Coin Dealers Reporting Requirements

Coin dealers must file a Cash Transaction Report (CTR) with FinCEN for each cash transaction exceeding 10,000.">How do coin dealers report cash transactions over 10,000? +

Introduction to Coin Dealers Reporting Requirements

The coin industry, which includes dealers in precious metals, coins, and other numismatic items, is subject to various reporting requirements to help combat money laundering and other financial crimes. These requirements are designed to ensure that coin dealers operate transparently and in compliance with anti-money laundering (AML) laws and regulations. In this article, we will delve into the specifics of coin dealers’ reporting requirements, the rationale behind these obligations, and the steps that dealers must take to comply.

Understanding the Legal Framework

The legal framework governing coin dealers’ reporting requirements is primarily based on the Bank Secrecy Act (BSA) of 1970, as amended. The BSA requires certain businesses, including those dealing in coins and precious metals, to report cash transactions exceeding $10,000 and to maintain records of these transactions. The Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury, is responsible for administering the BSA and its implementing regulations.

Key Reporting Requirements for Coin Dealers

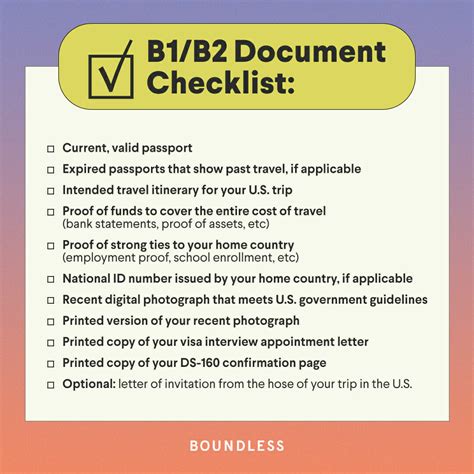

Coin dealers must comply with several key reporting requirements: - Cash Transaction Reports (CTRs): Dealers must file a CTR (FinCEN Form 104) for each cash transaction exceeding 10,000. This includes multiple transactions that total more than 10,000 in a single business day. - Suspicious Activity Reports (SARs): If a dealer suspects or has reason to suspect that a transaction involves illegal activity or is structured to evade reporting requirements, they must file a SAR (FinCEN Form 111). - Customer Identification Programs (CIPs): Dealers must establish CIPs to verify the identity of their customers. This is crucial for preventing money laundering and terrorist financing. - Record Keeping: Maintaining accurate and detailed records of transactions and customer identities is essential for compliance and audit purposes.

Implementation and Compliance

Implementing these reporting requirements involves several steps: - Training Staff: Ensuring that all staff members understand the reporting requirements and can identify suspicious transactions is critical. - Establishing Policies and Procedures: Developing clear, written policies and procedures for reporting and record-keeping helps in maintaining compliance. - Regular Audits: Conducting regular internal audits can help identify any deficiencies in the compliance program and allow for corrective actions. - Customer Education: Educating customers about the reasons behind these requirements can foster cooperation and trust.

📝 Note: Compliance with reporting requirements is not only a legal obligation but also a crucial aspect of running a reputable and trustworthy business in the coin and precious metals industry.

Challenges and Considerations

While the reporting requirements are in place to combat financial crimes, they also present challenges for coin dealers, such as: - Administrative Burden: The need to report transactions and maintain detailed records can be time-consuming and may require additional staff or resources. - Customer Privacy: Balancing the need to collect customer information with the need to protect customer privacy is a significant consideration. - Evolving Regulations: Keeping abreast of changes in regulations and ensuring ongoing compliance can be challenging.

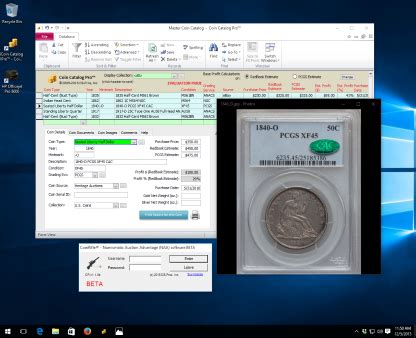

Technology and Compliance

Utilizing technology can help coin dealers manage their reporting requirements more efficiently. For example: - Software Solutions: There are various software solutions available that can assist with reporting, record-keeping, and customer identification. - Digital Storage: Secure digital storage solutions can help in maintaining and protecting sensitive customer and transaction data.

| Reporting Requirement | Description |

|---|---|

| Cash Transaction Reports (CTRs) | Report cash transactions exceeding $10,000 |

| Suspicious Activity Reports (SARs) | Report suspicious transactions |

| Customer Identification Programs (CIPs) | Verify customer identities |

| Record Keeping | Maintain detailed records of transactions and customer information |

In summary, coin dealers must navigate a complex regulatory environment to ensure compliance with reporting requirements designed to prevent money laundering and other financial crimes. By understanding these requirements, implementing effective compliance programs, and leveraging technology, dealers can not only meet their legal obligations but also contribute to the integrity of the financial system.

As we reflect on the importance of these reporting requirements, it becomes clear that compliance is an ongoing process that requires attention to detail, a commitment to transparency, and a dedication to ethical business practices. By working together, coin dealers, regulators, and law enforcement can help safeguard the financial system and ensure that the coin industry remains a trusted and viable market for collectors and investors alike.

What is the purpose of the Bank Secrecy Act?

+

The Bank Secrecy Act is designed to prevent and detect money laundering and other financial crimes by requiring businesses, including coin dealers, to report certain transactions and maintain records.

How do coin dealers report cash transactions over 10,000?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Coin dealers must file a Cash Transaction Report (CTR) with FinCEN for each cash transaction exceeding 10,000.

What is a Suspicious Activity Report (SAR), and when is it filed?

+

A SAR is filed when a coin dealer suspects or has reason to suspect that a transaction involves illegal activity or is structured to evade reporting requirements.