5 Documents Needed

Introduction to Essential Documents

When it comes to personal and professional dealings, having the right documents in place can make all the difference. These documents serve as the foundation for various aspects of life, including legal, financial, and personal security. In this article, we will explore five crucial documents that everyone should have, and why they are important.

1. Last Will and Testament

A Last Will and Testament is a document that outlines how a person’s assets and estate should be distributed after their death. This document is essential for ensuring that one’s wishes are respected and that their loved ones are taken care of. Some key points to consider when creating a Last Will and Testament include: * Appointment of an executor: The person responsible for carrying out the instructions in the will. * Distribution of assets: How property, money, and other assets will be divided among beneficiaries. * Guardianship: Who will take care of minor children or dependents.

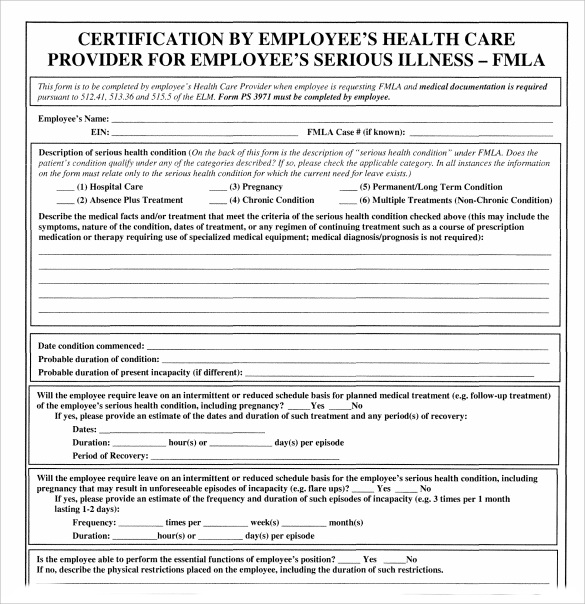

2. Power of Attorney

A Power of Attorney is a document that grants someone the authority to act on another person’s behalf in legal and financial matters. This document is important for ensuring that one’s affairs are managed properly in the event of incapacity or unavailability. There are different types of Power of Attorney, including: * General Power of Attorney: Grants broad powers to manage financial and legal affairs. * Special Power of Attorney: Limits the powers to specific areas, such as managing a business or property. * Healthcare Power of Attorney: Allows someone to make medical decisions on behalf of the grantor.

3. Living Trust

A Living Trust is a document that allows individuals to manage and distribute their assets during their lifetime and after their death. This document is useful for avoiding probate and ensuring that assets are passed on to beneficiaries quickly and efficiently. Some benefits of a Living Trust include: * Avoiding probate: Assets can be distributed without going through the court system. * Tax benefits: May reduce estate taxes and other taxes associated with asset distribution. * Flexibility: Can be amended or revoked during the grantor’s lifetime.

4. Advance Directive

An Advance Directive is a document that outlines a person’s medical wishes in the event that they become incapacitated or unable to communicate. This document is essential for ensuring that one’s medical treatment aligns with their values and preferences. Some key components of an Advance Directive include: * Living will: Outlines the types of medical treatment that are desired or refused. * Do Not Resuscitate (DNR) order: Instructs medical professionals not to perform CPR if the person’s heart stops. * Organ donation: Indicates whether the person wishes to donate their organs after death.

5. Insurance Policies

Insurance policies are documents that provide financial protection against various risks, such as death, disability, and illness. These documents are important for ensuring that one’s loved ones are taken care of in the event of an unexpected event. Some common types of insurance policies include: * Life insurance: Provides a death benefit to beneficiaries. * Disability insurance: Replaces income if the person becomes unable to work due to illness or injury. * Health insurance: Covers medical expenses and provides access to healthcare services.

📝 Note: It's essential to review and update these documents regularly to ensure they remain relevant and effective.

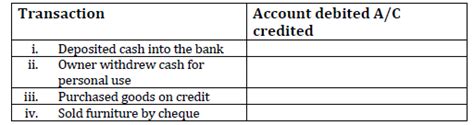

The following table summarizes the five essential documents:

| Document | Description |

|---|---|

| Last Will and Testament | Outlines the distribution of assets and estate after death |

| Power of Attorney | Grants authority to act on behalf of the grantor in legal and financial matters |

| Living Trust | Manages and distributes assets during lifetime and after death |

| Advance Directive | Outlines medical wishes in the event of incapacitation |

| Insurance Policies | Provides financial protection against various risks |

In summary, having the right documents in place is crucial for personal and professional security. The five documents outlined in this article – Last Will and Testament, Power of Attorney, Living Trust, Advance Directive, and Insurance Policies – provide a foundation for managing assets, ensuring medical treatment aligns with values, and protecting loved ones. By understanding the importance of these documents and taking steps to create and update them, individuals can ensure that their wishes are respected and their affairs are managed properly.

What is the purpose of a Last Will and Testament?

+

A Last Will and Testament outlines how a person’s assets and estate should be distributed after their death, ensuring that their wishes are respected and their loved ones are taken care of.

What is the difference between a Power of Attorney and a Living Trust?

+

A Power of Attorney grants authority to act on behalf of the grantor in legal and financial matters, while a Living Trust manages and distributes assets during lifetime and after death.

Why is it important to have an Advance Directive?

+

An Advance Directive outlines a person’s medical wishes in the event of incapacitation, ensuring that their medical treatment aligns with their values and preferences.