan?

+

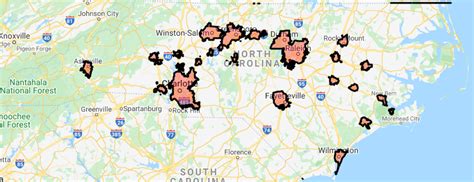

To check if a property is eligible for a USDA loan, you can visit the USDA’s website and use their property eligibility tool. This tool allows you to enter the property’s address and determine if it is located in an eligible rural area.

What credit score is required for a USDA loan?

+

While the USDA does not have a minimum credit score requirement, lenders often have their own requirements, which can vary. Typically, a credit score of 640 or higher is preferred for a USDA loan, but it’s possible to qualify with a lower score.