5 VRT Papers Needed

Introduction to VRT Papers

VRT papers, also known as Value-Added Tax (VAT) papers, are essential documents used to validate the authenticity of VAT-registered businesses. These papers serve as proof of a company’s VAT registration and are often required for various business transactions, such as tax returns, invoices, and receipts. In this article, we will delve into the world of VRT papers, exploring their significance, types, and applications.

Understanding the Importance of VRT Papers

VRT papers play a crucial role in ensuring the integrity of VAT-registered businesses. They provide a secure way to verify the authenticity of a company’s VAT registration, thereby preventing tax evasion and fraud. With VRT papers, businesses can demonstrate their compliance with tax regulations, which is essential for maintaining a good reputation and avoiding legal issues. Moreover, VRT papers facilitate the smooth operation of business transactions, as they provide a standardized way to document and record VAT-related information.

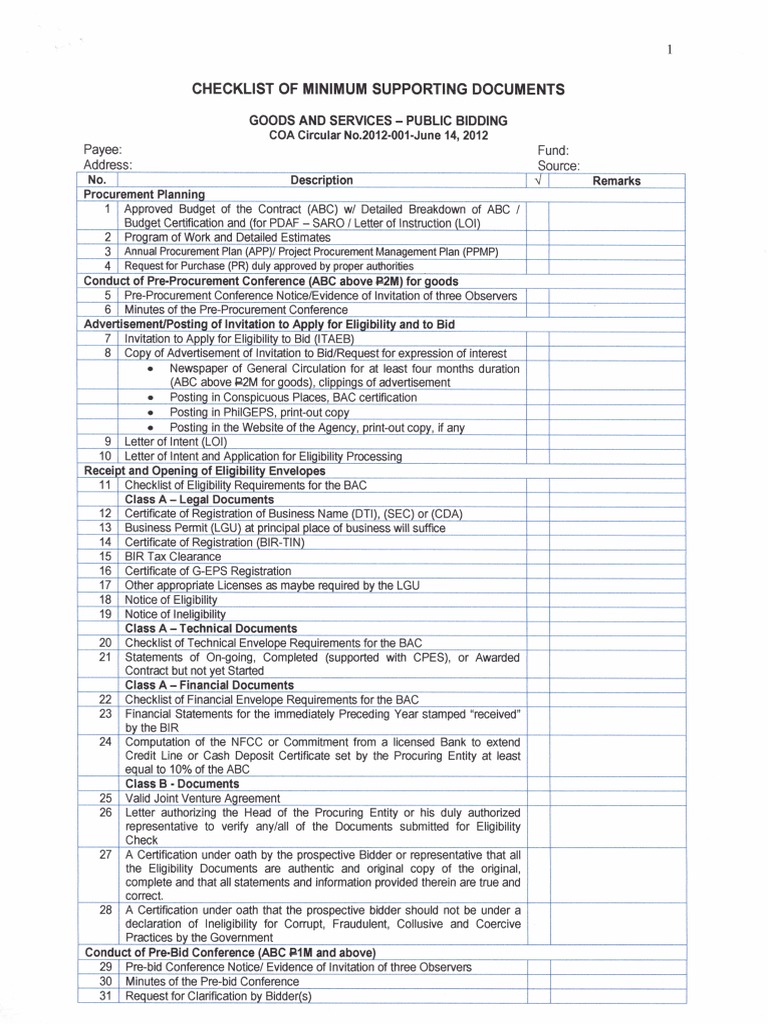

Types of VRT Papers

There are several types of VRT papers, each serving a specific purpose. The most common types include: * VAT registration certificate: This document confirms a company’s VAT registration and provides its unique VAT identification number. * VAT invoice: This document is used to record the sale of goods or services and includes the VAT amount charged. * VAT receipt: This document is used to acknowledge payment of VAT and provides proof of payment. * VAT return: This document is used to report a company’s VAT liability and is typically submitted to the tax authorities on a quarterly or annual basis. * VAT exemption certificate: This document is used to claim exemption from VAT on certain goods or services.

Applications of VRT Papers

VRT papers have a wide range of applications, including: * Business transactions: VRT papers are used to document and record VAT-related information, such as invoices, receipts, and tax returns. * Tax compliance: VRT papers provide proof of VAT registration and compliance with tax regulations, which is essential for maintaining a good reputation and avoiding legal issues. * Audits and inspections: VRT papers are used to verify the authenticity of VAT-registered businesses and ensure compliance with tax regulations during audits and inspections.

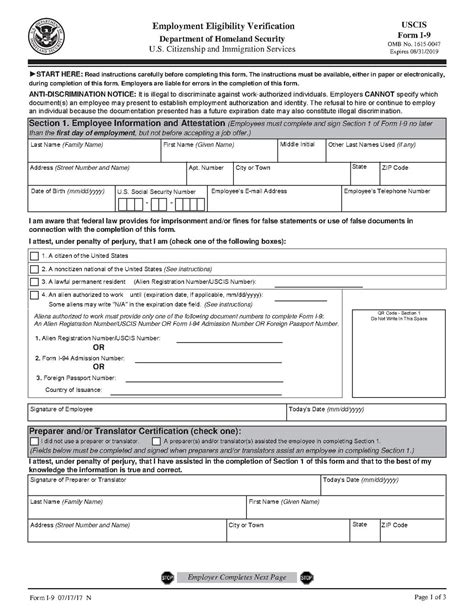

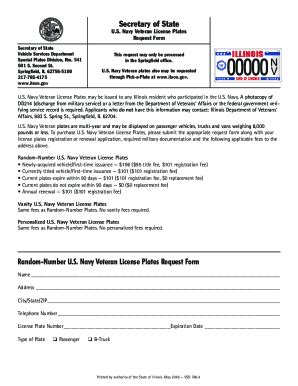

Obtaining VRT Papers

To obtain VRT papers, businesses must first register for VAT with the relevant tax authorities. The registration process typically involves submitting an application form, providing supporting documents, and paying the required registration fee. Once registered, businesses can obtain VRT papers from the tax authorities or through authorized agents.

Managing VRT Papers

Managing VRT papers is crucial to ensure compliance with tax regulations and to prevent errors or discrepancies. Businesses should: * Store VRT papers securely: VRT papers should be stored in a secure location, such as a safe or a locked cabinet, to prevent loss or theft. * Update VRT papers regularly: Businesses should regularly update their VRT papers to reflect changes in their VAT registration or business operations. * Verify VRT papers: Businesses should verify the authenticity of VRT papers before accepting them from suppliers or customers.

💡 Note: Businesses should ensure that their VRT papers are accurate and up-to-date to avoid any potential issues or penalties.

Benefits of Using VRT Papers

Using VRT papers offers several benefits, including: * Improved compliance: VRT papers provide proof of VAT registration and compliance with tax regulations, which helps to maintain a good reputation and avoid legal issues. * Increased efficiency: VRT papers streamline business transactions and reduce the risk of errors or discrepancies. * Enhanced security: VRT papers provide a secure way to verify the authenticity of VAT-registered businesses, thereby preventing tax evasion and fraud.

| VRT Paper Type | Purpose |

|---|---|

| VAT registration certificate | Confirms VAT registration and provides VAT identification number |

| VAT invoice | Records sale of goods or services and includes VAT amount charged |

| VAT receipt | Acknowledges payment of VAT and provides proof of payment |

| VAT return | Reports VAT liability and is submitted to tax authorities |

| VAT exemption certificate | Claims exemption from VAT on certain goods or services |

In summary, VRT papers are essential documents used to validate the authenticity of VAT-registered businesses. They provide a secure way to verify the authenticity of a company’s VAT registration and are used to document and record VAT-related information. By understanding the importance and applications of VRT papers, businesses can ensure compliance with tax regulations and maintain a good reputation.

What is the purpose of VRT papers?

+

VRT papers are used to validate the authenticity of VAT-registered businesses and provide proof of VAT registration and compliance with tax regulations.

How do I obtain VRT papers?

+

To obtain VRT papers, businesses must first register for VAT with the relevant tax authorities. The registration process typically involves submitting an application form, providing supporting documents, and paying the required registration fee.

What are the benefits of using VRT papers?

+

Using VRT papers offers several benefits, including improved compliance, increased efficiency, and enhanced security. VRT papers provide proof of VAT registration and compliance with tax regulations, which helps to maintain a good reputation and avoid legal issues.