5 Michigan Repossession Tips

Understanding the Basics of Repossession in Michigan

In Michigan, repossession laws are designed to protect both lenders and borrowers during the process of reclaiming vehicles or other items due to defaulted loans. It’s essential for individuals to understand their rights and the steps involved in repossession to navigate the situation effectively. Whether you’re a lender looking to repossess a vehicle or a borrower facing repossession, being informed is key. This article will delve into five crucial tips for navigating the repossession process in Michigan, emphasizing the importance of legal compliance, communication, and financial planning.

Tip 1: Know Your Rights Under Michigan Law

Michigan law provides specific guidelines for the repossession process, including the requirement that lenders must follow strict procedures to repossess a vehicle legally. Borrowers have the right to know when their vehicle is being repossessed and should be informed about the process and their options post-repossession. Lenders must also provide borrowers with notice and an opportunity to cure the default before proceeding with repossession. Understanding these rights is the first step in managing the repossession process effectively.

Tip 2: Communication is Key

Effective communication between lenders and borrowers is crucial in preventing misunderstandings and potential legal issues. Regular updates and clear explanations of the repossession process can help alleviate stress and ensure that both parties are aware of their obligations and rights. Borrowers should maintain open communication channels with their lenders to discuss any difficulties in making payments and explore possible alternatives, such as temporary hardship programs or loan modifications.

Tip 3: Financial Planning and Budgeting

To avoid repossession, it’s vital for borrowers to prioritize their financial obligations and create a realistic budget that accounts for all expenses, including loan payments. Financial planning involves not only managing current debt but also anticipating future expenses to prevent default. Borrowers should consider seeking advice from financial advisors to develop strategies for managing debt and avoiding delinquency.

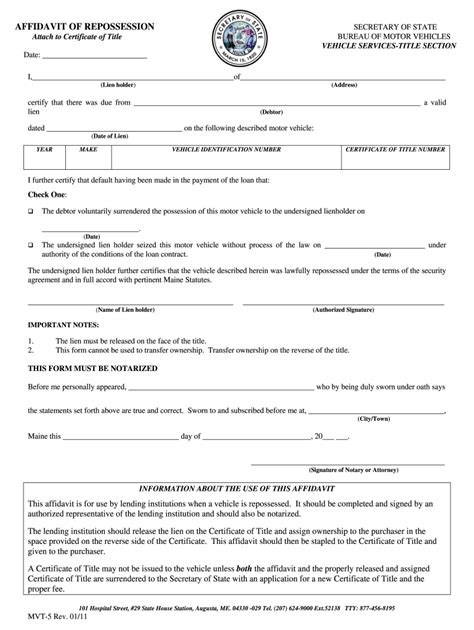

Tip 4: Understanding the Repossession Process

The repossession process in Michigan typically involves several steps, including default notification, repossession, and sale of the repossessed item. Lenders must comply with state regulations regarding how and when a vehicle can be repossessed, and borrowers should be aware of these regulations to protect their rights. After repossession, lenders will typically sell the item to recover the debt, and any surplus from the sale (after deducting the debt, fees, and costs) must be returned to the borrower.

Tip 5: Seeking Professional Advice

Given the complexity of repossession laws and the potential for legal disputes, seeking professional advice is often advisable. For borrowers, consulting with a consumer rights attorney can provide clarity on their legal options and protections. Lenders may also benefit from legal counsel to ensure compliance with all relevant laws and regulations, reducing the risk of legal challenges to the repossession process.

💡 Note: The process of repossession can be highly stressful and financially impactful. It's essential for all parties involved to approach the situation with a clear understanding of their rights and obligations under Michigan law.

In summary, navigating the repossession process in Michigan requires a comprehensive understanding of the law, effective communication, sound financial planning, and sometimes, professional advice. By being proactive and informed, individuals can better manage the challenges associated with repossession and work towards resolving debt issues in a fair and legal manner.

What are the legal steps a lender must take to repossess a vehicle in Michigan?

+

Lenders in Michigan must follow specific legal steps, including notifying the borrower of default and providing an opportunity to cure the default before proceeding with repossession. The process must comply with Michigan’s Uniform Commercial Code and other relevant state laws.

Can a borrower regain possession of a repossessed vehicle in Michigan?

+

Yes, in some cases, a borrower may be able to regain possession of a repossessed vehicle by paying off the outstanding debt, including any fees and costs associated with the repossession, before the vehicle is sold. This is typically referred to as “redeeming” the vehicle.

What happens to the surplus from the sale of a repossessed vehicle in Michigan?

+

After selling a repossessed vehicle, if there is a surplus (the sale price exceeds the debt, fees, and costs), the lender must return this surplus to the borrower. If there is a deficiency (the sale price is less than the debt, fees, and costs), the lender may pursue the borrower for the deficiency, depending on the terms of the loan agreement.