Paperwork

Refinance Requires Same Paperwork

Understanding the Refinance Process

Refinancing a mortgage can be a complex and overwhelming process, especially when it comes to the paperwork involved. Many homeowners assume that refinancing requires less paperwork than the initial mortgage application, but this is not always the case. In fact, refinancing typically requires the same amount of paperwork as the original mortgage application. This can be a surprise to many homeowners, who may be expecting a more streamlined process.

Why Refinancing Requires So Much Paperwork

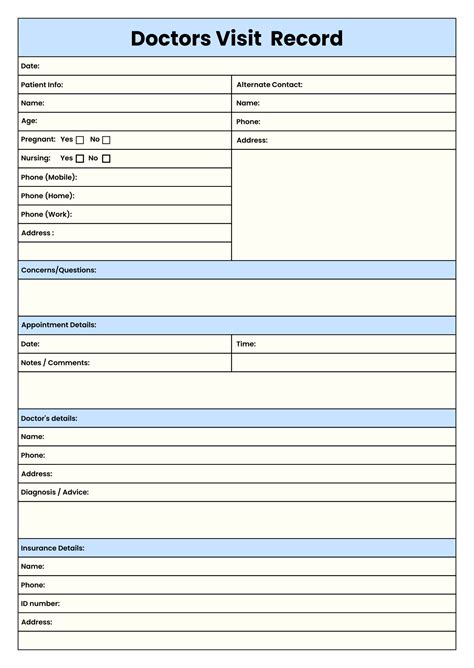

There are several reasons why refinancing requires the same amount of paperwork as the original mortgage application. One reason is that the lender needs to re-verify the homeowner’s income, credit score, and other financial information to ensure that they still qualify for the loan. This involves collecting and reviewing a range of documents, including pay stubs, bank statements, and tax returns. Additionally, the lender may need to conduct a new appraisal of the property to determine its current value.

Documents Required for Refinancing

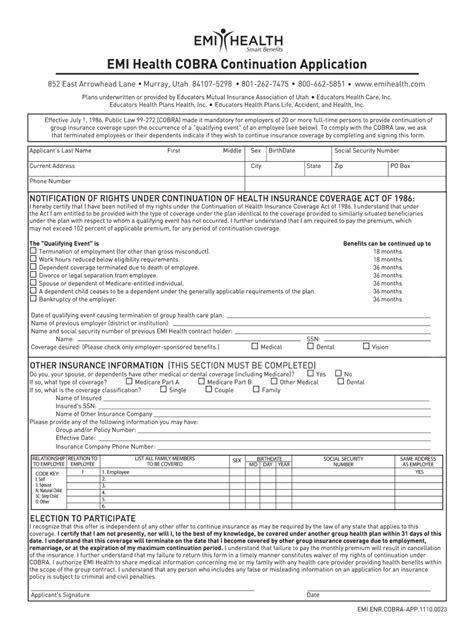

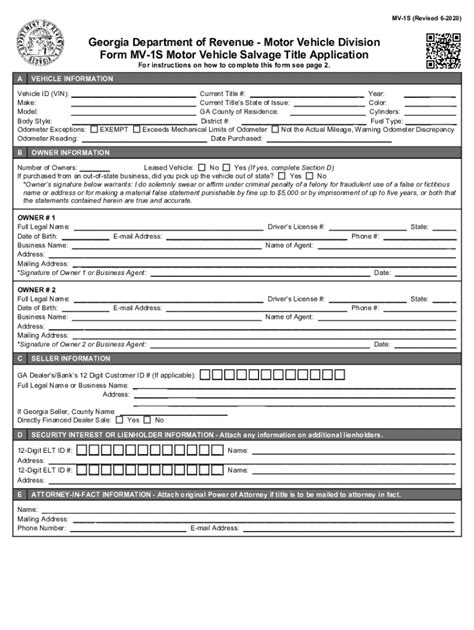

The specific documents required for refinancing may vary depending on the lender and the type of loan, but some common documents include: * Identification: Driver’s license, passport, or other government-issued ID * Income verification: Pay stubs, W-2 forms, and tax returns * Credit reports: The lender will typically pull a credit report to verify the homeowner’s credit score * Property valuation: An appraisal or other valuation of the property to determine its current value * Loan information: Information about the current loan, including the loan balance and payment history

Streamlining the Refinance Process

While refinancing may require a significant amount of paperwork, there are steps that homeowners can take to streamline the process. One option is to work with a lender that offers a streamlined refinance program, which can reduce the amount of paperwork required. Additionally, homeowners can gather all of the necessary documents in advance and have them ready to submit to the lender, which can help to speed up the process.

Benefits of Refinancing

Despite the paperwork involved, refinancing can be a great option for homeowners who want to take advantage of lower interest rates or tap into their home’s equity. Some benefits of refinancing include: * Lower monthly payments: Refinancing to a lower interest rate can reduce the monthly mortgage payment * Access to cash: Homeowners can tap into their home’s equity by refinancing to a larger loan * Debt consolidation: Refinancing can provide an opportunity to consolidate other debts, such as credit card balances, into a single loan with a lower interest rate

📝 Note: Homeowners should carefully consider their financial situation and goals before refinancing, as it may involve fees and other costs.

Conclusion and Next Steps

In conclusion, refinancing a mortgage requires the same amount of paperwork as the original mortgage application. While this may seem overwhelming, there are steps that homeowners can take to streamline the process and make it more manageable. By understanding the documents required for refinancing and gathering them in advance, homeowners can help to ensure a smooth and successful refinance process. Whether you’re looking to lower your monthly payments, tap into your home’s equity, or consolidate debt, refinancing can be a great option - as long as you’re prepared for the paperwork involved.

What is the main reason why refinancing requires so much paperwork?

+

The main reason why refinancing requires so much paperwork is that the lender needs to re-verify the homeowner’s income, credit score, and other financial information to ensure that they still qualify for the loan.

What are some common documents required for refinancing?

+

Some common documents required for refinancing include identification, income verification, credit reports, property valuation, and loan information.

How can homeowners streamline the refinance process?

+

Homeowners can streamline the refinance process by working with a lender that offers a streamlined refinance program, gathering all necessary documents in advance, and having them ready to submit to the lender.